If you're just getting into the contracting field, there are a lot of business and regulatory concepts that may be new to you. One of these is the concept of becoming a bonded contractor.

Being bonded means you've purchased a surety bond for your business. The contracting field is one of the occupational fields requiring the highest variety and quantity of surety bonds.

In this short article, you'll learn:

(Click on the bullet to skip to that part of the article.)

- What is a contractor license bond?

- Why are license bonds required?

- What is a right of way bond?

- What are payment and performance bonds?

What is a Surety Bond?

At a high level, a surety bond is type of insurance coverage that acts as a guarantee that you will:

- Follow a states building codes and regulations

- Follow county and city laws for public construction projects

- Conduct business with your customers with fair and ethical terms

- Pay suppliers and subcontractors for work completed

What makes a surety bond a little confusing is the fact that it's insurance you purchase for the protection of a third party, typically your customer and/or project owner, not your business.

If a contractor is deemed guilty of purposeful misconduct or fraud, the harmed party can make a claim against the bond for financial compensation, only up to the amount of the bond.

Surety bonds are used in the contracting field as a way of limiting the amount of "bad actors" in the field.

Again, in the contracting field, there are numerous types of surety bonds, each one similar but with a specific use case.

What is a Contractor License Bond?

A contractor license bond is surety bond required either before a license can be issued to a contractor or before contracting work can be started.

A contractor license bond is a state requirement in many states, the most common are:

- California contractor bonds

- Washington contractor bonds

- Oregon contractor bonds

- Virginia contractor bonds

- South Carolina contractor bonds

The license bond is a high level surety bond, meaning this bond not specific to any one project. Rather its purpose is to protect your customers for all projects.

Some cities require a contractor license bond as well. Examples include:

- Denver, Colorado general contractor bond

- Aurora, Colorado contractor bond

- Cleveland Heights, Ohio contractor bond

- Galveston, Texas general contractor bond

- Orlando, Florida contractor bond

For these local license bonds, you'll find out about them when you go to pull permits, plus you'll learn about additional bonding requirements for that city or county, like permit or right-of-way-bonds.

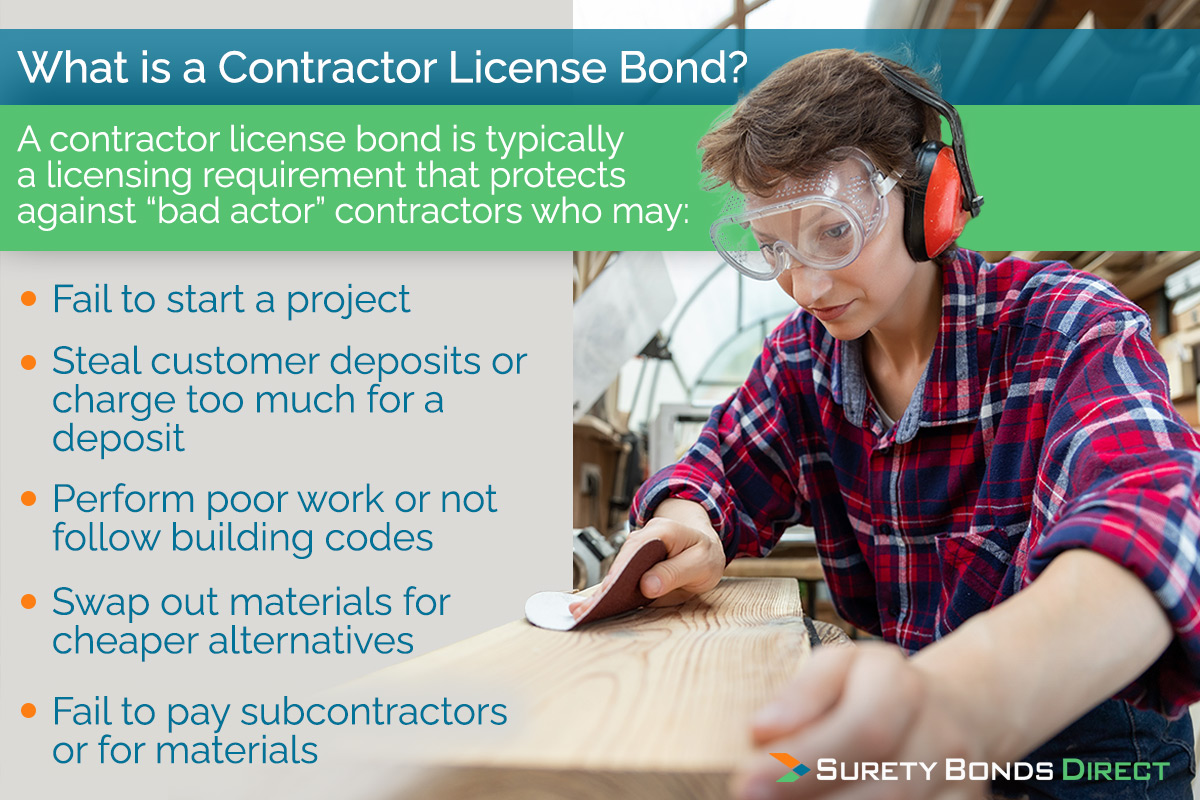

What Does a Contractor License Bond Protect Against?

Purposeful acts of misconduct or contractor fraud a license bond protect against are:

- Failing to start a project

- Stealing customer deposits or charging too much for a deposit

- Performing poor work or not following building codes

- Swapping out materials for cheaper alternatives

- Failing to pay subcontractors or for materials

So if a contractor is deemed guilty of these or similar acts, their customer can make a claim against the bond for financial compensation as long as the claim is deemed legitimate.

In the case of any successful claim, the contractor will have to pay the insurance company that provided the surety bond back for successful claims. In most cases, claims can be avoided as long as you work with your customers on any disagreements before they escalate.

You Might Need More Than One Contractor License Bond

It's important to know, in most cases, license bonds are required and purchased on per license basis.

For example, if you have a general contracting license and you obtain further specialty licenses like:

- Electrician licenses

- Plumbing licenses

- Carpentry licenses

- Or any of the dozens more including HVAC, homebuilding, landscaping, demolition, roofing and more

You will likely have to purchase a different contractor license bond for that each license type in each state where you do work.

Learn more about contractor license bonds by watching our video.

We also have a large library of articles that can help you understand the licensing process for many states. Some of our most popular articles are:

- Nevada contractor license

- Virginia contractor license

- South Carolina residential contractor license

- Tennessee home improvement license

- North Carolina contractor license

- Washington contractor license

What is a Contractor Permit And Right-of-Way Bond?

A permit bond and right-of-way bond is very similar to a license bond, but these are typically only required on a per project basis.

When you go to pull permits for a project, you will learn about any bonding requirements the county or city requires before the project can begin.

At a high level, a permit and right-of-way bond are the same. Right-of-way technically apples to construction projects that take place on public city property like:

- Sidewalks

- On or under streets

- Sewers

- Electrical lines

Nearly every city will require a right-of-way bond if you're hired to perform work for the city or you need to temporarily "damage" and repair city property for a private construction project.

A good example is the city of Denver, Colorado's right-of-way bonds. And again, nearly every city government will require this.

What Are Construction Bonds?

The last of the most common types of contractor bonds are called construction bonds. These are surety bonds required by a project owner on a per project basis.

The most common construction bonds are bid, payment and performance bonds.

When contractors win the bid for a large project, the project owner will require a performance surety bond and a payment surety bond. These two bonds are often paired together.

A bid bond may be required in-order to bid on a project. And keep in mind, construction bonding requirements are on top of any contractor license, permit, or right-of-way bonding requirements.

What is a Bid Bond?

A bid bond is your guarantee that your projected bid on a project is accurate and not a low ball offer that you will not be able to fulfill.

Bid bonds weed out low ball offers protecting the project owner's timeframe and initial investment in a project.

What is a Performance Bond?

The performance bond is your guarantee that you will follow the contract exactly and complete the project as laid out in the contract.

This protects the project owner in a case where a contractor abandons the project without finishing.

What is a Payment Bond?

The payment bond is your guarantee that you will pay all of the subcontractors you'll hire to complete the project.

This bond protects both the subcontractors and the project owner in the case where a contractor either abandons a project or refuses to pay subcontractors.

Other Construction Bonds

There are many other construction bonds with different names, but they all fulfill the same requirement:

Ensuring the project is completed according to the contract and that the contractor follows all building codes and construction laws.

Examples of these construction bonds include:

- Subdivision bonds

- Site improvement bonds

- Maintenance bonds

- Supply bond

How Do You Become a Bonded Contractor?

As you can see, there are a lot of surety bond requirements for contractors.

It can be overwhelming, but the good news is you don't need all of these bonds at once. Everything starts with the contractor license bond.

Plus, most contractors perform projects that do not necessarily require large construction bonds.

If you eventually get to that level, Surety Bonds Direct will help you get your specific bonding requirements in order.

If you need a contractor license bond, we can help you today. Go to our contractor license bond page and select your state.

You'll find the bond you need from there. If you need personalized help, call a bond specialist at 1-800-608-9950.