Understanding the Role of Surety Bond Companies

What do surety bond companies do?

What role do surety bond companies play in the business and legal transactions that keep our world running?

Consider this: What do all of the following relationships have in common?

- A contractor accepting a remodeling contract on a client’s home

- An automobile dealer selling a customer a used vehicle

- A public insurance adjuster negotiating a claim on its client’s behalf

- A mortgage broker helping its client secure a mortgage from a lender

- A fiduciary managing the assets in an employee benefit plan

The answer is: All of these business and legal relationships require trust and honesty and, in many states, trust and honesty are guaranteed and enforced through the legal mechanism of surety bonds.

The purpose of a surety bond is to allow the obligee (or a principal’s client) to obtain redress from the principal if the principal breaks the law or fails to honor a contract.

To obtain a license for many professions, or to enter into certain types of legal arrangements, you’ll need to first obtain a surety bond. So, what is a surety bond, and how do surety bond companies work? What role do surety bond companies play in creating accountability between businesses and individuals? Our goal in today’s article is to show you the answers to these important questions.

Understanding Surety Bonds

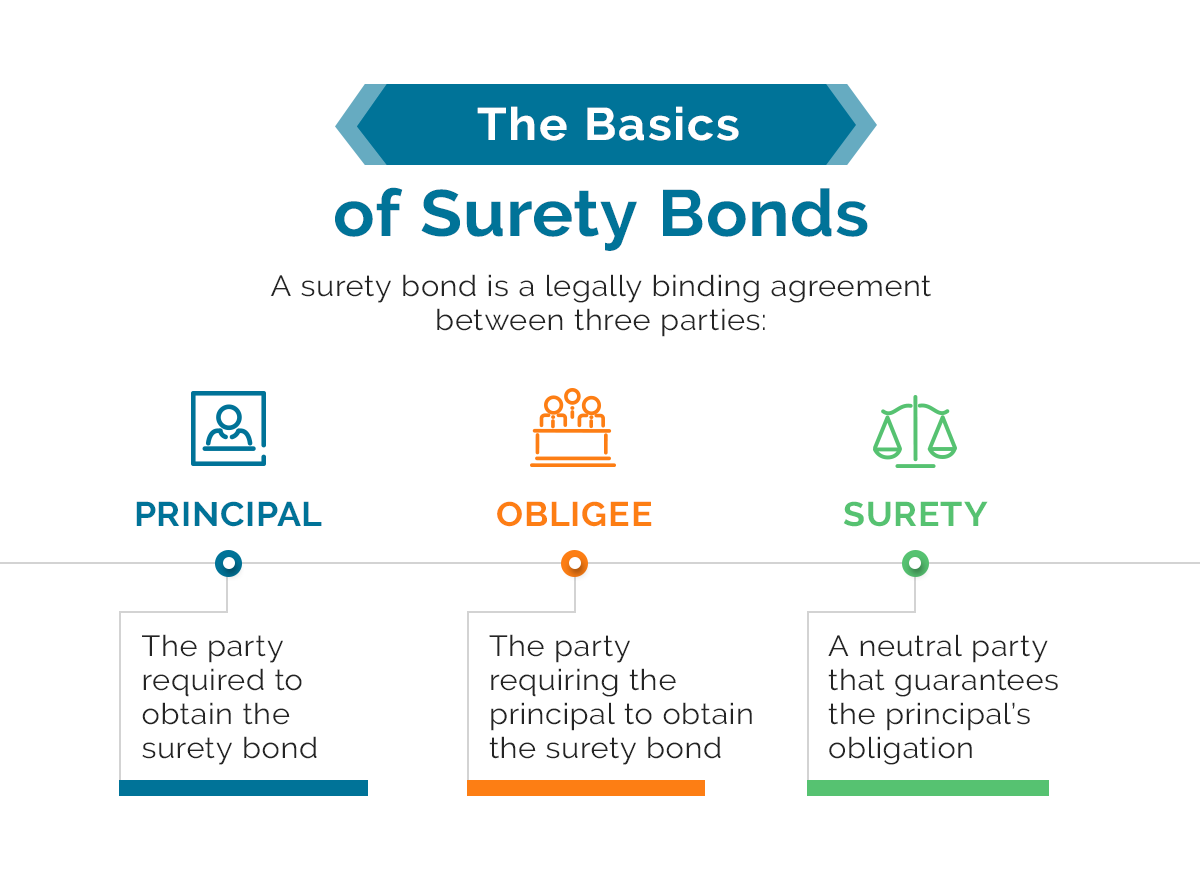

To understand how surety bond companies operate, you first need to understand the basics of surety bonds. A surety bond is a legally binding agreement between three parties:

- Principal: The party required to obtain the surety bond—usually an individual or business

- Obligee: The party that requires the principal to obtain the surety bond—usually a government agency

- Surety: A neutral third party that provides a financial guarantee of the principal’s obligation

The purpose of a surety bond is to allow the obligee (or a principal’s client) to obtain redress from the principal if the principal breaks the law or fails to honor a contract. That means, unlike insurance policies, surety bonds exist to protect the obligee and the principal’s clients, not the principal themselves. Furthermore, the principal is ultimately responsible for paying any valid claims against the bond.

For a more detailed examination of how a surety bond works, be sure to see our guide to surety bond basics. Next, let’s look at some common circumstances in which a surety bond is required.

When Is a Surety Bond Needed?

Dozens of different types of licenses and contracts require surety bonds. Some of the most common types of surety bonds include:

- Contractor License Bonds: Protect clients against misconduct by construction contractors

- Contract Bonds (Bid, Payment, and Performance): Protect governments and project owners against incomplete or sub-standard work by contractors

- Motor Vehicle Dealer Bonds: Protect vehicle buyers against misconduct by automobile dealers

- Mortgage Broker Bonds: Protect borrowers from misconduct by mortgage brokers

- Probate Bonds: Protect other parties from misconduct by an executor, administrator, guardian, or other court-appointed fiduciary

- Freight Broker (BMC-84) Bonds: Protect shippers and carriers from misconduct by freight brokers

- Durable Medical Equipment Provider (DMEPOS) Medicare Bonds: Protect the federal government from losses incurred by Medicare fraud

- Public Insurance Adjuster Bonds: Protect insurance policyholders from misconduct by public insurance adjusters

- Notary Bonds: Protect clients from misconduct by notaries public

- Business Service Bonds: Protects clients of businesses such as cleaning services, locksmiths, and pest control services against misconduct by the business’s employees

Surety bond laws vary widely by state and even municipality. Some states, for example, have tiered systems for contractor license bonds that require higher bond amounts for contractors who accept larger contracts. Make sure to check relevant state and local laws to learn about their surety bond requirements.

Surety Bond Providers

There are three main types of surety bond providers involved in the bonding process. They are:

- Insurance Companies: Some insurance companies sell certain types of surety bonds. Both large national insurers and smaller local insurers sometimes offer surety bonds, but they may not offer the full range of bond types.

- Surety Companies: These companies focus exclusively on surety bonds. They typically offer a more complete selection of surety bonds, but you’ll have to shop around between companies to find the best price.

- Surety Bond Brokers: A surety bond broker represents the customer and works with a network of multiple insurance companies and surety companies to find the lowest-priced quote for a principal. These brokers typically make the process of getting a competitive quote fast and efficient.

Working with Surety Bonds Direct offers several advantages over other types of sureties and even over other surety bond brokers. As a broker, we give our customers access to a large range of sureties at once. Unlike some other brokers, Surety Bonds Direct also works directly with surety companies to get faster and more affordable quotes for our customers with no fees from middlemen.

Responsibilities of a Surety Bond Company

Regardless of which kind of business writes the surety bond, the surety’s responsibilities will be the same. The surety’s obligations are:

- To guarantee the financial obligations listed in the surety bond

- To faithfully investigate any claims made against a surety bond and determine if the terms of the bond have been violated

- To financially reimburse a claimant for a valid claim against a surety bond—up to the bond coverage amount—if the principal cannot or will not pay

A surety company must also keep its own interests in mind when deciding the businesses or people it will issue a bond to. Unlike an insurance policy, a surety bond is not written with the assumption that it will be used, and most surety bonds never have to pay out a claim. Thus, a surety wants to ensure that the principals it bonds have the financial strength, professional capabilities, and personal character to operate legally and transparently.

Another critical difference between surety bonds and insurance is that, with a surety bond, the principal ultimately still bears full financial responsibility for all claims filed against the bond. Additionally, remember that the surety will pay only up to the amount of the bond’s coverage amount or penalty sum, which is why it’s always important that the principal has a surety bond with the amount of coverage required by law.

Thus, before writing most types of surety bonds, a surety company will evaluate a principal to assess its risk of causing a bond claim or failing to reimburse the surety for the payout of a valid claim. The procedure is similar, in some ways, to an insurance underwriting process, and it is a standard element of applying for most surety bonds.

The Surety Bonding Process

The application process for a surety bond can differ slightly, depending in which state you do business and the type of surety bond that you need. In most cases, the process of applying for a surety bond is as follows:

- The principal requests the specific type of surety bond it needs and specifies the state in which it needs it to be issued.

- The principal sends a surety bond application to the surety. The application process usually includes basic information about the principal and its business and financial history.

- The surety performs an underwriting process on the principal to assess its risk level.

- The surety will issue a quote to the principal based on the principal’s assessed risk level.

- The principal can either accept the quote or shop for a better rate.

- When the principal accepts a quote, the surety will send the principal the bond paperwork. The principal signs the paperwork, including the indemnity agreement that requires the principal to pay the surety back for any claims the surety pays out.

- The principal files the paperwork with the obligee, and the surety bond enters into force.

Despite its many steps, the surety bonding process is usually relatively quick. When the principal works with a surety that provides instant online surety bond quotes and digital bond paperwork, the process can often be completed in as little as 24 hours. Some bonds require a more extensive underwriting process or must be sent through the mail and, thus, take longer to issue.

By contrast, some surety bonds don’t require an underwriting process at all. These bonds are considered lower-risk and are available instantly for a standard flat premium. Types of bonds that are available instantly in most states without a credit check include:

- Notary public bonds

- Public insurance adjuster bonds

- Business service bonds

- Private detective and security agency bonds

Evaluating a Surety Bond Company

We’ve discussed how sureties want to work with principals that are reliable and trustworthy. However, it’s equally important that a principal works with a financially stable surety that can meet its contractual obligations.

If you’re applying for certain types of federal surety bonds, such as a freight broker bond or DMEPOS bond, you’ll need to choose a surety approved by the U.S. Department of the Treasury. Working with a U.S.-Treasury-approved surety is also a good way to ensure that your surety is credible, experienced, and financially stable, which is why Surety Bonds Direct works exclusively with U.S.-Treasury-approved sureties.

Other credentials also exist for evaluating surety bond companies. AM Best’s surety ratings are calculated by financial professionals to assess a surety’s financial strength, and its ratings are among the most well-known indicators of a reputable surety. Most principals want to look for a surety company with an A or A+ rating from AM Best, which indicates that the surety has “excellent” or “superior” stability and reliability. Surety Bonds Direct requires a minimum A rating for all sureties we work with.

How Surety Bond Companies Calculate Surety Bond Cost

A surety calculates a principal’s bond premium via an underwriting process that’s similar to the one required for getting a loan or an insurance policy. The surety will examine the principal’s personal and business history and look for items that indicate an elevated risk level. These typically include:

- Low credit scores

- Bankruptcies

- Large amounts of debt

- Revocations or suspensions of professional licenses

- Lawsuits against the principal

- Criminal convictions against the principal

A surety might still issue a surety bond to a principal with these items on its record, but the bond premium will usually be higher. A typical bond premium for a principal with good credit and a relatively clean record is one-half to three percent of the penalty sum, but surety bond costs can reach ten percent or higher for principals with low credit or a lot of debt.

However, there are several ways that principals with bad credit can still get the surety bonds they need at an affordable surety bond cost. Surety Bonds Direct allows principals to add a co-signer to some bonds, and we also offer surety bond premium financing that can help spread out the cost of a bond premium. For more about surety bond premiums and how they interact with credit scores, see our article on understanding credit and surety bonds.

Surety Bonds Direct is a surety bond broker with years of experience in the field and a wide network of the most reliable surety bond companies. Getting your surety bond quote is completely free, and most quotes take just a few minutes to issue. Start off with your no-obligation surety bond quote today, or call 1-800-608-9950 to speak to our surety bond experts.

Jason O'Leary

Jason O'Leary

updated: