How Much Does a Surety Bond Cost?

Several factors contribute to the cost of a bond. The price is generally set as a percentage of the bond amount. The cost can vary based on the specific applicant.

Several factors contribute to how a surety company calculates the cost of a bond. The price is generally set as a percentage of the bond amount. The cost can vary based on the specific applicant.

The cost of a surety bond is called the premium and is set as a percentage of the bond amount (the "bond amount" is sometimes referred to as the "penalty," "coverage," or "bond limit"). The percentage can vary widely, ranging anywhere from 0.5% to over 10% of the bond amount.

Because the cost can vary so much, it is important to rely on experienced surety bond experts to ensure you get the right bond from a reputable surety at the lowest cost available for your specific situation. You may also want to try ourSurety Bond Cost Calculator for a quick estimate of your bond cost.

An underwriter is an individual who evaluates the risk of loss to the surety company associated with a particular surety bond and applicant, based on the applicant’s credit score and other factors.

What is the Average Cost of a Surety Bond? Who Sets the Price of Surety Bonds?

Watch our video explaining how the cost of a surety bond is determined.

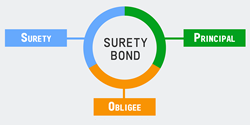

To get a better picture of how surety bonds are priced, it is first helpful to understand a bit about the bonding process, the parties involved, and the respective roles and responsibilities in determining your bond price or premium. If you haven't done so already, you may want to check out What is a Surety Bond? to get started.

- The process starts with another party, referred to as the obligee, who informs you or your business of a surety bond requirement. Usually, the obligee is a government agency. For some types of surety bonds, particularly contract bonds such as bid bonds, payment bonds, and performance bonds, the obligee may be a private party. The business owner who purchases the surety bond is referred to as the principal.

- You then research the type of surety bond that you need and the specific requirements for that type of surety bond in your state. Types of surety bonds that are federally required, such as BMC-84 freight broker bonds, are the same in every state. State license bonds, such as contractor license bonds and auto dealer license bonds, have widely varying bond requirements by state.

- You and your business work with a licensed agent or broker to apply for the bond through a surety company.

- The surety company's underwriters assess a variety of factors, such as the applicant’s credit history and the risk of the bond type.

- You are then provided with a surety bond quote with the bond premium. The premium, which is a percentage of the total bond amount, can vary according to the underwriter's risk assessment.

- If you and your business accept the quote, you pay the surety bond premium, and the bond company files the bond form paperwork.

It is beneficial to work with a surety-specialized broker for this process because brokers will generally get price quotes from multiple sureties. Remember, a broker is a licensed agent who represents your interests.

The surety companies determine the cost of your bond based on rate filings that have been approved by state insurance departments. Essentially, the surety company has determined different risk categories and assigned corresponding rates (prices) to each. The agents can then offer these prices to customers in the market.

How is the Bond Cost Calculated?

As discussed above, the surety companies use bond rate categories for each type of surety bond. The rate categories reflect the expected risk of loss determined for each risk type. Rates typically range from 0.5% to over 10% of the total bond amount. The rate multiplied by the bond amount equals the cost of the bond for each year.

The bond cost is then adjusted up or down as required for partial or multi-year terms. Many surety bond companies will offer a multi-year discount for bonds purchased for 2 or more year terms. For example, one large surety offers a 25% discount for each subsequent year purchased upfront for many types of surety bonds.

The key factors that may be used by surety underwriters to determine the rate category for a bond include:

- Your credit score and history (including payment trends and any judgments, liens, charge-offs or bankruptcies). The sureties and their underwriters believe there is a relationship between credit history and likelihood of adhering to bonding terms and conditions. An applicant who has not satisfied financial obligations in the past may be more likely to violate a bonding requirement, and thus presents a higher risk of loss for the insurer.

- Your experience and business credit history. The surety underwriter may review various sources to evaluate business credit history.

- The risk of loss to the surety bond company associated with the specific bond obligation.

- Your business and/or personal financial statements including balance sheets and income statements. This provides underwriters with a better understanding of financial wherewithal and ability to stand behind (indemnify) the bond obligation in the event of a claim.

- Licensing history. A review of applicable licensing databases can be used to determine if there has been a history of complaints, compliance violations or claims associated with the applicant’s past endeavors.

In most cases, only a few of the items above will be used to evaluate and price a request.

Bonds that guarantee tax or other payment commitments typically command a higher bond rate than those that ensure compliance with license or permit requirements.

Fixed Price & No Credit Check Bonds

Some bonds are available for set prices, regardless of the applicant’s credit. Common fixed price and no credit check bonds include:

- Notary public bonds

- ERISA bonds for pension fund fiduciaries

- Public insurance adjuster bonds

- Private investigator bonds

- Many city and county contractor license bonds

- Oregon contractor license bonds

- Fidelity bonds, such as business service bonds and janitorial service bonds

Other types of bonds are offered at low fixed prices because they are considered to be "safe" bonds by the surety companies due to low claim activity against the bonds. Some bonds such as certificate of title bonds and highway permit bonds are usually available without a credit check at 1% or 1.5% of the bond amount.

It's important to note that even on fixed-price, no-credit bonds other qualifying factors may be considered for eligibility such as bankruptcy history, prior surety bond claim activity, felony convictions, or other bond-specific questions.

Are Surety Bond Premiums More Expensive for New Businesses or Bad Credit?

Credit Scores Impact Bond Prices

In many cases, new businesses and applicants with bad credit will face somewhat higher surety bond premiums. That's because a surety assesses applicants on the applicant’s perceived level of risk. Note that for most bonds, the credit report -not only the credit score- is used by the underwriter, so liens, bankruptcy, and previous claims will also be reviewed.

A surety will often see an applicant as high-risk if the applicant is a new business that may not have a stable cash flow, or that has had credit problems in the past. The surety wants to ensure that any business or business owner whom it works with is likely to honor their contractual obligations.

For example, the cost of a $20,000 bond could range dramatically based on credit:

| Credit Score | 750 | 670 | 600 |

|---|---|---|---|

| Surety Bond Penalty | $20,000 | $20,000 | $20,000 |

| Rate | 1% | 2% | 5% |

| Surety Bond Cost (Premium) | $200 | $400 | $1,000 |

Fortunately, Surety Bonds Direct makes it easy to get a surety bond with bad credit or no credit. We recognize that bad credit is a common problem for many business owners and that anyone should be able to get the surety bond they need for an affordable premium. We offer many options for getting a surety bond with bad credit, and we work with a wide network of surety companies who specialize in customers with credit problems.

Can My Surety Bond Cost Change After the Bond Is Issued?

In most cases, the cost of your bond is fixed for the entire bond term. However, changes to the bond amount, the term of the bond, or the ownership structure of the bonded company may result in an increase or decrease in the premium (bond cost). Additionally, many bonds contain cancellation provisions in the event that the insurer or the customer needs to terminate the bond.

A mid-term surety bond cancellation may be eligible for a partial return of premium to the customer. It is important to point out that some surety bonds are not cancellable during the term. Other bonds may require an official release from the obligee for cancellation.

Will the Surety Bond Cost Change at Renewal?

The cost of the bond may change at renewal. A good surety agent will shop for a better rate on behalf of the business owner to see if new sureties have entered the market which may be offering better pricing for the bond type.

Most sureties will also reevaluate the application so any changes in the principal’s credit score , licensing status, or changes in the other factors used by the underwriters may impact the renewal bond cost. Renewal costs may also change based on changes in the overall claim and loss history experienced by the surety for a bond class.

How to Get a Free Quote for Your Surety Bond Cost

Start with our easy online quote request form. For most surety bonds, your free quote will take only 2 minutes, and there’s never any obligation! If you prefer, call 800-608-9950 to speak with a surety bond specialist. The helpful and knowledgeable staff at Surety Bonds Direct has years of experience delivering surety bonds at great rates to all types of customers across the country. We handle bonds for both new and existing businesses, and our expertise allows us to secure excellent bond rates for customers with poor credit and with excellent credit alike.

We use a simplified bonding process and leverage our deep surety marketplace expertise to negotiate the best rates with leading surety companies on your behalf. Premium financing options may also be available to spread out the cost of your bond over time.

Jason O'Leary

Jason O'Leary

updated: