Using a travel agent to plan a complex vacation where you need plane tickets, hotels, car rentals, routes to tourist destinations, and set time tables makes sense.

Planning a complex vacation takes a lot of coordination. It's a balance between the "cheapest" prices, quality of service, and speed to meet deadlines.

NVOCCs and ocean freight forwarders are like travel agents, but they coordinate complex logistics of shipping a customer's goods to international destinations. And they both balance "cheapest" prices, quality of service and speed to deliver their clients goods to the destination on time.

NVOCCs and ocean freight forwarders share similar responsibilities. Both are Ocean Transport Intermediaries licensed through the Federal Maritime Commission.

Yet there are a few key responsibilities that differentiate the two.

In this article you'll learn:

- What an NVOCC is and what their responsibilities are

- What an ocean freight forwarder is and what their responsibilities are

- A recap of the important differences

- An overview of getting licensed as both an NVOCC and an ocean freight forwarder

What Is An NVOCC?

NVOCC stands for non-vessel operating common carrier. (You may see non-vessel owner common carrier as well.)

This means an NVOCC does not own the ship carrying the goods. They lease space and containers with shipping companies who own the container ships. If the NVOCC has a big enough operation, they may own their own fleet of shipping containers (again, not the ship).

Conversely, a VOCC or vessel operating (owner) common carrier is the shipping company who owns the ship. VOCCs rely on NVOCCs and ocean freight forwarders to fill up their ships with goods.

An NVOCC forms close relationships and signs contracts with different shipping companies to guarantee the shipment of a certain number of units each year. This guarantee of units shipped allows the NVOCC to negotiate lower shipping rates. Compare this to working directly with a VOCC where you'll be quoted a higher shipping rate each time.

An NVOCC will act as the shipper, even though they do not own the ship itself. This has benefits over an ocean freight forwarder. More on this benefit below.

an NVOCC's main responsibility is to:

- Ensure safe and timely transportation of customers goods

- Proper packing and sometimes transportation of goods to the container ship

- Creation of shipping paperwork

- Filing of all necessary paperwork

- Customs clearance

- Route selection based on their existing relationships

- Tracking the goods through the shipping process

The biggest differentiator of an NVOCC compared to an ocean freight forwarder is issuing a bill of lading. This will be covered in detail below.

What Is An Ocean Freight Forwarder?

An ocean freight forwarder is an agent for the shipper. They are much closer to the travel agent comparison discussed earlier.

Ocean freight forwarders handle the shipping of goods from a company's warehouse to port and onto the final destination.

These responsibilities include:

- Finding and negotiating land transportation of goods

- Possible warehousing and storage of goods

- Finding and negotiating container ship transportation of goods to the final port

- Work with multiple shippers or NVOCCs to find the best mix of fastest route, lowest price and the reliability of all shippers during the process

An ocean freight forwarder does not lease any space on a ship. They don't create and sign their own bill of lading for your shipment. They rely on the Master Bill of Lading.

This gives the Freight Forwarder more flexibility than an NVOCC which works with one or a limited number of shipping companies they've built relationships with. An ocean freight forwarder has a greater number of shipping companies and routes available to choose from. This gives them the ability to balance price, speed, and quality to hit a company's shipping goals.

And this is where the differences between Ocean Freight Forwarders and NVOCCs begin to blur. Many NVOCCs are freight forwarders and freight forwarders will work with NVOCCs to build out their shipping itinerary..

NVOCCs who aren't freight forwarders can handle many of the same responsibilities as a freight forwarder such as land base shipping and warehousing because they hire a freight forwarder to help with the responsibilities they are not licensed to complete.

This is where the confusion and intermingling of responsibilities comes from.

The 5 Major Differences Between an NVOCC And an Ocean Freight Forwarder

1. The Bill of Lading

The bill of lading is a legal document that acts as a:

- Receipt of goods

- Full descriptions of goods

- Description of containers used

- Title to the goods

- Even a contract to transport the goods

Let's Walk Through An Example

A company wants to ship goods to a foreign port.

Scenario 1: NVOCC

The NVOCC will issue a bill of lading to the company as receipt of the goods. This bill of lading will have a full description of the goods, the containers used, and the consignee or purchaser of the goods at the final port.

When the VOCC takes possession of the goods, the NVOCC will receive a Master Bill of Lading as official receipt of the goods.

Scenario 2: Ocean Freight Forwarder

A freight forwarder will take receipt of the company's goods. And since they work as an agent, they may have many companies they're collecting goods from to be placed on the same ship going to the same destination.

Once the shipping company takes possession of the goods, they'll issue the Master Bill of Lading. In this case the Master Bill of Lading describes all of the goods from the freight forwarder. This means all the goods from every company the freight forwarder works for. The consignee for each individual group of goods is not listed on this bill of lading. Rather only the shipping company's NVOCC or agent will be listed.

The benefit of using an NVOCC is knowing the consignee will take receipt of the goods. Title (ownership) of the goods will be transferred.

If anything were to go wrong, you have a clear path of receipt of the goods through the process.

When using a freight forwarder, you lose this path of receipt once the shipping company takes control.

2. Governing Standards

Freight Forwarders have their own governing body called the International Federation of Freight Forwarders Association.

NVOCCs are independent. They follow their own standards for deciding how to run their business.

3. Availability of Routes And Shipping Companies

Since freight forwarders act as agents, they can research and choose from many routes and shipping companies to get the best price, speed, and reliability.

NVOCCs are carriers and have relationships with a select group of shipping companies. This limits the availability of routes and other shipping companies who might be less expensive.

Yet, an NVOCC might still be a better option if you use the same route over and over again. The NVOCC will be able to quote you lower rates based on the relationship and repeat business.

4. Assets Owned and Operated

Freight forwarders may own and operate warehousing to help transport goods from airports, trains, and trucks to the ports for ocean transportation. Freight forwarders do not own any shipping containers.

NVOCCs by definition do not own warehouses or manage the land transportation of goods. They can and in many cases do because they become a company that operates as both the freight forwarder and the carrier.

NOVCCs do control, and many times own, a fleet of shipping containers for use on ships.

5. How They Get Paid

Freight forwarders charge a flat fee for putting the entire shipping process together.

NVOCCs charge a percentage profit based on the goods being shipped.

NVOCC And Ocean Freight Forwarder Licensing

To recap, both an NVOCC and ocean freight forwarder are Ocean Transportation Intermediaries (OTI) licensed by the Federal Maritime Commission (FMC) according to the Shipping Act of 1984.

NVOCCs and ocean freight forwarders originating from the United States are required to be licensed through the Federal Maritime Commission in order to advertise themselves to the public.

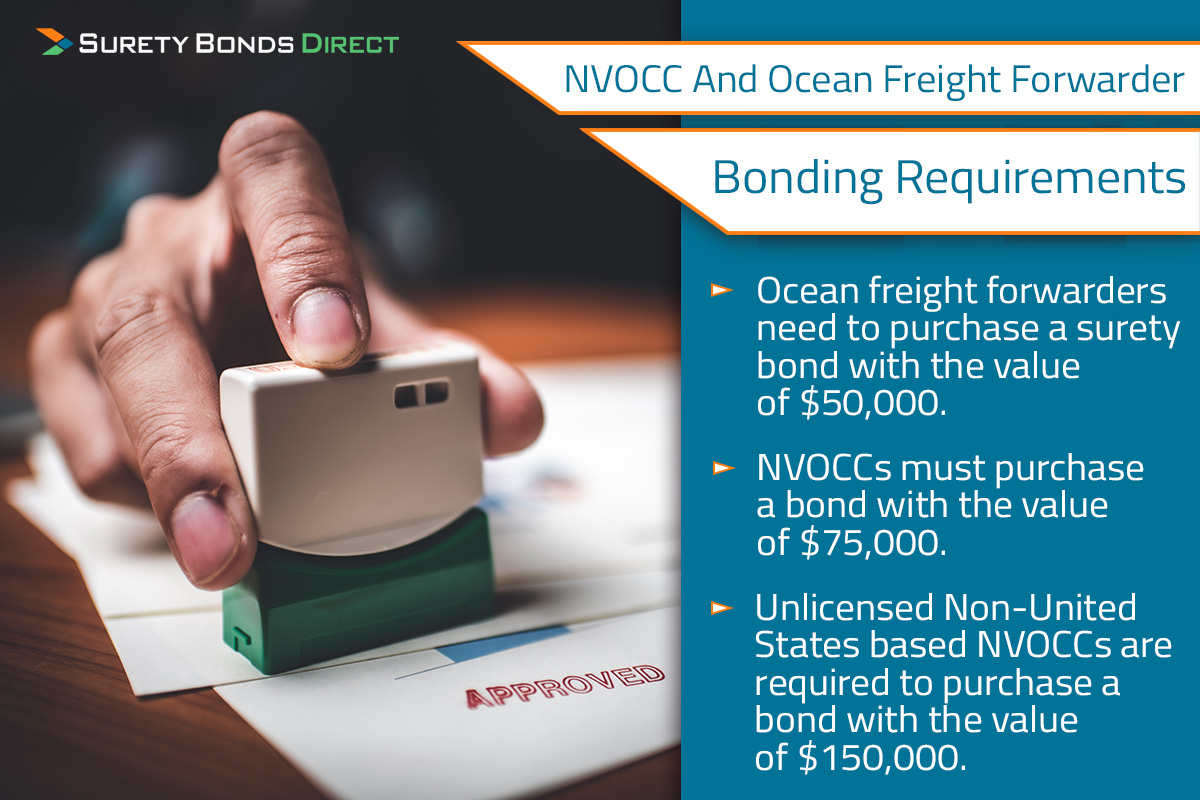

NVOCC And Ocean Freight Forwarder Bonding Requirements

Watch our video explaining the details of the NVOCC bond and OTI bonding requirements.

As part of licensing, both NVOCC And ocean freight forwarders are required to submit proof of financial responsibility in the form of a surety bond often called a FMC-48 bond (named after the form number), insurance policies, and sometimes additional surety obligations.

- Ocean freight forwarders need to purchase a surety bond with the value of $50,000.

- NVOCCs must purchase a bond with the value of $75,000.

- Unlicensed Non-United States based NVOCCs are required to purchase a bond with the value of $150,000.

NVOCCs who manage routes from the United States to China may file Optional Rider, called the "China Rider," for additional financial responsibility to meet the Chinese government's requirements.

This rider adds $50,000 to the NVOCC bond and pays for any fines and penalties for activities imposed by the Chinese government.

The difference in bond amount is due to NVOCC's taking legal responsibility as the shipper for the customer's goods under the bill of lading.

If partners form a business entity of Ocean Transportation Intermediaries, they must furnish financial responsibility according to form 69. Here's how to determine the proper amount

Step 1: Add the total of obtaining a surety bond according to above (either $50k or $75k) for each member.

Step 2: Choose the lesser total from step 1 or $3,000,000 in aggregate. Read more about these requirements here.

This bond protects the companies using any of the OTIs in the case of lost or damaged goods during shipping.

How Much Does an OTI Surety Bond Cost?

We've covered the bond amounts as:

- $50,000 for an ocean freight forwarder

- $75,000 for an NVOCC

- $150,000 for unlicensed non-US based NVOCCs

This amount is not the cost. The cost to purchase this bond is based on personal credit, years of experience, claims history, and/or license infractions. These factors are considered by the underwriter to determines a premium rate. Most OTI bonds we quote at Surety Bonds Direct are 1%.

| Bond Amount | Rate | Cost |

|---|---|---|

| $50,000 | 1% | $500 |

| $75,000 | 1% | $750 |

| $10,000 | 1% | $1,500 |

How Often Does A Bond Renew?

NVOCC and ocean freight forwarder bonds renew on a yearly basis.

Now You Know The Difference Between an NVOCC And An Ocean Freight Forwarder

The difference may seem small but when it comes to the bill of lading and responsibility over the goods, it's important.

The licensing process for both NVOCCs and ocean freight forwarders starts with form FMC-18 and includes applicable fees, experience requirements, and more depending on whether you're applying as a sole proprietor or a business entity.

When it comes time to secure your surety bond for form FMC-48 or FMC-69, get a free quote or call us at 1-800-608-9950. Our bond experts will secure the best rate for your bond.