Everything You Need to Know About Home Improvement Contractor Bonds

A guide to the essential functions of home improvement contractor bonds, why they’re important for protecting a contractor’s customers, and how to find an affordable premium from a reputable surety.

Construction and maintenance contractors are often required to obtain a contractor license surety bond as part of the application process for a contractor’s license. In most states, small home improvement contractors are not required to obtain surety bonds. However, several states do require small residential contractors to furnish home improvement contractor bonds.

For contractors who work in these states, obtaining an affordable home improvement contractor bond is a key part of getting a home improvement contractor license. What are the basic functions of a home improvement contractor surety bond, and what should a contractor expect when obtaining one? This article will cover the essential functions of home improvement contractor bonds, why they’re important for protecting a contractor’s customers, and how to find an affordable premium from a reputable surety.

Home Improvement Contractor Bonds: The Basics

Home improvement contractor bonds are a type of surety bond. A surety bond is a legally binding three-party contract that provides a financial guarantee that one party will fulfill its obligation to a second party. A neutral third party acts as a guarantor of the first party’s obligations. Our article, What Is a Surety Bond? provides a quick overview of surety bonds and defines key roles like principal, obligee, and surety. In the case of home improvement contractor bonds, the roles are as follows:

| Principal | the home improvement contractor who obtains the surety bond |

|---|---|

| Obligee | the state or local government agency that requires the contractor to furnish a home improvement contractor bond |

| Surety | an insurance company that writes the bond and provides a financial guarantee that the principal will operate ethically and legally |

If a homeowner believes that a home improvement contractor has acted illegally, unethically, or has violated state regulations or statutes, the homeowner can file a claim with the surety against the contractor’s bond, and the surety will investigate the claim for validity. If the surety finds that the claim is valid and the bonded contractor is unsuccessful in rectifying the matter, the surety may be obligated to pay the claimant an amount up to the bond’s coverage amount. In many cases, the contractor is then responsible for paying the surety back in full.

As previously mentioned, many states require contractor license surety bonds for large commercial and residential contractors, but small home improvement contractors are usually exempt from these surety bond requirements.

However, in a handful of states, including Texas, Maryland, and the District of Columbia, home improvement contractor bonds are required for smaller contractors. In these states, home improvement contractors will need to submit a contractor surety bond along with their license application in order to get a home improvement contractor’s license and legally operate in the state.

Why Are Home Improvement Contractor Bonds Important?

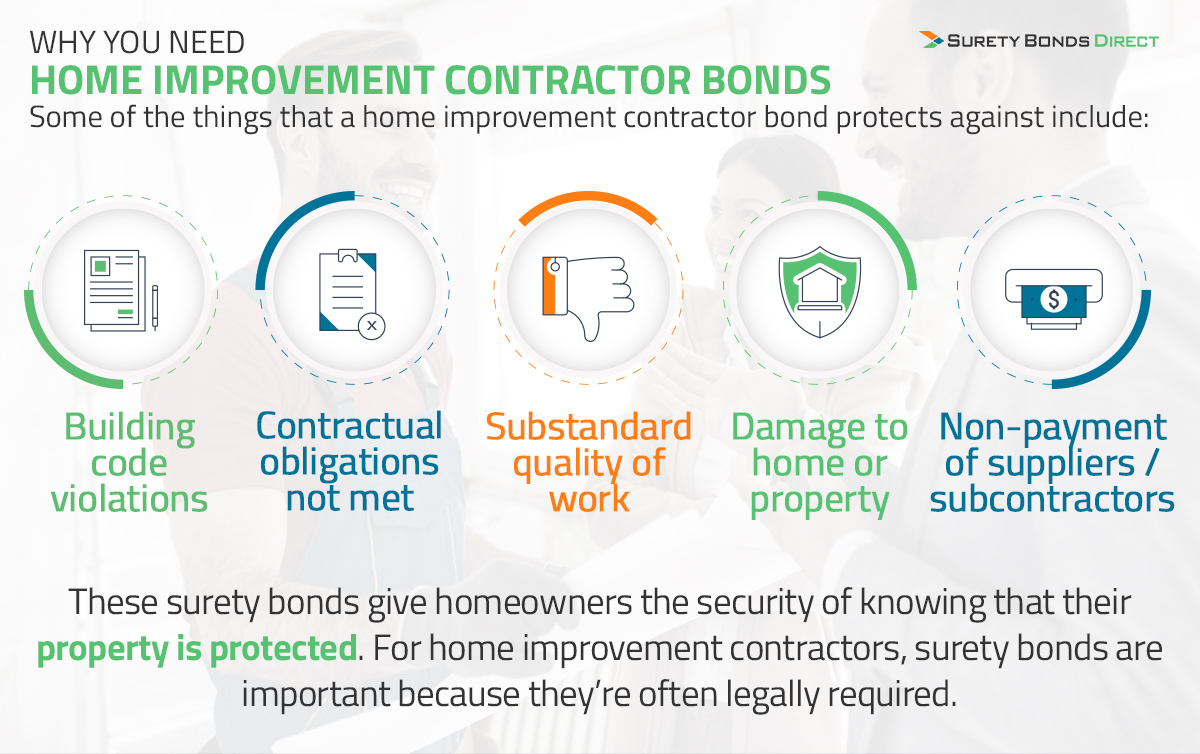

Home improvement contractor surety bonds are similar to other types of contractor license bonds in that they protect property owners from illegal or unethical conduct by contractors. Some of the things that a home improvement contractor bond protects against include:

- Building code violations

- Failure to meet contractual obligations

- Substandard quality of work

- Damage to the home or property

- Non-payment of suppliers and subcontractors

Home improvement contractor surety bonds help protect the homeowner from financial losses in the event that a contractor commits any of these legal or ethical violations. These surety bonds give homeowners the security of knowing that their property is protected. For home improvement contractors, surety bonds are important because they’re often legally required in order to do business.

States That Require Home Improvement Contractor Bonds

Each state that requires home improvement contractor bonds has slightly different requirements. Some states, such as Texas and Ohio, license home improvement contractors at the local level, meaning that these states have a variety of requirements for home improvement contractor bond terms and coverage amounts. In other states and municipalities, home improvement contractor surety bonds are required only if the contractor does not meet certain financial requirements.

In all of the following states, home improvement contractors must secure a surety bond in order to become licensed. Contractors should make sure to choose the correct surety bond for their state or municipality:

| State | Surety Bond | Surety Bond Amount |

|---|---|---|

| District of Columbia | Home Improvement Contractor Bond | $25,000 surety bond, available for a flat fee |

| Louisiana | Home Service Contractor Provider Bond | Minimum $25,000 surety bond, depending on the value of contracts accepted |

| Maryland | Home Improvement Contractor Bond | $20,000 or $100,000 surety bond |

| New York | Home Improvement Contractor Bond | $20,000 surety bond, required in New York City only |

| Ohio | Home Improvement Contractor Bond | Required by various municipalities in Ohio, with varying bond amounts and terms |

| Tennessee | Home Improvement Contractor Bond | $10,000 surety bond, available for a flat fee |

| Texas | Home Improvement Contractor Bond | Required by various municipalities in Texas, with varying bond amounts and terms |

| Virginia | Home Services Contractor Bond | $10,000 to $90,000 surety bond, depending on the value of contracts accepted |

A home improvement contractor applying for a surety bond should research their state’s requirements in detail to ensure that they completely understand the terms of the contract. Don’t hesitate to contact your state’s contractor licensing agency to get the most up-to-date information on bond requirements.

What to Expect When Getting a Home Improvement Contractor Bond

In order to obtain a home improvement contractor bond, a contractor will follow these steps:

- A contractor requests a premium quote for a home improvement contractor bond from a surety company or surety broker. As part of the quote process, the contractor will answer a few basic questions about their business’s history and may need to submit financial and business records.

- The surety’s underwriters assess the contractor’s level of risk based on a credit check and the information submitted by the contractor. The surety then calculates a premium based on the contractor’s risk level.

- The surety sends a surety bond premium quote to the contractor, which the contractor can accept or decline.

- The contractor pays the premium and purchases their home improvement contractor surety bond.

- The surety sends the bond forms and bond certificate to the contractor via mail or e-mail.

- The contractor signs the surety bond as the principal.

- The contractor submits a copy of the bond certificate with their application for a state or local contractor’s license.

It’s important to remember that the premium for a home improvement contractor bond can be affected by many different factors. In the next section, we’ll discuss some of the most common factors that determine surety bond premiums.

How a Surety Assesses Risk

When a principal applies for a home improvement contractor bond, the surety reviews information about the principal’s personal credit and financial history. This information allows the surety to calculate the contractor’s risk of having a claim filed against their bond or failing to repay money that the surety pays to a claimant. The surety will then assign a higher or lower premium based on its rate-making tables.

The principal’s credit score is the number-one factor in calculating a surety bond premium. A surety often assigns a higher risk rating to a principal with a lower credit score, making it more expensive to purchase a surety bond. However, several other factors in a home improvement contractor’s history can also affect surety bond premiums, including:

- Previous bond claims

- Lawsuit judgments

- Felony or misdemeanor convictions

- Suspensions or revocations of a business or professional license

- New businesses

These factors can make it difficult for some home improvement contractors to obtain surety bonds, but options are available to make premiums more affordable.

Finding an Affordable Premium for a Home Improvement Contractor Bond

Getting a home improvement contractor bond is one of the many expenses that can come with starting a home improvement business, so it’s important to find an affordable premium. It can be particularly difficult to get a surety bond with bad credit due to the high premiums that principals with credit problems face. Fortunately, there are several potential options for finding a surety bond, even for principals with low or no credit.

One commonly used option is to add a cosigner to a surety bond. A cosigner takes on shared responsibility for any debt that the principal may owe to the surety, which reduces the surety’s risk and, thus, can help reduce the principal’s premium. Cosigners are often spouses but can be any adult individual. The better the cosigner’s credit score, the lower the premium will be.

Premium financing options may also be available for home improvement contractor bonds. Premium financing allows a contractor to spread out the cost of a bond premium over a period of months rather than paying it all at once. This can be particularly key for small contractors who need to conserve capital as much as possible when starting out.

Surety Bonds Direct offers multiple options to help small contractors across the credit spectrum secure home improvement bonds at affordable prices. Just ask our bond experts about premium financing after getting your free surety bond quote, or indicate that you wish to add a cosigner to your bond when filling out your quote request form.

Surety Bonds Direct is the quickest and most hassle-free way to get a home improvement contractor bond. We make it easy to get fast, free, no-obligation surety bond quotes online for home improvement contractor bonds, with more affordable premiums and options for customers with good credit, bad credit, or no credit. Get your quote now, or call 1-800-608-9950 to speak to our surety bond experts.

Jason O'Leary

Jason O'Leary

updated: