Surety Law: The Legal Concepts Behind Surety Bonds

Without a firm understanding of the foundational concepts of surety bonds, a business's legal obligations may not always be clear.

Common sense dictates that a business that wants to stay on the right side of the law will first have to know the law. That's especially true when it comes to surety bonds. State and federal laws require that many types of businesses obtain surety bonds to guarantee their obligations to their customers and to the government. But, without a firm understanding of the foundational concepts of surety bonds, a business's legal obligations may not always be clear.

At Surety Bonds Direct, we know that the process of buying a surety bond can seem complex and full of legal jargon. However, when the basic concepts are explained in plain language, anyone can grasp them. Once you understand the legal concepts behind surety bonds, you'll be able to get a clearer picture of what kind of surety bonds your business requires and what specific obligations you may have under the law. Join us for a quick tour through the major legal concepts behind surety law.

Surety Bond Parties and Terms

So, what is a surety bond? A surety bond is a type of three-party contract that creates a legally binding guarantee that one party will fulfill a contractual obligation or duty to a second party. The third party in the contract provides a guarantee of financial compensation in the event that the first party is found to be in default of the contract. The terms for the surety bond parties involved are:

- The principal

- the party that is required to obtain the surety bond. A principal is typically a business, such as a construction contractor.

- The obligee

- the party that requires the principal to obtain a surety bond. An obligee is typically a state or federal U.S. government agency, although it can sometimes be another entity, such as a private construction project owner.

- The surety

- a neutral third party that financially guarantees the principal's performance or compliance. A surety is typically an insurance company.

Some other key terms to know about surety bonds include:

- Surety Bond Claim

- A claim for compensation that an obligee, customer, or client can file against the principal's surety bond if they believe the principal is in default

- Penalty Sum/Bond Amount

- The maximum amount that a surety will pay to the filer of a valid claim against the surety bond

- Surety Underwriting

- The process by which a surety assesses a principal's risk level by analyzing their financial and business history and sets the surety bond cost accordingly

- General Indemnity Agreement

- A contract that a surety requires a principal to sign, guaranteeing that the principal will reimburse the surety for any money paid out to a claimant

We offer even more in-depth information on how a surety bond works in our Surety Bond Information Center. When you're comfortable with these concepts, let's move on to surety bond claims, the legal mechanism used to enforce the guarantees of a surety bond.

Surety Bond Claims

Most businesses that purchase surety bonds never need the surety bond. However, in the event that a dispute occurs between a business and their customers or government, a surety bond creates an efficient way to resolve the dispute through a neutral party and allow obligees or direct claimants to recover their losses. If a government agency, customer, or subcontractor believes that a business has violated a law, contract, or ethical standard, they can file a claim against the business's surety bond. Examples of allegations that can result in a surety bond claim include:

- A construction contractor fails to complete work to a contractual standard or pay their subcontractors on time

- A motor vehicle dealership knowingly misrepresents a vehicle's condition

- A public insurance adjuster violates state insurance law

- A collection agency fails to pay the proceeds from a collection to its client

- A gas station fails to pay fuel tax on gasoline that it sells

When a claim is filed against a surety bond, the surety will investigate relevant factors, such as:

- Whether the violation falls within the scope of the surety bond

- The validity of the bond and of the original contract

- Whether the principal has violated the law or contract terms

If the surety finds that the principal is in default, the claim will be resolved in the claimant's favor, and the claimant will be paid. In the next section, we'll look at who is obligated to pay.

General Indemnity Agreements

Unlike some other insurance products, surety bonds are written with minimal expectation of loss, and the risk is still considered to ultimately rest with the principal. Thus, when a principal applies for and signs a surety bond, the surety will require the principal to sign a General Indemnity Agreement (GIA). This agreement requires the principal to pay the surety back for any liabilities, including claims that result from the surety's issuance of the bond.

A GIA gives a surety several different powerful legal tools for enforcing the provisions of a surety bond. These typically include requirements such as:

- That the principal indemnifies and holds harmless the surety from any liabilities

- That the principal cooperates with the surety's investigation of a claim

- That the surety has the final right to either pay or reject a claim

- That the surety may require collateral (such as funds) from the principal

- That the surety may use the principal's collateral to pay its liabilities under a valid claim

In practice, an indemnity agreement works like this: If a surety reviews a claim and finds that the principal is in default, the surety will typically first give the principal the opportunity to pay the claim amount. This is usually a preferable option for principals who are able to pay. If the principal does not pay when given the opportunity, the surety will then pay the claim amount up to the penalty sum. The principal will then be legally required to pay the surety back.

It's worth noting that indemnity can extend beyond simply paying the amount of a claim, depending on the structure of the contract. For example, in some construction contracts, the surety will take responsibility for seeing the project through to completion if the principal is unable to do so. Courts have held, in cases such as Cagle Construction LLC v. Travelers Indemnity Company, that the principal can be held responsible for liabilities beyond the original claim amount, such as the cost of hiring a new contractor to complete the project.

Government Construction Projects and the Miller Act

Surety bonds for construction contractors are among the most common types of surety bond, and the Miller Act is one of the major reasons why. The Miller Act is a 1935 federal law that requires contractors to obtain surety bonds before submitting a bid on any federal construction contract with a value of over $100,000 (and some contracts with values under that).

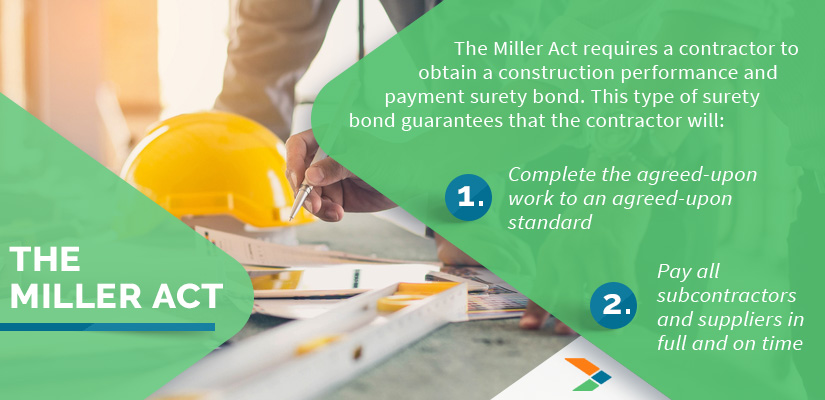

Typically, the Miller Act requires a contractor to obtain a construction performance and payment surety bond. This type of surety bond guarantees that the contractor will:

- Complete the agreed-upon work to an agreed-upon standard

- Pay all subcontractors and suppliers in full and on time

Should a project owner or subcontractor believe that the contractor is in default on either of these obligations, they can file a claim against the contractor's bond. Note that many state and local governments have so-called "Little Miller Acts" that establish similar surety bond requirements for their construction contracts.

Non-Construction Federal Bond Requirements

The federal government also requires certain types of medical practices that accept Medicare to obtain Medicare surety bonds. Specifically, any business that sells durable medical equipment, such as prosthetics, dialysis supplies, CPAP machines, or orthotic inserts, must obtain a DMEPOS Medicare surety bond before they can bill Medicare for services rendered to beneficiaries.

Breweries, distilleries, and wineries are also required to obtain surety bonds before they begin operations. A federal alcohol tax bond, also called a TTB bond, guarantees that an alcoholic beverage manufacturer will pay all applicable taxes to the federal government.

Finally, freight brokers are also required by the Federal Motor Carrier Safety Association to obtain a $75,000 surety bond using FMCSA Form BMC-84. Alternatively, a freight broker can choose to file a BMC-85 trust fund agreement with the FMCSA and create a $75,000 trust fund. Most freight brokers choose a BMC-84 surety bond instead, due to the lower expenditure of cash required and the lack of insolvency protection in BMC-85 trust companies.

State Surety Bond Laws

Many U.S. states have surety bond requirements for certain professions and businesses. Motor vehicle dealer licenses, mortgage broker licenses, medical marijuana dispensary licenses, and construction contractor licenses are all common examples. Applicants for many of these license types will need first to obtain surety bonds, depending on each state's surety bonds law.

Since each state has its own laws about which types of business licenses require surety bonds and what penalty sums the surety bonds are required to cover, a business owner should know which types of surety bonds their individual state requires for their business. No two states are exactly the same, but these types of bonds are commonly required across many different states:

- Contractor License Bonds: For construction contractors such as general commercial and residential contractors, roofers, plumbers, electricians, painters, and HVAC contractors

- Mortgage Broker License Bonds: For mortgage brokers who help connect borrowers with mortgage lenders

- Marijuana License Bonds: For cultivators, dispensaries, distributors, manufacturers, event organizers, and testing labs that work with medical or recreational cannabis products

- Public Adjuster License Bonds: For public insurance adjusters who help insurance policyholders file and negotiate their claims

- Fuel Tax Bonds: For businesses that sell and/or distribute fuel, such as gas stations and fuel wholesalers

Many state surety bond requirements have multiple categories. For example, in some states, construction contractors' bond requirements are determined by how much business the contractor does per year and what kind of projects the contractor takes on. Large commercial contractors may have to obtain a substantially higher bond amount than small residential contractors. Check your state laws and speak with a surety specialist to verify that you have the correct bond amount.

Do you have questions about how to get bonded? Are you looking for a great rate on a contractor surety bond, motor vehicle dealer surety bond, DMEPOS surety bond, or any other kind of essential surety bond? Surety Bonds Direct can help you untangle the legal language and get the bond you need for an affordable premium. Get started today with a no-obligation quote using our quick and easy surety bond quote form, or call our experts at 1-800-608-9950.

Jason O'Leary

Jason O'Leary

updated: