Being notified you must purchase a probate bond means you've just taken on a serious responsibility. There's already a lot to take in given your situation, if you're like most people, you're probably wondering:

- What is a probate bond?

- Why are you required to purchase it?

- Who pays for a probate bond?

What is a Probate Bond And Why Do You Have To Purchase It?

Yes, you must purchase a probate bond when the probate court tells you it's required. However, the funds to purchase the bond typically come from the finances of the estate.

Let’s start with, what is a probate bond?

A probate bond is a type of surety bond, or insurance contract, purchased for the financial protection of a third party. In the case of a probate bond, this third party may be:

- A child or children you just became the guardian over

- An estate or will you were just named the administrator of

- A veteran who's finances you're responsible for

Unfortunately, there are people who will purposefully take advantage of these situations and purposefully commit fraud for their own benefit or the benefit of another individual. The probate bond provides financial protection to these third parties as financial recourse for an act of purposeful misconduct or fraud.

Let's look at examples of each type of common probate bond.

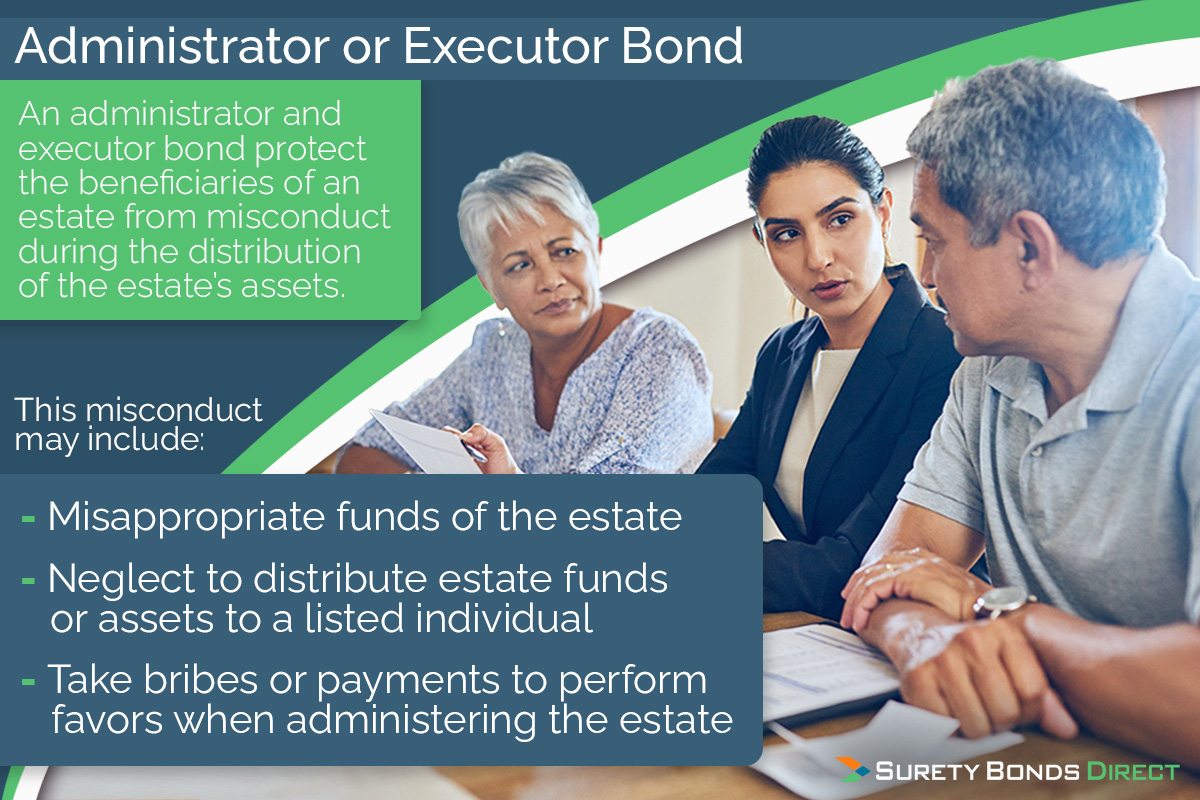

Administrator or Executor Bond

An administrator or executor is an individual who is in charge of administering the assets of a will from a recently deceased family member or acquaintance.

The difference between an administrator and executor are:

- An administrator is appointed by the court because the deceased did not name a person to handle the will or because the person named refuses to take on the responsibility

- An executor has been named as the person who will help administer the assets of the estate

The probate bond that covers these scenarios is sometimes referred to as an "estate bond" but officially called an:

There are many reasons why the court may require a probate bond. Some common reasons are an estate with substantial assets or if the court replaces an administrator after a petition from the heirs in the will.

Ultimately, it is up to the judge on whether a bond is required.

What Does The Bond Protect Against?

An administrator and executor bond provides protection to the beneficiaries. The individual administering the assets of the will has the opportunity to purposefully:

- Misappropriate funds of the estate

- Neglect to distribute estate funds or assets to a listed individual

- Take bribes or payments to perform favors when administering the will

In the case any of these actions are committed, the beneficiaries can make a claim against the bond for financial remedy. The amount of the administrator or executor bond is the maximum amount available in a claim situation.

Start by getting a free quote for the administrator bond or executor bond by using our quote form or call 1-800-608-9950.

Trustee Bond

Trusts, similar to a will, are estate planning tools.

- A will is a legal document that provides instructions on how to distribute assets after death

- A trust is a legal arrangement that allows for ownership of assets managed by the trust so that there is no ownership change in the event of death of the primary trustee(s)

A trustee is a person or company responsible for following the rules to manage or transfer assets according to the trusts instructions.

The trustor decides whether or not the trustee is required to purchase a trustee bond. Typically, a trustor may require the purchase of a bond if the named trustee is not a family member or close friend.

What Does a Trustee Bond Protect Against?

The trustee faces the same situations of fraud faced by an administrator or executor:

- Misappropriation of funds from the trust

- Neglecting to distribute estate funds or trust assets to a listed individual

- Acceptance of "bribes" or payments to perform favors when distributing trust assets

As with the administrator or executor bond, if the trustee has been proven to commit any of these fraudulent acts, the beneficiaries can make a claim against the bond for financial recovery. The money available is the amount of the trustee bond required by the trust's creator.

If you need a trustee bond, use our free quote form to get pricing or call a bond specialist at 1-800-608-9950.

Guardianship Bonds

A guardian is an individual who has been named the provider and caregiver for another person. Typically guardians are named in the case of the parents suddenly passing away or if an elderly individual is unable to properly care for themself.

This type of bond is called a guardianship bond.

A guardianship bond is required by state law in many states while other states give the discretion to require a bond to the court. The amount of the guardianship bond is determined by the court. The amount is typically determined when considering the individual's assets the guardian is responsible for.

What Does a Guardianship Bond Protect Against?

The guardian is responsible for the assets of an individual. This can include any physical or financial assets owned by the individual requiring care or left to that person in a will. The guardian has the ability to purposefully:

- Sell assets and steal profits

- Mismanage or misspend money

- Siphon money into third-party accounts

If the court uncovers evidence of fraud or abuse, the court can make a claim against the bond to recover lost or stolen funds.

If you need a guardianship bond, use our free quote form to get pricing or call a bond specialist at 1-800-608-9950.

Veterans Affairs Custodian Bonds

The Department of Veterans Affairs may provide financial benefits to certain veterans who have been injured in the line of duty or to family members who lost a loved one in service.

In many cases the beneficiary may unable to adequately manage these benefits. This can be for a variety of reasons:

- An injured beneficiary requires assistance to ensure bills are paid or checks are deposited at the bank

- A beneficiary may be a young or elderly family member who requires assistance managing the finances issued to them

This type of bond is called a Veterans Affairs bond or a custodian bond.

A Veterans Affairs bond is typically required when the assets under supervision exceed $25,000. In similar cases to a guardianship bond, if the court has to appoint a custodian, a VA bond may be required.

In nearly all cases this bond will not be required for the following custodians:

- Spouses

- A trust company or bank with trust powers

What Does a Veteran's Affairs Bond Protect Against?

A Veterans Affairs bond is nearly identical to a guardianship bond. The major difference is who's requiring the bond. In the case of a VA bond it is US Department of Veterans Affairs while with a guardianship bond, it's the probate court overseeing the appointment.

The protections are nearly identical. If the custodian purposefully:

- Sells assets and steal profits

- Mismanages money

- Siphons money into third-party accounts

- Frivolously wastes finances on wrongful purchases

The VA bond provides the financial recourse to the beneficiary to obtain some or all of the money back.

To learn more about the details of a surety bond and how claims are enforced, read our post about what is a surety bond.

If you need a Veterans Affairs custodian bond, use our free quote form to get pricing or call a bond specialist at 1-800-608-9950.

How To Pay The Lowest Price for a Probate Bond?

Again, you are responsible for purchasing a probate bond. For all types of probate bonds:

- Administrator and executor bonds

- Trustee bonds

- Guardianship bonds

- Veterans Affairs bonds

The bond cost is typically paid for from the estate assets. But you still must go through the below process to purchase a probate bond.

Because a probate bond is a type of insurance contract, it's written by an insurance company called a surety.

The surety will price the bond based on the type of probate bond required.

- For administrator and executor bonds up to $150,000, there is no credit check required.

- Every other probate bond must have at least a 600 credit score for approval.

Once you qualify the surety will determine the rate based on the bond amount. Typically the higher the bond amount, the lower the rate.

To get the best possible rate and price for your probate bond, use a specialized surety agency like Surety Bonds Direct.

Surety Bonds Direct works with multiple A rated (highest quality) sureties who specialize in probate bonds to provide the lowest rates possible.

You can request a free price quote from Surety Bonds Direct. This way you know exactly what you'd have to pay to secure your probate bond. To get your pricing, use our online quote tool or call a bond specialist at 1-800-608-9950.