What is a Surety Bond?

Learn the surety bond basics with an easy-to-read overview of surety. You'll be an expert in no time!

What Does a Surety Bond Mean?

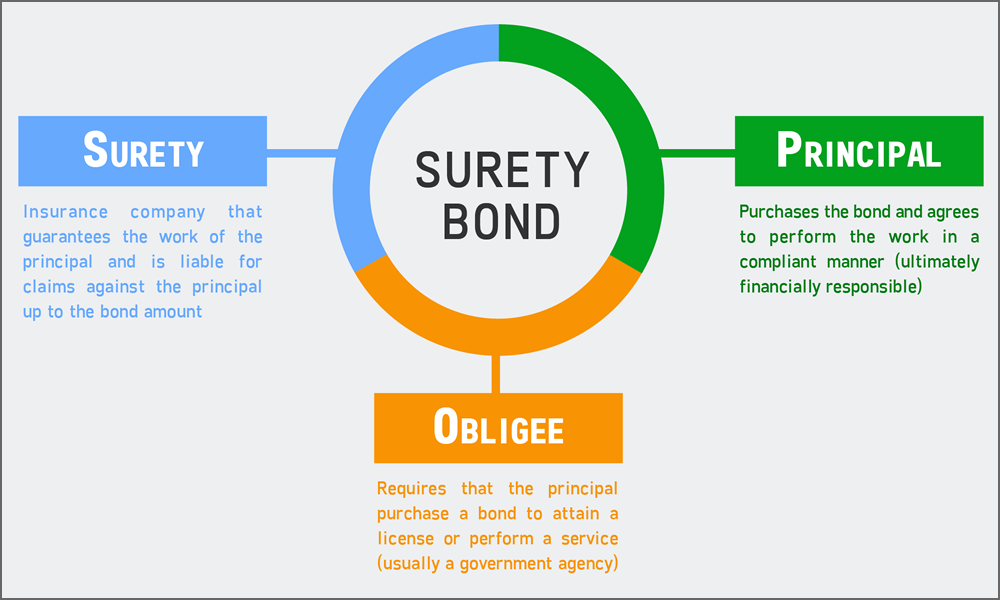

A surety bond (pronounced "shur-ih-tee bond") can be defined in its simplest form as a written agreement to guarantee compliance, payment, or performance of an act. Surety is a unique type of insurance because it involves a three-party agreement. The three parties in a surety agreement are:

- Principal – the party that purchases the bond and undertakes an obligation to perform an act as promised.

- Surety – the insurance company or surety company that guarantees the obligation will be performed. If the principal fails to perform the act as promised, the surety is contractually liable for losses sustained.

- Obligee (pronounced obb-li-jee) - the party who requires, and often receives the benefit of— the surety bond. For most surety bonds, the obligee is a local, state or federal government organization.

Surety Bond Need to Know

In practice, surety bonds can have several variations to their definition, meaning, and purpose depending on the specific bond requirement. There are thousands of different types of surety bonds across the country. Some surety bonds provide coverage for, or ensure compliance with, local, state, or federal licensing and permit requirements. Other surety bonds guarantee payment of tax or other financial obligations. These bonds are referred to as "strict financial guarantee" bonds and often times are more expensive due to inherent risk of guaranteeing a payment as opposed to a compliance requirement.

Another common type of surety bond called is referred to as a contract bond. These surety bonds provide a guarantee that contractors complete construction projects in accordance with specifications and make all required payments to subcontractors and suppliers. Contractors engaged in a variety of both government contracts and private sector work must secure contract bonds as required by project owners.

Most surety bonds are issued for a set term (usually 1, 2, or 3 years) or they are issued as "continuous" bonds. A continuous bond simply means that the bond form is written so the bond is in force until cancelled by the surety company. Many state contractor license and auto dealer bonds are written as continuous bonds.

Commercial license and permit bonds have a statutory amount (coverage) that usually ranges from $5,000 to $100,000. Contract surety bonds typically range from about $50,000 to several million dollars based on the size of the construction project to be bonded. States with the most surety bond requirements include California, Florida, and Texas.

The official surety bond documents typically include a one or two page "bond form". This is the actual bond contract and includes information on the bonded company or individual, owners, the surety company, and the surety agent. It also outlines the obligation associated with the bond. The bond form is typically signed by the principal(s) and made official by inclusion of the surety company's official seal and signature of the attorney-in-fact. A power of attorney will also accompany the official bond form.

Who Buys Surety Bonds?

Surety bonds are purchased by a wide variety of businesses and individuals across the country. In most cases, surety bonds are purchased to satisfy occupational licensing requirements set out by a federal, state or local government authority. This requiring party is referred to as the "obligee" and each obligee has a unique bond form outlining the terms of the bond contract and often times referencing state laws and statutes detailing the terms of the bond. These contracts reference state laws and statutes detailing the terms of the bond.

Surety bonds are required in all states to guarantee compliance and financials terms associated with a license or permit across a wide variety of industries and professions. A business demonstrates its commitment to financial responsibility and commitment to ethical business practices with a surety bond. Common surety bonds required to obtain a professional license include:

- Construction contractors surety bonds

- Auto dealer license surety bonds

- Public insurance adjuster license surety bonds

- Credit repair service/provider license surety bonds

- Private investigator license surety bonds

- Mortgage broker or loan originator license surety bonds

- Many other types of professional license surety bonds

How does the Surety Bonding Process Work?

Most people and businesses have no idea what a surety bond is until they are told that they need to post a surety bond. Once you are informed that you or your business must furnish a surety bond, it is a good idea to do some online research on the specific bond requirement. You should also start by contacting an agency that specializes in providing surety bonds. These agencies are knowledgeable about the various requirements, they typically work with reputable A-rated surety bond companies, offer competitive pricing and can guide you through the process of securing your surety bond.

As part of the surety bond application, the applicant will usually need to provide basic information on the business and its owners such as names, addresses, and years in business. The application information may also include employer identification numbers, social security numbers, and occupational license numbers so underwriters can review personal and business credit history. In some cases business and/or personal financials may also be requested by the surety company.

There are two other techniques that are commonly used to strengthen a surety bond application and help secure an approval or get a lower premium. These are the use of collateral or co-signers. Collateral in the form of cash or an irrevocable letter of credit from a bank can be deposited with the carrier to be drawn upon in the event of a claim. Similarly, a co-signer with a superior credit history to the owners may allow an underwriter to offer a lower rate for the surety bond.

Once the application has been reviewed (either electronically or by surety company underwriters), the submission will be given a risk category and a corresponding premium will be assigned based on the surety company's applicable rate filings. The premium is the price that the applicant will pay for the bond for the designated term.

How Long Does it Take to Get a Surety Bond?

Getting a surety bond is typically a quick and painless process. Frequently, applicants can be approved the same day and receive the surety bond the next day. Some bonding companies have simple user friendly online quote request forms that only take a few minutes to complete. An applicant will typically need to be prepared to provide basic information about the bond required, the business, personal information such as name, address, and social security.

Much of the underwriting is automated to allow for rapid approvals and pricing. In some cases, additional information may be required of the applicant but this information can usually be sent to the agent electronically.

The only place that you may need to wait is when submitting your bond to the obligee if they require submission of the bond and your application documents in person.

Who Does a Surety Bond Protect?

Unlike most insurance policies, surety bonds do not protect (or provide coverage to) the owner of the policy (the bond). A surety bond is typically written to protect, indemnify, or provide a financial guarantee to third parties such as customers, suppliers or state taxpayers. If one of these parties is damaged financially by the principal's violation of bonding terms and conditions then a claim may be filed against the bond. The claim is then investigated by the obligee and if determined to be valid, the insurance company and the principal are typically liable for any damages up to full amount of the bond. The surety company has agreed to undertake the risk in exchange for a premium paid by the principal.

Which Surety Bond Do I Need?

Surety Bonds Direct offers thousands of different types of surety bonds, so it’s important to ensure that your business has the right one. In most cases, the obligee (the party that requires your business to obtain the surety bond) will specify the details of the bond you need. This information will include the bond type, bond amount, and any other specific requirements the obligee may impose.

However, surety bond requirements also vary greatly by state. Click to find surety bonds in your state.

How Much Does a Surety Bond Cost?

The premium that a business will pay for a surety bond is a percentage of the bond's coverage amount. The final amount of the premium is determined by several factors, including:

- The coverage amount required by the bond

- The type of surety bond

- The applicant's credit score

- The applicant’s financial history

For more information on what you can expect to pay for a surety bond, see Surety Bond Costs Explained, or use our free Surety Bond Cost Calculator to calculate your premium. And don’t forget that credit problems don’t have to prevent your business from getting a surety bond—see How to Get a Surety Bond with Bad Credit for more information.

Common Surety Bond Questions

Many of our customers have questions about surety bonds, such as:

- Can I get a surety bond for my new business through Surety Bonds Direct?

- How can I get a surety bond with bad credit?

- Can I get surety bond premium financing to make my premiums more affordable?

- What's the best way to choose a surety bond company?

We answer all of these questions and more in our Surety Bonds FAQ.

History of Surety Bonds

A Mesopotamian tablet dating back to about 2750 BC is believed to be the first use of surety. Over the next several hundreds of years, evidence of the use of various forms of surety and surety bonds exists in Rome, Persia, Babylon and Medieval England. Corporate uses of surety bonds are first known to have existed in the United States and England in the mid-1800s. The Heard Act (later replaced by the Miller Act) was passed in the United States in 1894 requiring that surety bonds be posted to guarantee performance of contractual duties for all construction projects involving federal funding.

What is a Surety Bond Infographic

Jason O'Leary

Jason O'Leary

updated: