What is the Purpose of the Bond?

Georgia auto dealer bonds are a type of surety bond mandated and regulated by the Georgia Board of Used Motor Vehicles to ensure that consumers in the state of Georgia have financial recourse in the event that a licensed motor vehicle dealer engages in unethical business practices or fails to comply with licensing regulations or state laws.

Additionally, the dealer license and the bond provide a limited guarantee of payment for state mandated taxes and fees. The Georgia Code specifies that used auto dealers doing business in the state of Georgia provide financial security by securing a used vehicle dealer license bond from the Georgia Board of Used Motor Vehicles.

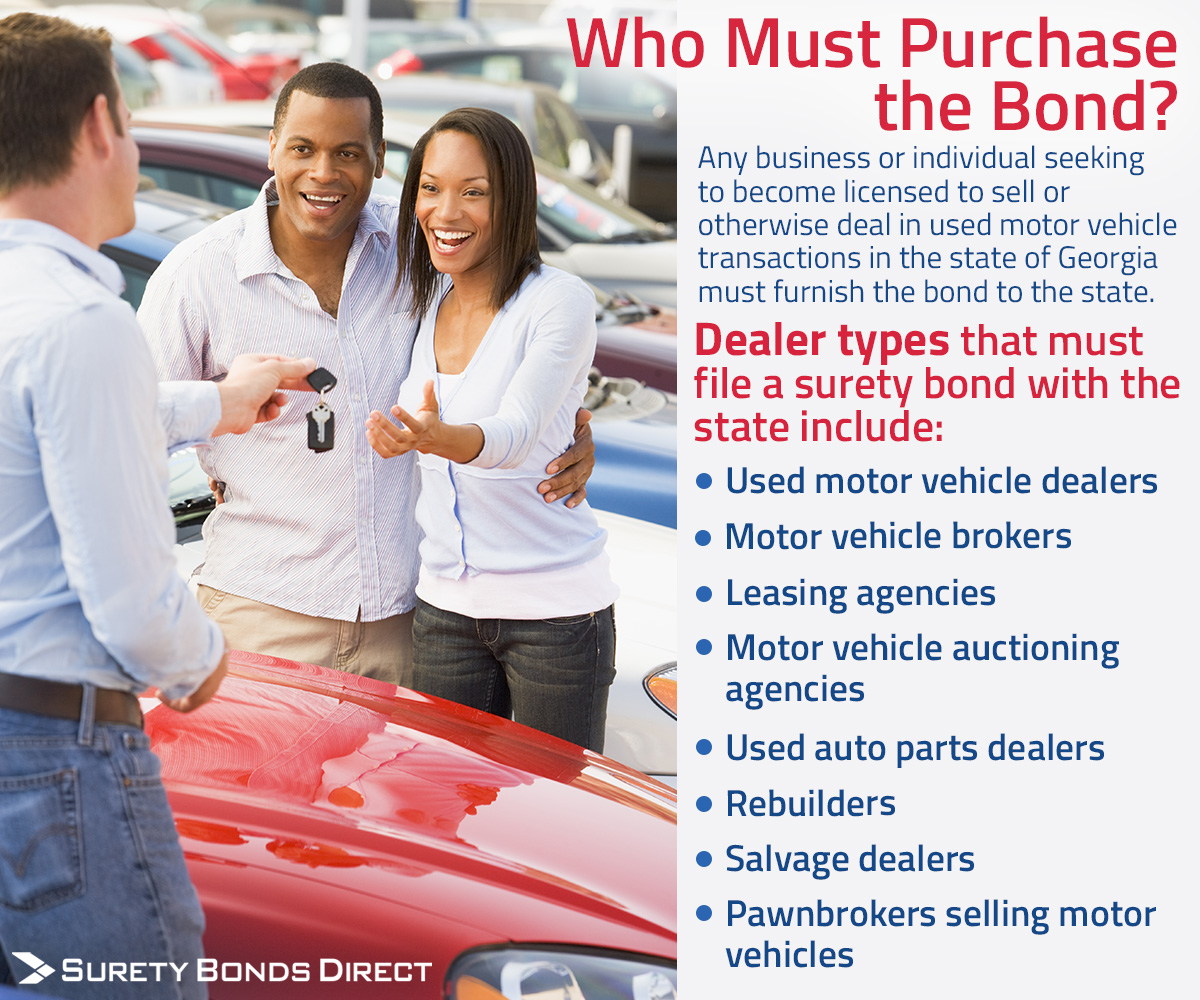

Who Must Purchase the Bond?

Any business or individual seeking to become licensed to sell or otherwise deal in used motor vehicle transactions in the state of Georgia must furnish the bond to the state. More specifically, anyone who sells, leases with the option to purchase, or negotiates the sale of used motor vehicles either directly or indirectly must file a bond with the state.

In terms of dealer types, used motor vehicle dealers, including motor vehicle brokers, leasing agencies, motor vehicle auctioning companies, used auto parts dealers, rebuilders, salvage dealers and pawnbrokers selling motor vehicles must all file a motor vehicle dealer surety bond with the state.

Bond Coverage Amounts and Terms

The bond amount for used motor vehicle dealers, including motor vehicle brokers, leasing agencies, motor vehicle auctioning companies is $35,000. The bond amount required for used motor vehicle parts dealers, rebuilders, and salvage dealers is $10,000. All used motor vehicle dealer bonds have a set expiration date of March 31 of even-numbered years. All used motor vehicle parts dealer bonds have a set expiration date on December 31 of even-numbered years. All bonds can be renewed for subsequent 2-year periods through payment of premium to the surety company.

| label | Vehicle Dealers | Parts Dealers |

|---|---|---|

| Applies to | Used & New Dealers, Leasing Agencies, Auction Companies | Parts Dealers, Rebuilders, Salvage Dealers |

| Expiration | March 31 even-numbered years | December 31 even-numbered years |

| Bond Amount | $35,000 | $10,000 |

What is the Cost of the Bond?

The $35,000 Used Car Dealer Bond cost starts around $275 for the 2-year term and can range to over $2,500. The $10,000 Used Motor Vehicle Parts Dealer Bond costs start at $123 for the 2-year term. The price of the bond varies based on underwriting guidelines that use personal and business credit history for the owners in addition to experience and claim history for the business.

Where to Buy the Bond?

Bonds are purchased from licensed surety bond agents or brokers who handle sales and service for various surety bond underwriters. Many prospective used auto dealers choose to secure quotes and purchase bonds from national dealer bond brokers to ensure they receive the most competitive offerings from multiple qualified surety companies that specialize in this type of bond. For example, Surety Bonds Direct is a leading volume issuer of Georgia Auto Dealer Bonds and works with sureties that offer a discount of up to 10% for Georgia Independent Auto Dealer Association ("GIADA") members.

What is Included on the Bond Documents?

In addition to the standard state required legal language, the official bond will contain specific information about the specific bonded party including; the auto dealer’s legal business name, business address, the effective date of the bond, the expiration date of the bond, and the name and contact information for the surety company.

The official bond documents will also include corporate seals and signatures for the surety agent and surety company along with a power of attorney document. The bonded dealer will need to sign the official bond form before submitting to the state.

Where is the Bond Filed?

Completed bond forms signed and sealed by the surety company (or surety agent) and the dealer, including the power of attorney should be mailed to the following address:

State Board of Registration of Used Motor Vehicle Dealers & Used Motor Vehicle Parts Dealers

Used Motor Vehicle Dealers Division

237 Coliseum Drive

Macon, Georgia 31217

Other Steps to Getting Used Car Dealer Bond License in Georgia

In addition to the dealer surety bond, there are several other steps to completing the licensing application with the state of Georgia. Below is a list of key steps but it is important to consult with the state licensing guidelines for a complete list of requirements.

- Completed application form

- Proof applicant has applied for a sales tax registration number

- Established place of business, and landline telephone listed in the business name

- Signage at the established place of business advertising the business as a used car dealership

- Pre-license inspection to ensure compliance with Board law and rules for an established place of business

- Fee as specified in the state fee schedule

- Certificates of insurance

- Fingerprints as required

- Proof applicant has attended state mandated seminar

- Licensed dealers must obtain 6 hours of continuing education in order to renew a license

Whether you're a new dealer or an existing dealer that wants to check to make sure you're not overpaying for your bond renewal, you can get a free, no-obligation quote online. It only takes 2 minutes. If you'd prefer, call 1-800-608-9950 to speak with a surety bond expert.