Becoming a freight broker is a popular profession with a growth rate of about 7% through 2028 according to Zippa. But becoming a freight broker requires work and there are some fixed and variable costs you should understand first.

This article will cover:

- The 8 freight broker license costs (not all of them are required)

- The two primary required costs including the surety bond

- What a surety bond is and why it's required

- The variable costs and options available

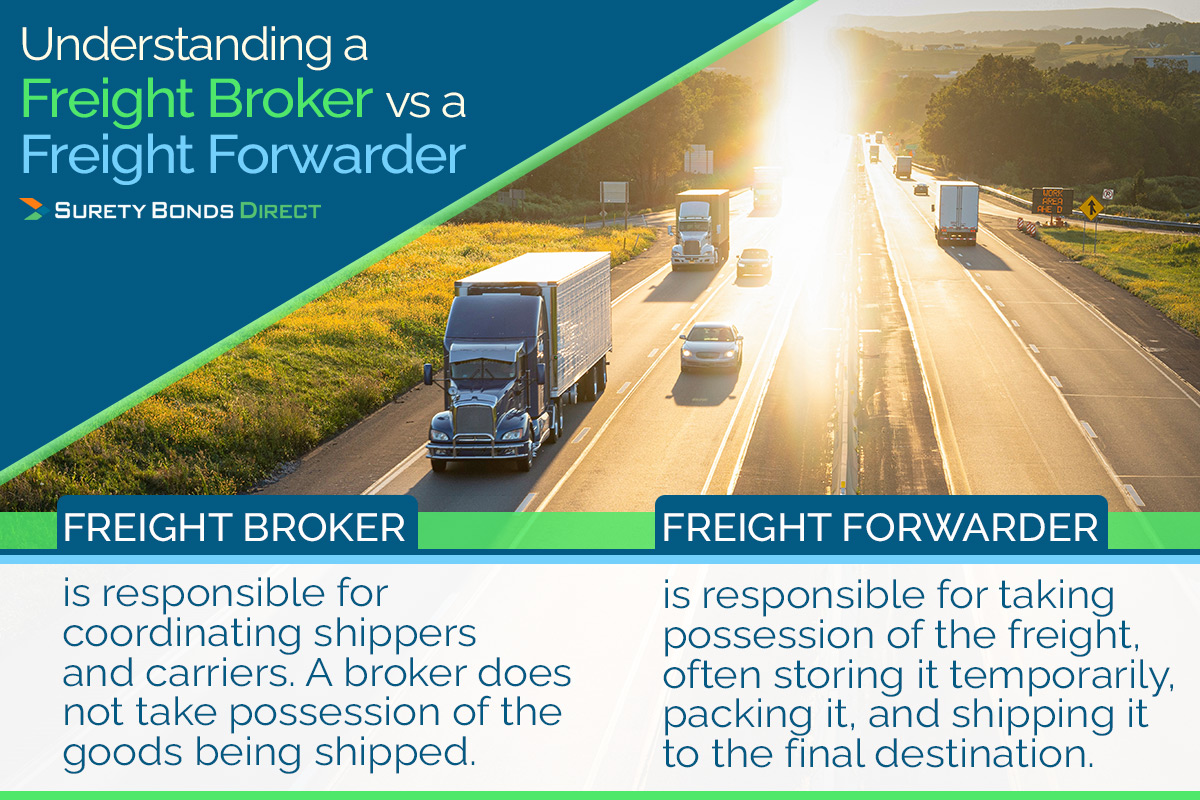

Understanding a Freight Broker vs a Freight Forwarder

Before we dive into freight broker license costs, it's important to understand the difference between a freight broker and a freight forwarder.

Freight Broker

In general a freight broker is responsible for coordinating shippers and carriers. A broker does not take possession of the goods being shipped.

Household Goods Freight Freight Broker

A household goods broker is specifically responsible for coordinating shippers and carriers for transporting household goods across state lines or within state lines. Again, a broker never takes possession of the household goods.

Freight or Household Goods Freight Forwarder

A forwarder is responsible for taking possession of the freight, often storing it temporarily, packing it, and shipping it to the final destination. A freight forwarder does not necessarily operate the motor carriers transporting the goods.

Freight Broker License Cost And Variables

- Application fee (required)

- $75,000 surety bond or trust fund (required)

- Public liability insurance (variable)

- Cargo insurance (variable)

- Incorporation (optional, highly recommended)

- Education (optional, recommended)

- Software (optional, recommended)

- Marketing

Fixed License Costs

1: Application Fee

A non-refundable $300 application fee is required to submit your application.

2: Proof of Insurance Coverage

What Is This Insurance Coverage?

This is not typical insurance coverage. Insurance (as we'll talk about below) typically is purchased to cover you, your business, vehicles, at times the goods you're shipping. This type of insurance is different.

You are "purchasing" or "putting up" $75,000 worth of coverage for the protection of the:

- Shipper

- Owner of the goods

- Consignee

- Carrier company

- FMCSA themselves

This $75,000 is set aside to pay potential claims against you as the broker or forwarder for:

- Late payments

- Stealing from payments

- Shipping delays

- Damage of cargo

- Breach of contract

This is not to say you will wittingly commit any of these acts. In fact, just because a claim was made against you does not mean it was a legitimate claim.

It's best to work with your customers in the case of any dispute before any claim is made.

Claims are capped at the $75,000 amount.

Two Options To Satisfy This $75,000 Proof of Insurance

You have an option to purchase:

- A surety bond

- A trust fund agreement

Trust Fund Agreement

A trust fund company requires the $75,000 to be liquid. In limited cases the trust company will create an installment plan, but this on a case by case basis.

The trust fund company will hold the $75,000 and in most cases a bank fee of 1% to 2% will be charged per year.

Surety Bond

Rather than coming up with $75,000 yourself, you can purchase a surety bond known as a freight broker bond. A surety bond is an insurance-like product written by an insurance company where you pay a small percentage of the $75,000 amount.

The percentage is calculated based on your:

- Personal credit history

- Business or industry experience

- Prior claims on past bonds if applicable

Most freight brokers choose a surety bond because you don't have to come up with or tie up the full $75,000 requirement. Rather you pay a small percentage of just over 1% to 5% (maybe more depending on the situation).

Read our full article explaining the difference between the BMC-84 surety bond and BMC-85 trust fund options.

Variable and Optional Freight Broker License Costs

Cost #3: Public Liability Insurance

As a freight broker or freight forwarder, you can usually waive this insurance requirement.

However, freight forwarders who operate motor carriers are required to purchase this insurance coverage. There are two types:

- Freight: $750,000 to $5 million in coverage depending on the commodities transported. $300,000 for non-hazardous freight moved in vehicles weighing under 10,000 pounds.

- Passengers: $5 million in coverage. $1.5 million for registrants operating only vehicles with seating capacity for 15 passengers or less.

Proof of this insurance is recorded on BMC-91 or BMC-91X forms.

Cost #4: Cargo Insurance

This insurance applies to:

- Household goods motor carriers

- Household goods freight forwarders

Freight brokers do not have to carry this type of insurance. Yet, if you're going to be a freight forwarder of household goods, this is a required cost of running your business.

Variable and Optional Freight Broker Business Costs

Cost #5: Incorporation Fees

If you register with the FMCSA as a sole proprietorship, your social security number will be publicly published on the FMCSA website.

This fact along with business liability make creating a business entity a good idea. Typical costs associated with creating and registering a business entity are:

- $100 to $300 of filing fees based on the state

- $50 to $200 for additional government filing fees depending on the type of company you're creating

- $500 to $700 or more for attorney fees if you use an attorney

- Websites like Legal Zoom charge anywhere from $79 to $350 plus filing fees

Incorporating is a highly variable cost, but one you should consider when setting up a legitimate business.

Cost #6: Education

There are no education requirements for becoming a freight broker or freight forwarder. But if you're new to the industry, understanding the markets, the players in the market, and the expectations is key.

There are numerous education options available:

- $97 online courses

- $400 to $3000 community college or trade schools

- Multiple hundred to thousands of dollar accelerate online seminar style courses

- Plus more

One of the best education options would be to work as a freight broker for another company. Working for a freight broker or forwarder company can help you obtain real experience quickly.

Cost #7: Software

Among the other expenses like:

- Phone

- Phone plan

- Internet access

You will need a software solution to manage your contacts, jobs, and leads. These software solutions range from using a:

- Free software like Google Sheets

- To generic HubSpot contact management system

- To specialized software solutions built specifically for freight brokers

These software costs range from $600 to $1600 per year. Some don't offer public pricing until you speak with a sales person.

Either way, software will be vital to manage the details and relationships in your business.

Cost #8: Marketing

When you strike out on your own, marketing expenses are a must. If nobody knows what you do, how will they be able to purchase your services?

Some marketing expenses for you to consider are:

- Business website

- Content creation

- Online ads

- Attending trade shows

- Networking with other freight brokers and forwarders

All of these costs can range from free to thousands of dollars per month. Remember, these are the costs that drive revenue.

When You Need A Freight Broker Surety Bond Call Surety Bonds Direct

Surety Bonds Direct is a specialized surety bond agency rated as one of the best surety bond companies for freight brokers. We have relationships with multiple surety companies who write freight broker bonds to help you become a bonded carrier. Plus the sureties we work with are "A rated" allowing us to provide you a 100% money back guarantee that your bond will be accepted by the FMCSA.

We're able to get you approved securing the lowest possible price for your freight broker bond.

If you want to know the exact price for your freight broker bond, request a quote today. Quotes are good for 30 days. You can even set an effective date up to 90 days. All freight broker bond quotes are free and there's no obligation to purchase now.

If you'd prefer to talk to a bond specialist, call us at 1-800-608-9950.