Dealer Licensing Basics for Florida

The state of Florida defines a motor vehicle dealer as anyone engaged in the business of buying, selling, or dealing in motor vehicles or offering or displaying motor vehicles for sale at wholesale or retail, or who may service and repair motor vehicles pursuant to an agreement as defined in current state statutes.

The statute requires that all businesses engaged in the sale of three or motor vehicles within a twelve-month period must obtain the proper state issued dealer license. Specifically, this applies to all new and used car dealership owners selling automobiles, recreational vehicles (RVs), or motorcycles.

The Florida Department of Highway Safety and Motor Vehicles (FLHSMV) Bureau of Dealer Services issues and renews licenses for motor vehicle, auction, salvage, wholesale, mobile home, recreational vehicle dealers and manufacturers, distributors. The bureau also licenses mobile home installers and monitors the construction and installation of mobile homes. The FLHSMV, Bureau of Dealer Services also has offices throughout the state to offer professional assistance to consumers and members of the motor vehicle industry.

The state’s purpose in defining motor vehicle dealers and setting regulations and licensing requirements is to help ensure responsible and ethical business practices are employed in the buying and selling of automobiles. In conjunction with the motor vehicle dealer license, each licensee must also furnish to the state of Florida a $25,000 motor vehicle dealer surety bond.

The surety bond provides a limited guarantee to ensure the public will be compensated for any financial damages caused by the dealership in its failure to comply with the provisions of Florida licensing regulations and laws. Common infractions resulting in a valid bond claim include failure to comply with the proper transfer of a title or misrepresentation regarding the financing or sale of a vehicle.

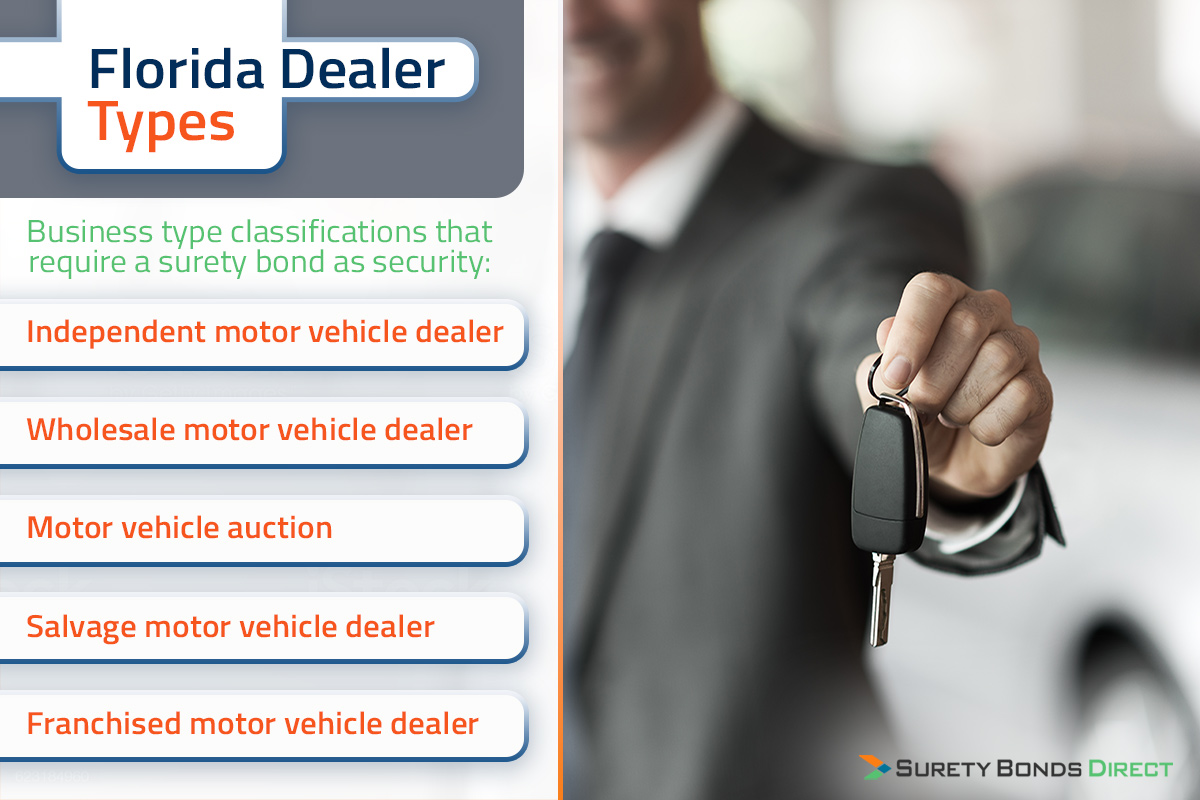

Florida Dealer Types

One of the first steps in the process of pursuing your dealer license in Florida is to determine your dealer type and understand the corresponding licensing and security requirements. Following are the business type classifications that also require a surety bond as security.

| License Type | Any person... |

|---|---|

| Independent Motor Vehicle Dealer | ... who engages in buying, selling, servicing, repairing, or dealing in motor vehicles (other than a wholesale or franchised motor vehicle dealer) |

| Wholesale Motor Vehicle Dealer | ... whose business is to buy, sell, or deal motor vehicles exclusively at auction or at wholesale. |

| Motor Vehicle Auction | ... who sell vehicles to buyers who are also licensed motor vehicle dealers. |

| Salvage Motor Vehicle Dealer | ... who acquires wrecked or salvaged vehicles with the intent to sell them for parts |

| Franchised Motor Vehicle Dealer | ... who engages in buying, selling, servicing, repairing, or dealing in motor vehicles under a franchise contract, new motor vehicle franchise, or sales and service agreement |

Licensing Checklist

Once you have determined your license classification, the following is a general overview of the steps required to secure your motor vehicle dealer license in the state of Florida.

- Complete Florida Dealership License Application (form 86056) and pay the initial application fee

- Purchase and file a $25,000 surety bond (form 86020) or irrevocable letter of credit with the State of Florida Department of Highway Safety & Motor Vehicles (DMV)

- Provide proof of registration to the FLHSMV of the business entity and fictitious name, if any, with the Florida Division of Corporations

- Provide a copy of completion of dealer training to the FLHSMV; The applicant will be awarded a certificate of completion by a Department approved Dealer Training School after they complete the pre-licensing class. A copy of this certificate of completion is required with the license application

- Provide proof of garage liability insurance policy or general liability policy

- Provide proof of commercial automobile coverage at a minimum of $25,000 coverage that includes property damage and bodily injury and a minimum of $10,000 in personal injury coverage

- Provide a proof of electronic fingerprinting to the FLHSMV from an FDLE service provider. The applicant must contact the FDLE approved service provider and be electronically fingerprinted. Applicant must attach a copy of this receipt with their license application

The Fine Print in the Dealer Surety Bond

The bonded principal is making an application for a license, under Section 320.27, Florida Statutes, to engage in the business of buying, selling or dealing in motor vehicles or offering or displaying motor vehicles for sale, as defined by the law.

As a condition precedent to the licensee’s appointment, the dealer shall deliver annually to the State of Florida Department of Highway Safety & Motor Vehicles (DMV) (“obligee”) a good and sufficient surety bond for the license period conditioned that the principal must comply with the conditions of any written contract in connection with the sale or exchange of any motor vehicles and shall not violate any of the provisions of Chapter 319 and 320, Florida Statutes.

The bond is for the benefit of any person in a retail or wholesale transaction who suffers any financial loss as a result of a violation of the conditions in connection with the sale or exchange of any motor vehicles, or any failure to comply with the conditions of any written contract made by the dealer in connection with the sale or exchange of any motor vehicle, or as a result of any violation of the provisions of Chapter 319 or 320, Florida Statutes as it pertains to the conduct of the business as a licensed auto dealer.

The aggregate liability of the surety in any one year is limited to the sum of the bond and the surety has the right to terminate its liability after the expiration of thirty days by serving written notice to the obligee of its election so to do, by registered mail.

Dealer Bond Terms and Expiration Dates

Florida dealer surety bonds are issued for 1 year terms with fixed expiration dates. The FLHSMV has staggered the expiration dates based on the type of license. For new applicants, the "first year" will be the period from the start of the bond until the next expiration date for that license type, and 1-year increments thereafter.

| License Type | License Class Code | Surety Bond Term |

|---|---|---|

| Franchised motor vehicle dealer | VF | January 1 - December 31 |

| Franchised motor vehicle service facility | SF | January 1 - December 31 |

| Non-resident dealer | NI, NH, NR | January 1 - December 31 |

| Independent motor vehicle dealer | VI | May 1 - April 30 |

| Wholesale motor vehicle dealer | VW | May 1 - April 30 |

| Motor vehicle auction | VA | May 1 - April 30 |

| Salvage motor vehicle dealer | SD | May 1 - April 30 |

| Mobile home dealer | DH | October 1-September 30 |

| Mobile home broker | BH | October 1-September 30 |

| Recreational vehicle dealer | RV | October 1-September 30 |

| Used Recreational vehicle dealer | RU | October 1-September 30 |

How much does a Florida Dealer Bond cost?

Florida dealer surety bonds are priced primarily based on the owner’s personal credit profile. Costs for the $25,000 surety bond typically range from about $188 per year to $1,250 per year. An auto dealer’s experience in the industry may also factor into the price depending on the surety company’s underwriting guidelines. The online surety bond application process takes just a couple minutes through a national online bonding company such as Surety Bonds Direct, LLC.

If you are applying for a new license, regardless of license type, your first year premium may be pro-rated since the term of the bond will be less than 1 year. Some sureties will charge a full 1-year premium on the first (partial) year then pro-rate the second year. If you'd like to speak with a bond specialist about your best options, call 1-800-608-9950 or request a quote online.