How to Get a Florida Public Adjuster’s License: Everything You Need to Know

What is a Florida public adjuster, and how can you become one? Learn all about these insurance professionals and their licensing process.

Florida has over 21 million residents, and those residents have millions upon millions of homes, businesses, vehicles, and other life essentials. Floridians protect their most important possessions with insurance policies so that when a hurricane strikes or their car is damaged in an accident, they’ll have the resources they need to get back on their feet.

When the beneficiaries of an insurance policy file a claim on that policy, they often hire public insurance adjusters to represent their interests in settling the claim. These insurance professionals help claimants fill out and submit their claim forms, but they also investigate the claims themselves and assist clients in negotiating settlements with insurance companies.

Becoming a public insurance adjuster in Florida can be a strong career choice. However, before you can get your Florida public adjuster’s license, you’ll have to complete an application process that includes getting a Florida public adjuster surety bond. Below, you’ll learn how the process works and how Surety Bonds Direct can help.

What Does a Florida Public Insurance Adjuster Do?

An insurance adjuster is someone who helps process and investigate insurance claims. Adjusters determine whether a claim is covered under the claimant’s policy and work to reach a claim settlement. Many insurance adjusters work for the insurance carriers that write the policies. Public adjusters are a specific type of insurance adjusters who work for the insured parties rather than insurance carriers.

An adjuster will do some or all of the following in the course of their duties:

- Carefully review the claimant’s insurance policy.

- Interview witnesses to the event that caused the claim.

- Obtain records about the event from police or other authorities.

- Inspect property damage in person.

- Calculate and negotiate insurance settlements.

These are the basic elements of the public adjuster’s job, but some of the most important aspects of the profession are determined by those for whom an adjuster works.

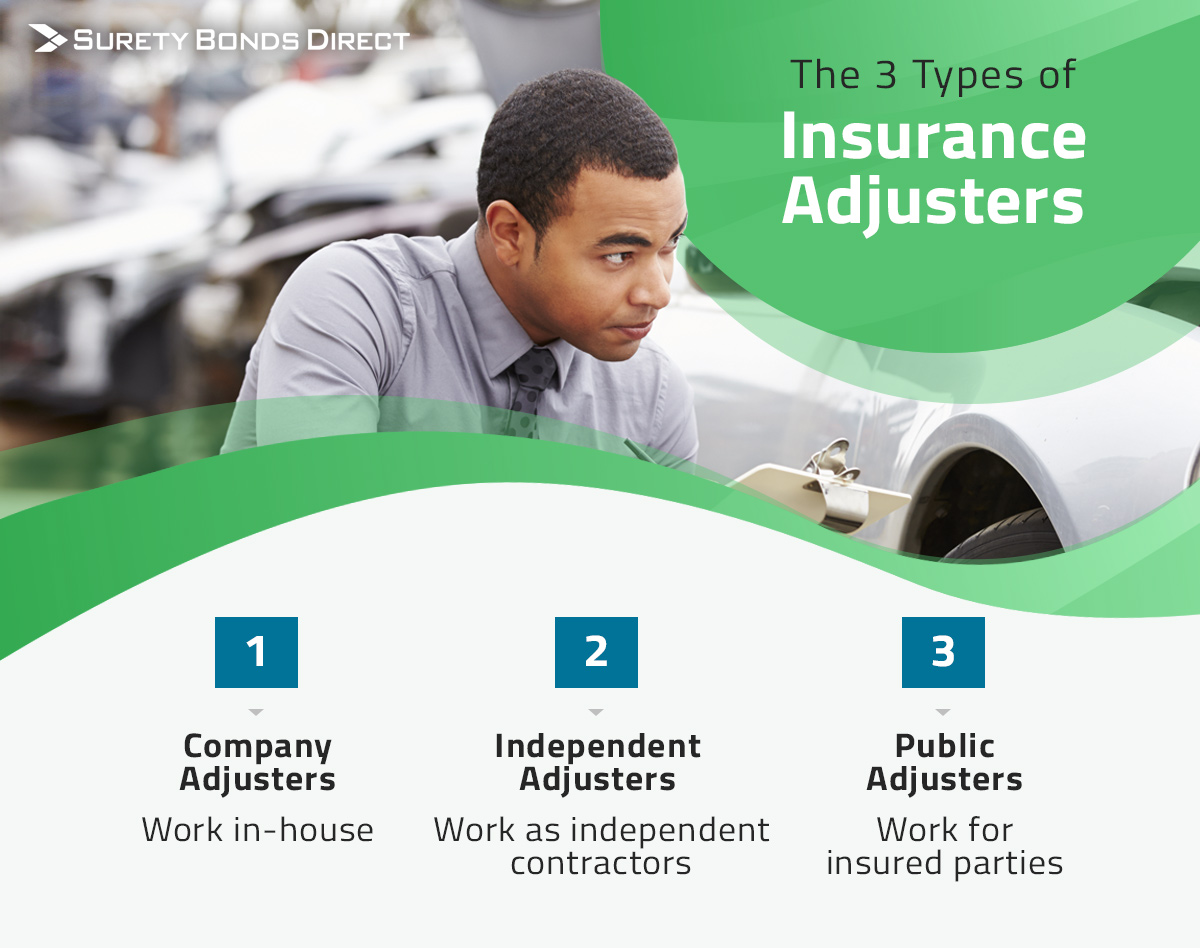

Types of Insurance Adjusters

So what’s the difference between public insurance adjusters and other types of insurance adjusters in Florida? These are the three types of adjusters:

| Type of Adjuster | Role of Adjuster |

|---|---|

| Company Adjusters | Work in-house for an insurance company and represent the insurance company’s interests in the claims process. |

| Independent Adjusters | Work as hired contractors for an insurance company. However, they still represent the insurance company’s interests rather than those of the claimants |

| Public Adjusters | Work for insured parties and represent the interests of a claimant rather than an insurance company in an insurance claim process. |

Public adjusters provide an important service by keeping insurance carriers accountable to their policyholders. They help ensure that every claim gets investigated thoroughly and fairly and that claimants get a fair insurance settlement when they need it most.

Many Florida insurance adjusters also develop a specialty in an area such as automobile claims, hurricane damage claims, or commercial property claims. The more an adjuster knows about their area of expertise, the more efficiently and accurately they’ll be able to evaluate and negotiate claims.

Why Become a Public Adjuster?

For a person with the right skills and aptitude, becoming a public adjuster is a challenging but rewarding career. Some of the benefits that public adjusters can expect include:

- An average salary of $68,130 per year

- The opportunity to spend time in the field, traveling and investigating claims

- Real-life analytical puzzles that challenge your knowledge and logic constantly

- A chance to help and fight for people who are in difficult circumstances

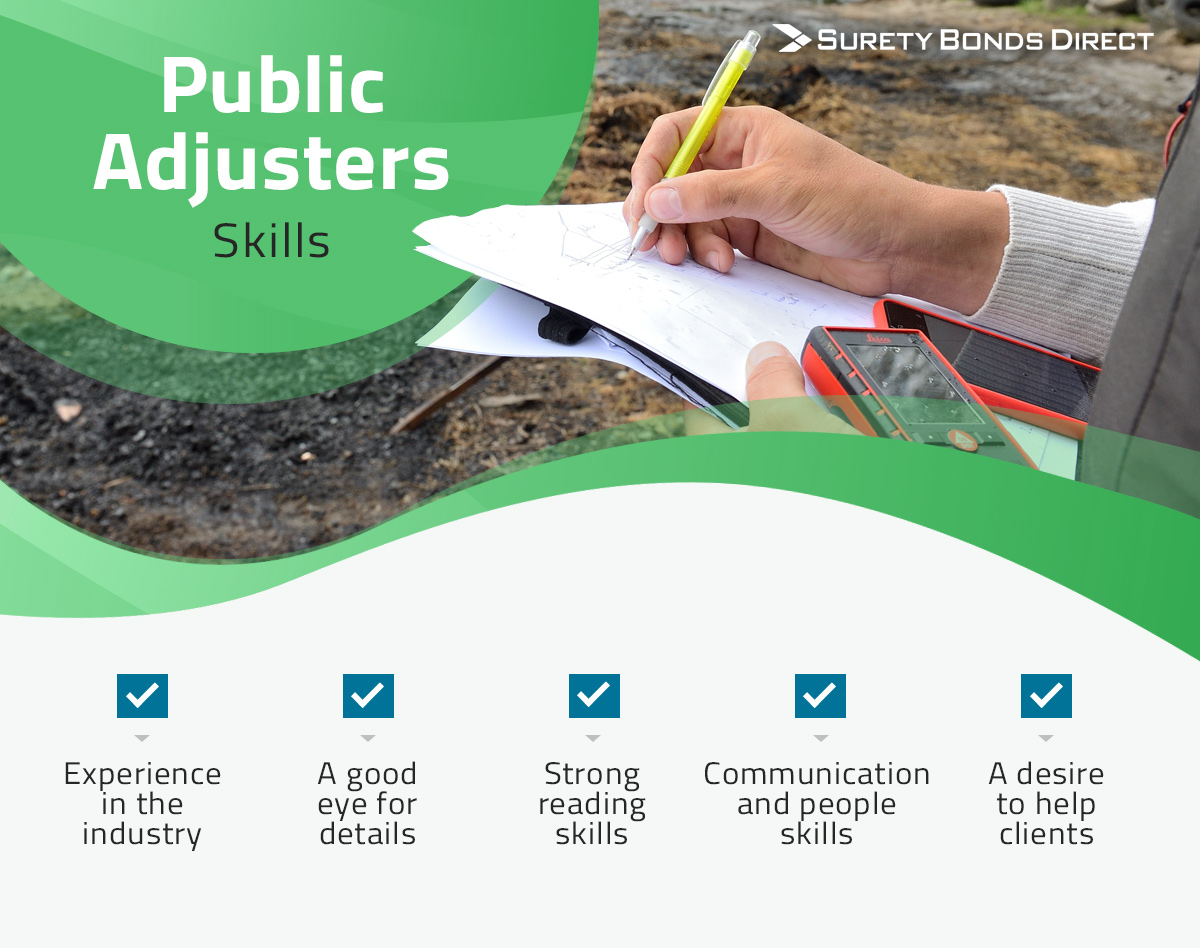

What kind of skills make someone most suitable for a job as a public adjuster?

- Experience in the insurance industry, especially property/casualty or worker’s comp

- A good eye for details and a sharp memory

- Strong reading skills and the ability to understand complex insurance policies

- Communication and people skills for working with both claimants and insurance companies

- A desire to provide a great experience for clients and help them get the settlements that they deserve

What Is a Florida Public Adjuster’s License?

Florida and many states require public insurance adjusters to hold a license from the state government. This license requirement ensures that all people offering their services as public adjusters have a basic level of competence in their field, and they must obey all relevant laws and professional standards. A public adjuster in Florida needs to obtain a Florida 3-20 public adjuster license to legally offer their services to the public as a public adjuster.

Other types of adjusters, such as company adjusters, need to obtain different types of Florida adjuster licenses. The other major public adjuster’s license in Florida is called a 6-20 all-lines insurance adjuster license. (“All-lines” means that the adjuster is licensed to work in all major “lines” of insurance, including property/casualty and workers’ compensation.) A 6-20 adjuster license allows the adjuster to work as an independent or company adjuster, and it’s the license you’ll need to have before you become a Florida public adjuster.

Qualifications to Become a Florida Public Insurance Adjuster

The most important qualification for getting your Florida 3-20 public adjuster’s license is holding a 6-20 adjuster’s license first. This requirement helps ensure that candidates for a public adjuster’s license have the requisite experience in various insurance lines.

Candidates for public adjuster licensure also have to prove they have practical experience in claims adjusting. The law requires the candidate to get appointed as a public adjuster apprentice, independent adjuster, or corporate adjuster. You’ll need to hold this appointment for at least six continuous months before applying for a 3-20 public adjuster license.

There’s one exception to the licensing law for public adjusters in Florida: A licensed attorney in good standing with the Florida Bar can perform the services of a public adjuster in Florida without needing a public adjuster’s license. This law allows attorneys to represent clients effectively in insurance settlement negotiations.

Florida Public Adjuster’s License: Costs at a Glance

How much does it cost to get a 3-20 public adjuster’s license in Florida? The list of standard fees totals approximately $650.00 once you include the minimum cost of purchasing a surety bond. However, this may not account for other factors, such as fees that private vendors charge or waivers that you may qualify for. If you pay using a credit card, your credit card company may also charge convenience fees.

As you learn about the steps to getting a Florida public adjuster’s license, look for the notes on fees in each step. These will inform you about what the state of Florida requires you to pay at each stage of your licensing procedure. Unfortunately, all fees charged in the process are non-refundable.

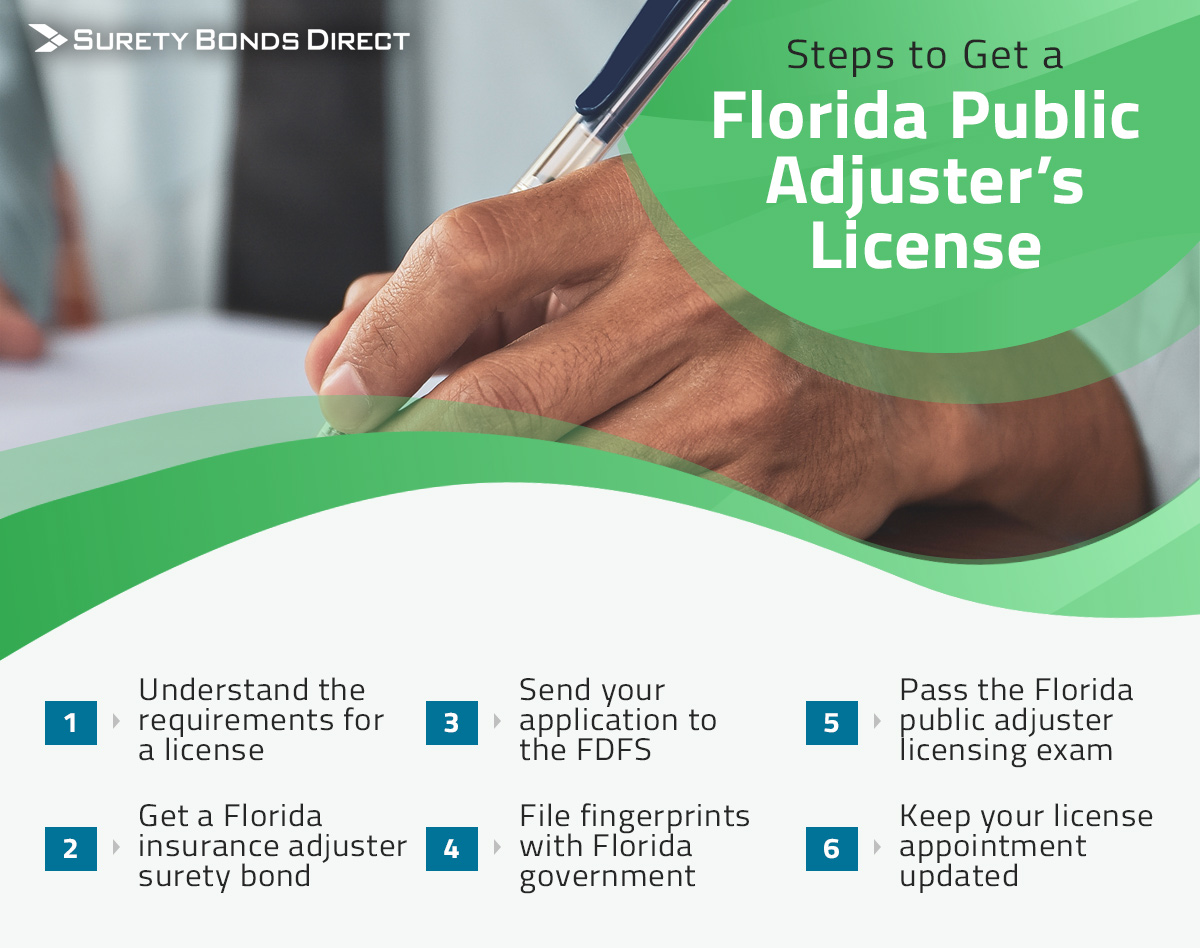

Steps to Getting a Public Adjuster’s License in Florida

Anyone who wants to pursue a public adjuster’s license in Florida will need to understand the process first. Next, we’ll discuss each step in the process toward your Florida public adjuster’s license.

Step 1: Understand the requirements for getting a public adjuster’s license.

The state of Florida requires any applicant for an insurance adjuster’s license to meet several conditions. First, you’ll need to meet the professional qualifications previously discussed, including holding a 6-20 all-lines adjuster’s license and having held an appointment as an adjuster for at least six consecutive months. In addition to the professional qualifications, an applicant also needs to meet these criteria:

- The applicant must be at least 18.

- The applicant must be a U.S. citizen or a legal resident alien with permission to work.

- The applicant must live in Florida or have their main place of business located in Florida.

- The applicant can’t hold a resident insurance adjuster license in any other state.

Step 2: Purchase a Florida insurance adjuster surety bond.

Before you apply for an adjuster’s license, you’ll first need to purchase a Florida public adjuster surety bond with a coverage amount of $50,000. These three-party legal contracts provide a financial guarantee that an adjuster will obey the law and operate ethically. Need more information? Wondering “What is a surety bond, exactly?” Click to read our guide to surety bond basics.

Why does Florida require public adjusters to get a surety bond? A public adjuster has an important responsibility to both the claimants and the insurance companies with which they work. The adjuster must conduct their business honestly and transparently. Surety bonds allow the government or another party to seek financial redress from an adjuster through an efficient process backed by a binding guarantee.

Fortunately, it’s quick and simple to get a public adjuster bond in Florida. Surety Bonds Direct offers one-, two-, and three-year Florida insurance adjuster surety bonds for one-time prices starting as low as $500.00. Unlike some other types of surety bonds, Florida public adjuster bonds don’t require a credit check, and all bond principals qualify for the same low premium rate.

- One-Year Florida Public Adjuster Bond: $500.00

Step 3: Send your application to the Florida Department of Financial Services (FDFS).

Once you have your bond in hand, the next step is to submit your application for licensure as a Florida public insurance adjuster. You’ll need to use the FDFS’s online Bureau of Licensing portal to create a MyProfile, from which you can view and track the status of your application.

The application itself will include basic information, such as your personal details, information about your public adjuster apprenticeship and 6-20 adjuster license, and proof that you’ve obtained the required Florida public adjuster bond.

- Application Fee: $50.00

- License ID Fee: $5.00

Step 4: Get fingerprinted and file your fingerprints with the state government.

The state of Florida requires all public insurance adjusters to submit a copy of their fingerprints before they can become licensed. Use the fingerprinting vendor specified by the Division of Insurance Agent and Agency Services, as the state government does not accept fingerprinting from other vendors or other government agencies. You’ll have the option to submit your fingerprints either electronically or via a paper copy in the mail.

- Fingerprinting Fee: $48.05

Step 5: Take and pass the Florida public adjuster licensing exam.

Your next step is taking the state licensing exam to become a Florida insurance adjuster. Start by reading the Florida Insurance Licensing Candidate Handbook. This document will give you key information on how to schedule your test, exam rules, study tips, and more. Register for the test through PearsonVUE, the state’s testing vendor. You’ll have two hours to complete the test, which has a total of 100 multiple-choice questions, plus ten non-scored pre-test questions. Once you earn a passing score on the test, your score will be valid until one year after the day you took the test.

- State Exam Fee: $44.00

Step 6: Keep your license appointment updated, and don’t forget continuing education.

Once you’ve completed the requirements, the state government will send you confirmation via email that your Florida public adjuster license is now active. As soon as you’ve confirmed that you have an active license, start working on getting your appointment. A public adjuster can be appointed either in their own name or by a public adjusting firm. Your public adjuster license will expire if you haven’t held an appointment in 48 months. Remember that the FDFS also requires adjusters to complete 24 hours of continuing education every two years. You’ll need to have this requirement completed by the last day of your birth month. Continuing education classes will help you keep up with the latest technology, insurance law, and many other important topics.

- Appointment Fee: $60

Surety Bonds Direct is the professional’s choice for Florida public adjuster bonds. We offer the surety bonds you need right now as an instant purchase with no credit check. Get your Florida public adjuster bond today, or call us at 1-800-608-9950 to talk to our friendly surety bond professionals.

Jason O'Leary

Jason O'Leary

updated: