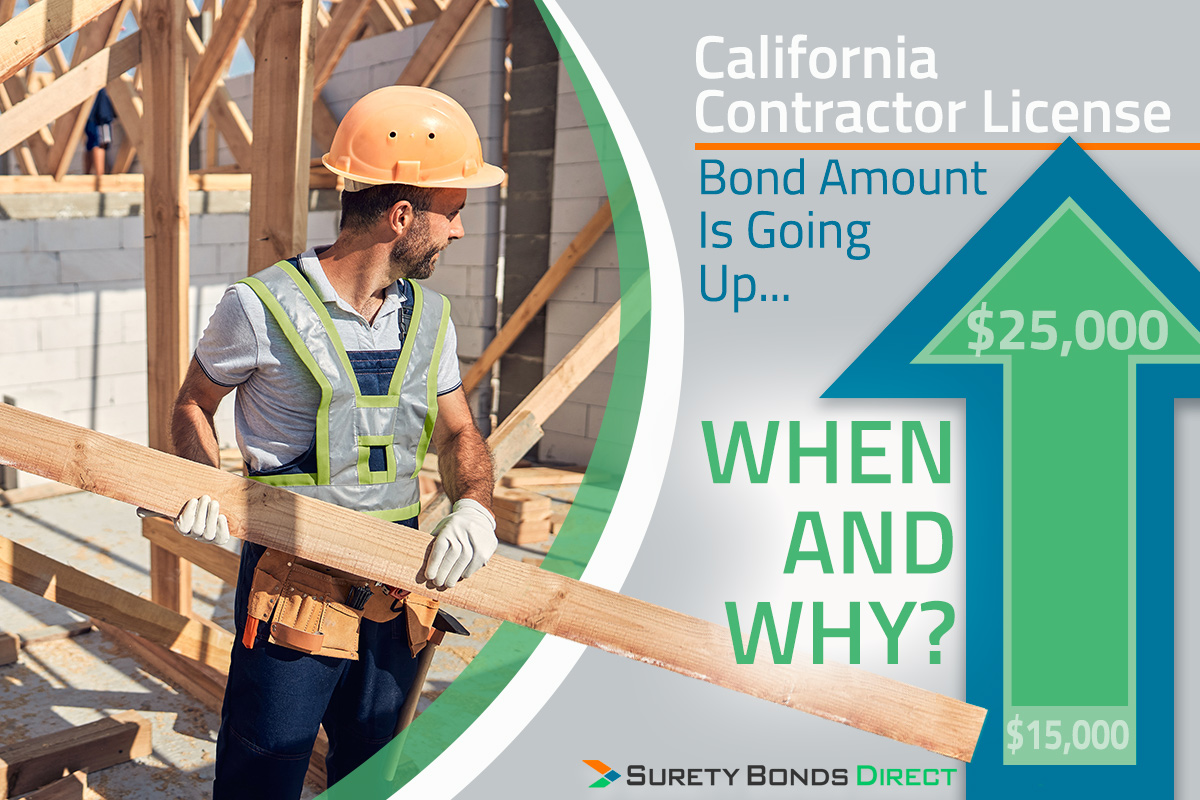

January 1st, 2023 California contractor license bond amounts are increasing to $25,000.

This new amount applies to:

- Contractor license bond: $15,000 changing to $25,000

- Qualifying individual bond: $12,500 changing to $25,000

Surety companies were notified with instructions for increasing all licensees' Contractor Bonds and Bonds for Qualified Individuals on file with the CSLB.

Different surety insurance companies are handling increasing the bond in different ways.

- Some surety companies are no longer going to offer contractors license bonds in California. These bonds will be canceled and you will need to purchase and file a new bond.

- Most surety companies will create a rider for you and file the rider with the CSLB to adjust the your bond. You're still responsible for paying the pro-rated bond premium for the increased amount. (See below for an example).

- With the rider, your rate (what you pay as a percentage of the bond amount) will most likely not change, but your premium will increase. For example if your premium rate was 3% on a $15,000 bond, that's $450. Now your premium will be 3% on the $25,000 bond or $750.

Pro-Rating Bond Payment Examples

Some surety companies are requiring the prorated (increased) premium to be paid by December 1st (due to 30-day cancellation notie requirement on the bond). Here's what that looks like:

Scenario One:

If your rate is 3% and your renewal date is July 1st, you have six months before your renewal, but your license has to be covered by the new $25,000 bond amount starting January 1st.

Old Bond Amount:

3% rate * $15,000 bond amount = $450 premium / 6 months = $225

New Bond Amount:

3% rate * $25,000 bond amount = $750 premium / 6 months = $375

You would pay:

$375 - $225 = $150

Your bond premiums are paid through to your scheduled renewal date.

Scenario Two:

If your rate is 3% and your renewal date is July 1st but you don't pay the prorated difference by December 1st, your surety company may prorate the length of your bond instead. Here's how this works.

Old Bond Amount Per Day:

3% rate * $15,000 bond amount = $450 premium / 365 days = $1.23 per day

New Bond Amount Per Day:

3% rate * $25,000 bond amount = $750 / 365 days = $2.05 per day

You Owe Per Day Starting January 1st:

$2.05 - $1.23 = $0.82 per day

Current Renewal Date: July 1st

If no premium is paid on time, your existing payment of $450 will have 50% ($225) "banked" to apply to 2023. At $2.05/day, that will yield 110 days that you’ve paid for at the new bond amount, so your new bond expiration date will be April 20th (110 days into 2023).

When you renew your bond in March 2023, you’ll be renewing a $25,000 bond.

It's important you contact your surety company for specific instructions on your bond.

Are You A Surety Bonds Direct Customer?

If you're a Surety Bonds Direct customer, we will be contacting you to make sure your bond is taken care of.

Rest assured that on January 1, 2023, your bond will be increased to $25,000 regardless of the procedures of the specific surety company. Surety Bonds Direct will contact each CSLB bonded principal directly to ensure that you know the process and additional premium.

Not A Surety Bonds Direct Customer?

If you're not a Surety Bonds Direct customer, contact your surety broker to find out how your surety insurance company is handling this change. This might be a good opportunity to shop and see if the rate of your contractor bond is competitive and possibly obtain a lower rate.

Are You Getting A New Contractors License Bond or Bond of Qualifying Individual?

If you're filing for a new contractor bond or bond of qualifying individual, contact us (1-800-608-9950) for help or request a free quote.

You will purchase a prorated bond for the remainder of the year based on the $15,000 bond amount. The remaining period of your year will be prorated based on the $25,000 bond amount.

For example, if you purchased a bond on November, 1st 2022 and your bond rate is 3%:

2022 Payment:

3% rate * $15,000 bond amount / 12 months = $37.50 * 2 remaining months = $75.

3% rate * $25,000 bond amount / 12 months = $62.50 * 10 months in 2023 = $625.

Total amount due: $700.

Get Your Plan Finalized Now

It's best if you contact your surety broker and find out the plan for your specific bond.

This way you won't be caught rushing to figure out specifics when your renewal data comes.

Why Did The CSLB Decide To Increase Surety Bond Amounts To $25,000?

It All Came Down To Question 8 In 2016

The increase is the result of Senate Bill 607, signed into law in 2021.

This decision goes back to 2016 and 16 questions the CSLB was asked. Question eight asked the CSLB to describe its plan for "financially protecting consumers" after the 2016 passage of Senate Bill 467.

Senate Bill 467 eliminated the requirement for contractors to have $2,500 in working capital as a condition of getting their license.

In response to question 8, in 2016 the CSLB increased the contractor license bond amount from $12,500 to $15,000 to cover for the $2,500 of working capital, no longer required.

During this time the CLSB stated:

"Greater consumer protection is realized with the increase in the contractor bond because a construction project can easily exceed $15,000 in costs and potential financial injury to a consumer."

It appears they knew back in 2016, $15,000 was not an adequate amount. Fast forward to September 2019, a study was appointed to evaluate whether:

- $15,000 was sufficient

- If an increase is necessary

The CSLB Is Primarily Concerned With 2 Things

First is consumer protection. We'll get to the figures in a minute.

Second, is "barrier to entry" for future contractors.

Let's first cover the "barrier to entry" question.

Did a $15,000 Bond Deter New Contractors From Getting Their License?

The CSLB surveyed 4,132 California contractors, asking them:

"Do you believe the cost of having a contractor's bond prevents people from joining the construction industry?"

| Do you believe the cost of having a contractor's bond prevents people from joining the construction industry? | Number of Respondents | Percentage of Total Responses |

|---|---|---|

| Yes | 622 | 15% |

| No | 3,510 | 86% |

| TOTAL | 4,132 | 100% |

86% of licensed contractors polled do not believe the cost was a barrier of entry.

A previous report made the argument that a lower barrier to entry was beneficial.

A Lower Barrier To Entry Is Good

On one hand, it was argued that a lower barrier to entry:

- Lowers the price of construction jobs

- Opens the ability of all income levels to retain construction services

An increase in bond value would mean fewer contractors and higher rates as a result.

Credit Worthiness Is an Issue For Contractors

It was also brought up that many contractors struggle with credit worthiness. A lower credit score means the premium on the bond would be higher causing an affordability issue with some contractors pushing them to forgo getting licensed.

Do You Even Need A Bond?

As a contractor, you used to be able to deposit a full $15,000 certificate of deposit in your bank.

However, it was discovered:

- Most contractors didn't have $15,000 in cash or didn't want to tie up that much capital to get their license.

- When a claim was made against a contractor who chose this method, the money was promptly withdrawn before the claim had to be paid.

This was never a popular option. According to the CSLB, only 28 license applicants have ever posted a $15,000 certificate of deposit.

Here's the real question the study was assessing...

Does a $15,000 Bond Protect the Consumer From Unscrupulous Contractors?

Let's look at the figures the CSLB discovered, which led to the increase of the contractor's bond to $25,000.

1. How Many Complaints Were Filed By Residential Consumers Between 2015 And 2020?

| Year | $501 - $5,000 | $5,001 - $10,000 | $10,001 - $15,000 | $15,001 - $25,000 | $25,001 - $50,000 | $50,001 - $75,000 | $75,001 - $100,000 | $100,000 - $500,000 | Over $500,000 |

|---|---|---|---|---|---|---|---|---|---|

| 2015 | 31.01% | 17.40% | 10.00% | 11.40% | 12.30% | 5.30% | 2.50% | 7.90% | 2.10% |

| 2016 | 28.90% | 16.70% | 10.10% | 12.50% | 12.50% | 4.80% | 2.80% | 9.70% | 2.60% |

| 2017 | 25.40% | 16.50% | 8.70% | 12.30% | 16.10% | 6.00% | 3.20% | 9.10% | 2.60% |

| 2018 | 25.30% | 15.40% | 8.80% | 12.70% | 16.10% | 6.10% | 3.40% | 9.90% | 2.40% |

| 2019 | 22.40% | 15.00% | 9.50% | 12.90% | 16.30% | 6.20% | 3.80% | 10.80% | 3.00% |

| 2020 | 24.30% | 13.10% | 8.10% | 14.50% | 17.40% | 5.80% | 3.50% | 10.20% | 2.90% |

| AVG | 26.20% | 15.70% | 9.20% | 12.70% | 15.10% | 5.70% | 3.20% | 9.60% | 2.60% |

- 48.9% of complaints involved contracts over $15,000, more than the bonding amount

- 28% of complaints were for contracts between $15,000 and $25,000

- 25% of complaints were for contracts between $5,000 and $15,000

28% is not much higher than 25%, but the number of complaints between $15,000 and $25,000 has been rising every year.

Plus the dollar value of contracts have been steadily rising even before the current inflationary boom.

Finally, 22% of claimants each year are limited to the aggregate liability cap of $7,500. What does this mean?

Aggregate Liability Cap

When two or more successful claims are placed against the same bond, the consumer is restricted to a maximum of $7,500 claim payout.

$7,500 is not much recourse when most construction contracts for remodeling are in excess of $60,424.

2. The Contract Cost Of Remodeling Projects

| Project | Level | Cost |

|---|---|---|

| Bathroom Remodel | Midrange | $24,757 |

| Bathroom Remodel | Upscale | $75,763 |

| Bathroom Addition | Midrange | $58,038 |

| Bathroom Addition | Upscale | $104,722 |

| Deck Addition | Composite | $22,762 |

| Deck Addition | Wood | $18,059 |

| Entry Door Replacement | Steel | $2,048 |

| Garage Door Replacement | ---- | $3,874 |

| Major Kitchen Remodel | Midrange | $75,292 |

| Major Kitchen Remodel | Upscale | $148,216 |

| Manufactured Stone Veneer | ---- | $10,175 |

| Master Suite Addition | Midrange | $159,510 |

| Master Suite Addition | Upscale | $325,452 |

| Minor Kitchen Remodel | Midrange | $26,150 |

| Roofing Replacement | Asphalt Shingles | $27,769 |

| Roofing Replacement | Metal | $46,932 |

| Siding Replacement | Fiber-Cement | $20,064 |

| Siding Replacement | Vinyl | $16,937 |

| Window Replacement | Vinyl | $19,184 |

| Window Replacement | Wood | $22,976 |

| Avg Cost of Improvements In Chart | $60,434 |

- The average cost of a significant remodeling project is $60,424.

- The middle range cost is between $15,000 and $25,000.

- The high end additions and remodels are north of $100,000.

It's no question over time construction costs will continue to rise, even outside of inflation pressures.

3. Residential vs. Commercial Projects

Finally, the CSLB discovered that most complaints were made by residential homeowners.

Commercial construction projects tend to go into the millions of dollars. The business(s) contracting the project will consult attorneys or obtain bonds or insurance to protect themselves because of the amount of money involved.

Homeowners are much less likely to go through the trouble of hiring an attorney or purchasing insurance for a remodeling project.

From a consumer protection angle, it's clear the $15,000 bond amount is becoming obsolete. Add to this the aggregated liability cap of $7,500 and it's clear why the CSLB determined raising the bond amount was appropriate.

Considering Other States

The CSLB looked into the bonding policies of other states for guidance. Arizona, Hawaii, Washington, and others have similar bonding requirements to California.

| State | Bond and Financial Requirements |

|---|---|

| Arizona | License bonds range from $2,500 to $100,000. The amount of the bond is based on the type of license and anticipated volume of work |

| Hawaii | Bonds in varying amounts are required; the minimum is $5,000. Whether a bond is required at all, as well as the amount of the bond is based on financial statements provided by the applicant and what kind of work is being performed. |

| Louisiana | Contractors shall post a bond or other surety in the minimum amount of $1,000. Financial statements are provided with the license application. |

| Nevada | Bonds range from $1,000 to $500,000 based on financial data provided by applicants. |

| Oregon | Contractors are divided by residential services or commercial services. Required commercial services bonds range from $20,000 to $75,000. Required residential services bond range from $10,000 to $20,000. |

| Utah | Contractors are classified by the value of their contracts and their annual volume of work. Bonds between $15,000 and $50,000 may be required depending on contractor’s debt. |

| Washington | Contractors are divided between general and specialty. For general contractors, the bond amount is $12,000. For specialty contractors, the bond amount is $6,000. |

Bonds of Qualifying Individuals

You may never have obtained a bond of qualifying individual before.

Qualifying Individual

A qualifying individual bond is when the individual overseeing a construction project is working for a business that has the official contractors license. This individual does not have the contractors license themselves.

Every year since 1967, when the contractor bond amount was increased for the first time, the qualifying individual bond was increased in step.

The only time this did not happen was in 2019. The qualifying individual bond was kept at $12,500. The CSLB looked for reasons why the increase did not happen... no concrete reasons could be found.

Plus the CSLB found that in situations when the "qualified individual" was in charge of a construction project, no project managers had the qualifying individual bond. Rather the licensed business would pay another bonded qualified individual for the use of their name on the license application.

When you look at the data and consider the responsibilities of a qualified individual, it was clear that the CSLB would raise the amount of this bond to match the license bond.

Expect Another Increase By 2025?

Looking at the past increases, especially as of late, it seems every three years an increase is expected to happen.

This would put us at the end of 2025 when the next potential increase could happen. But the only way to be sure is consistently stay up to date with the CSLB news.

Right now, you have to get your current California contractor surety bond in order.