Home owner associations can include single family neighborhoods, townhomes, and condo communities. These associations collect payments from the property owners to keep the shared spaces clean and landscaped. Townhomes and condos also use the funds for maintaining and replacing shared structures like roofing and siding.

The businesses or individuals who run these associations collect a lot of money in a central location. This is why most associations are required to purchase or elect to purchase a fidelity surety bond.

This short article will explain:

- They type of fidelity bond HOA's purchase

- How the bond protects the property owners

- How to purchase a HOA fidelity bond for the lowest price

What is a HOA Fidelity Bond?

A fidelity bond is a type of "good faith" surety bond.

A surety bond is a legal agreement similar to an insurance policy, but not quite the same. Unlike traditional insurance which is purchased to protect the policy owner, a surety bond is purchased to protect the "customers" of the bond owner.

Customers can be:

- Actual customers of a business or individual

- A state or city government licensing or revenue department

- Or beneficiaries of a service or agreement

In the context of a homeowners association, a surety bond (or fidelity bond) is purchased to protect the association and property owners from financial fraud committed by the individuals who handle money for the association.

Financial theft can cause severe loss to an association and impact the fees property owners are required to pay. A surety bond provides an avenue for financial recovery in these instances.

In some states, an HOA fidelity bond is required by law and in other states, there is no legal requirement for the association or the individual in charge of handling funds to be bonded. However, most associations or property managers will elect to have these individuals bonded.

The correct type of surety bond (or fidelity bond) is called an employee dishonesty bond.

What is an Employee Dishonesty Bond

An employee dishonesty coverage is purchased by any type of business or individual where an employee or the individual has access to:

- Business finances

- Bank accounts

- The ability to issue checks

- Valuable company assets

- In some cases even valuable digital property

These responsibilities expose the business to fraudulent acts of theft or purposeful property damage.

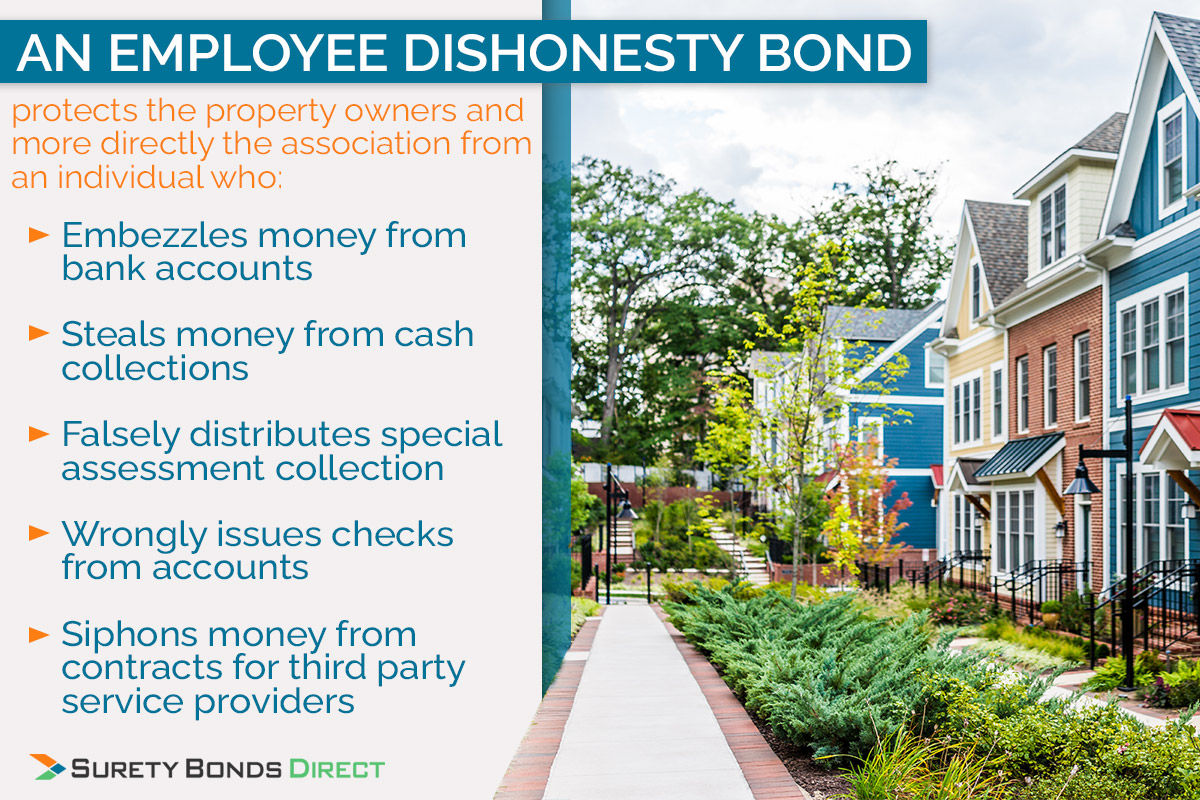

In the case of a homeowners association, an employee dishonesty bond protects the property owners and more directly the association from an individual who:

- Embezzles money from bank accounts

- Steals money from cash collections

- Falsely distributes special assessment collection

- Wrongly issues checks from accounts

- Siphons money from contracts for third party service providers

In the event any these acts occur the association can convict the individual or employee and make a claim against the employee dishonesty bond. The bond will pay for any damage but only up the amount of the bond.

What About The Hiring Of Service Providers

Home owner associations are in charge of hiring third party service providers on behalf of the property owners. These providers typically include:

- Landscapers

- Pool maintenance

- Pest control companies

If an association employee failed to conduct proper research when hiring a company an employee dishonesty bond would provide no protection.

However, it's possible an employee could hire a company with the intent to siphon money from the contract. In this case, an employee dishonesty bond would serve as protection.

Businesses like landscapers and pool maintenance providers should have their own type of surety bond called a business service bond. In most cases when hiring service providers for a commercial contract, the hiring business or association should require all applicants to be bonded.

A business service bond is similar to an employee dishonesty bond. It protects the property owners from the employees or the service providers stealing private property or purposefully damaging private property while performing work.

HOAs should be well versed in a business service bonds to ensure third party providers are property bonded and for the correct amount before signing any long term contracts.

How Much Does an Employee Dishonesty Bond Cost?

In the case of a homeowners association you first need to determine the appropriate bond amount. This is up to you and it's typically based on the amount of money or funds a treasurer has access to during the course of association business.

Determining The Appropriate Bond Amount

Here are some examples from states that require associations to be bonded.

Florida HOA Fidelity Bond Requirement

Florida law requires homeowners associations to purchase a bond with an amount large enough to cover the maximum funds that will be in the custody of the association or its management agent at any one time.

California HOA Fidelity Bond Requirement

California law requires associations to be bonded, but the bond amount is decided by the managing agent and board members of the association.

Virginia HOA Fidelity Bond Requirement

Virginia has more strict bonding requirements for homeowner associations. The bond amount must be equal to the lesser of $1 million or the amount of reserve balances plus one fourth of the aggregate annual assessment of the property owners.

Virginia requires a minimum coverage of $10,000.

Mississippi HOA Bond Requirement

Mississippi requires a bond amount equal to or more than the combined amount of the reserves of the association and total assessments for the highest balance during the previous year.

Colorado HOA Bond Requirement

Colorado HOA fidelity bond requirements only apply to communities with thirty or more units that delegate powers of the executive board to a managing agent.

In Colorado the bond amount is no less than $50,000 or any higher amount required by the executive board.

The correct bond amount should be more than enough to cover the amount of funds available to an individual who physically handles the distribution of these funds.

If the amount required is greater than $100,000 it's likely you won't find a surety willing to write an employee dishonesty bond. For these higher amounts, you'll be better off getting a crime insurance policy. Surety Bonds Direct is not an insurance provider, we only provide surety bonds.

Determining How Many Individuals Need To Be Bonded

Once the appropriate amount is determined. The price of an employee dishonesty bond is based on the number of employees being bonded.

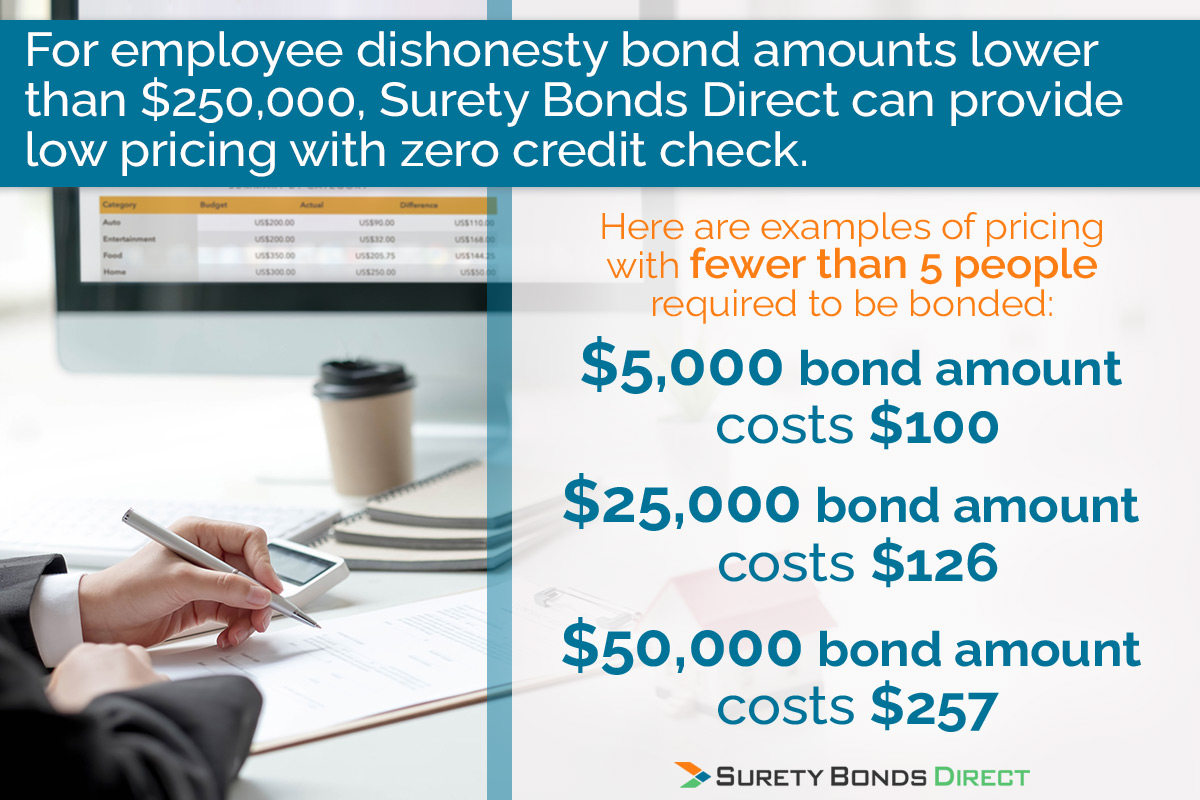

For employee dishonesty bond amounts lower than $250,000, Surety Bonds Direct can provide low pricing with zero credit check.

Here are examples of pricing with fewer than 5 people are required to be bonded:

- $5,000 bond amount costs $100

- $25,000 bond amount costs $126

- $50,000 bond amount costs $257

If more than 5 people and as employees are added requirements change:

- $25,000 bond amount costs $345

- $50,000 bond amount costs $460

To receive exact pricing for your HOA, use Surety Bonds Direct free bond quote form. You can also call a bond specialist at 1-800-608-9950.

When You Need an HOA Fidelity Bond Call Surety Bonds Direct

Now you understand the type of fidelity bond HOAs are required or elect to purchase when they want financial protection from employees who handle money or accounts for the association.

Whether you live in a state that requires an association to be bonded or you're electing to purchase an employee dishonesty bond, Surety Bonds Direct can help you get the lowest possible bond pricing. Once you request your free quote, employee dishonesty bonds can be purchase and issued, typically, within one business day.