As you would expect, getting a commercial general contractor's license requires the most steps among all Arkansas contractor licenses. Plus the commercial license is one of the two that require a surety bond in-order for the license to be released from the Arkansas Contractors Licensing Board.

This short article will explain the 7 steps to get your license issued successfully.

- The two different commercial licenses

- The filing and application fees

- The details of providing references for your application

- What is and how to purchase the $10,000 surety bond

- The details of the Business and Law exam

- Providing a financial report from a CPA

- What you can do instead of providing the financial report

- Making sure your business is filed correctly

The 7 Steps For Getting an Arkansas Commercial Contractor License

A licensed commercial contractor can perform any commercial contracting project. The formal definition from the Arkansas Contractors License Bond is, a commercial project is any project that is not a single-family residence.

By obtaining your commercial license, you automatically qualify to do residential work in the same classification / speciality as those listed on the commercial license.

There are two types of commercial licenses:

- Restricted - Perform any project that is less than $750,000 in total project cost

- Unrestricted - Perform any project size

Commercial Classifications

There are 7 major classifications where you must prove 5 years of experience.

- Heavy construction

- Municipal and utility

- Highway, railroad, and airport

- Building (commercial and residential)

- Light building (commercial and residential)

- Mechanical (plumbing and HVAC)

- Electrical

There are dozens of specialty classifications where you must show at least 1 year of experience.

You can find the list on page 6 of the commercial application.

Step 1 - Application Fees

Arkansas makes this easy. There is only a $100 filing fee.

There are other expenses to get your application submitted:

- Purchasing the $10,000 surety bond (the price is a small fraction of this bond amount)

- Having a CPA prepare a financial statement

- Possibly purchasing an optional surety bond to forgo having a financial statement

- The cost of purchasing a workers compensation insurance policy if it's applicable to your business

All of these fee or cost scenarios will be highlighted in their respective steps.

Step 2 - Collect 3 References Proving Experience and Expertise

You must provide three references from within the last 90 days of submitting your application for review. These references are testifying that you have the experience and expertise to obtain the license classification or classifications for which you are applying.

These references should not be a supplier or a banker unless they have personally seen your work and are able to describe it.

Finally, the reference must complete the appropriate pages on the license application. You as the licensee are not allowed to fill out the references section.

Here are some example questions from the application:

- List the type of work this company or individual has completed of which you have firsthand knowledge.

- Are you aware of any project that this company or individual has filed to complete?

- Would you recommend this company or individual to be a licensed contractor?

Remember, these references must be less than 90 days old from the time your application is reviewed.

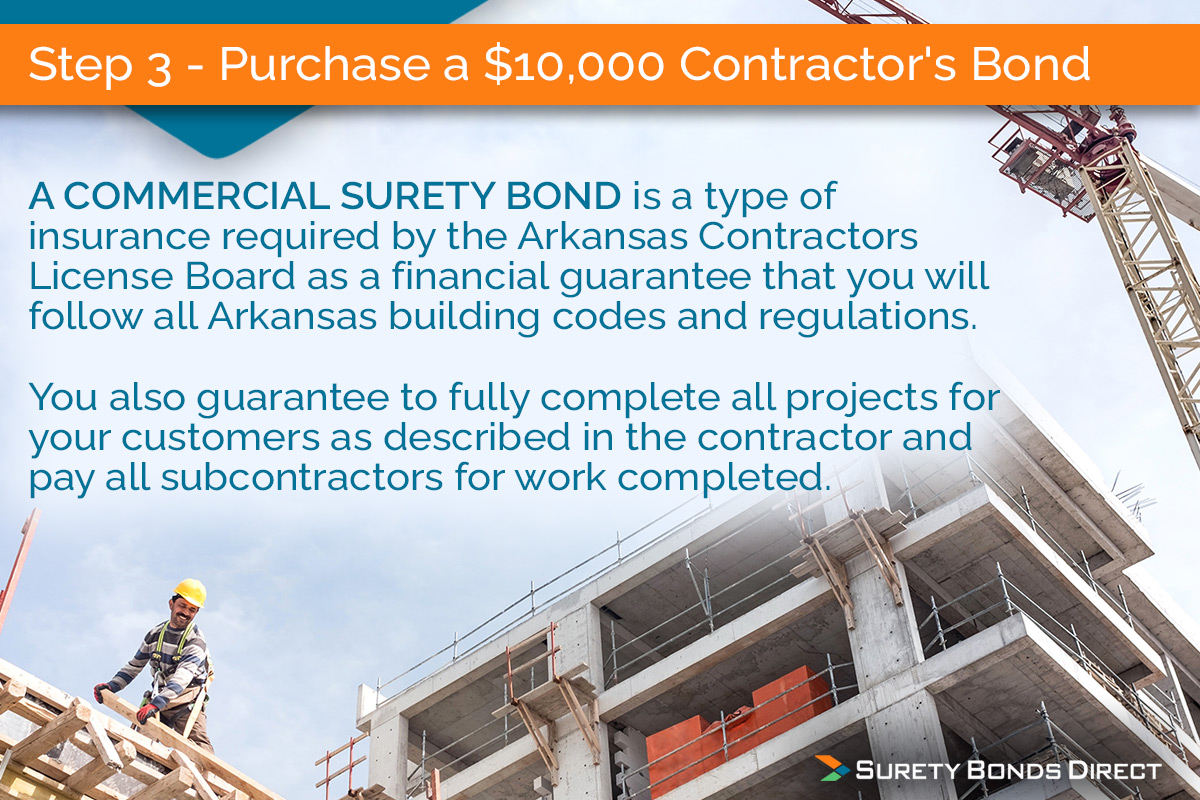

Step 3 - Purchase a $10,000 Contractor's Bond

If this is your first time obtaining a contractor's license, you may have never heard of a surety bond.

A surety bond is a type of insurance required by the Arkansas Contractors License Board as a financial guarantee that you will follow all Arkansas building codes and regulations. You also guarantee to fully complete all projects for your customers as described in the contractor and pay all subcontractors for work completed.

In short, a surety bond is a financial promise that you will do the contracting work you're supposed to do according to the law and the project agreement.

It's an unfortunate fact that there will always be a few licensed contractors who purposefully cut corners and decide to financially harm their customers or subcontractors.

Examples of these fraudulent acts include:

- Failing to start a project

- Failing to complete a project

- Performing inadequate work on a project to save money

- Not paying subcontractors for completed work

If a contractor if accused of any of these acts, the customer or subcontractor can make a claim against the contractor bond for financial reimbursement. However, these claims must be deemed valid by the state for the surety to payout and they're capped at the $10,000 amount, the amount of the contractor bond.

How Much Does a $10,000 Contractor Bond Cost?

The cost of an Arkansas contractor bond is determined in a similar manner to a typical insurance policy.

A surety, an insurance company that writes surety bonds, will determine a rate using factors such as:

- Personal credit of the individual or business owners

- Industry and contracting business experience

- Past claims from other contracting business if applicable

- Plus the contracting industry in the state

BOX: The rate multiplied by the $10,000 bond amount is the price.

But Surety Bonds Direct, has already secured a low fixed price of $100 with no credit check required.

We're able to offer this because, as a specialized surety agency, we work with the A rated sureties that specialize in contractor bonds.

It's important that the business name and individual names on the contractor bond match the name on the application. Make sure when you purchase your bond, you use the exact names. If they differ, even by a comma, the Arkansas Contractors License Board won't accept the bond.

Click here and you can purchase the contractor bond today. It will issued and emailed to you within one business day.

Step 4 - Pass The Arkansas Business and Law Exam

This is an examination of only the Arkansas edition of the contractors business and law regulations. Make sure you're taking the correct exam, the Arkansas edition, as there are others to choose from.

It's given through PSI and a testing center. The test is open book with 50 questions and a 2 hour time limit.

The test will cover topics such as:

- Business planning and start up including business structures and marketing skills

- Operations management including estimating projects and safety

- Financial management, tax basics, and necessary laws affecting contractors in Arkansas

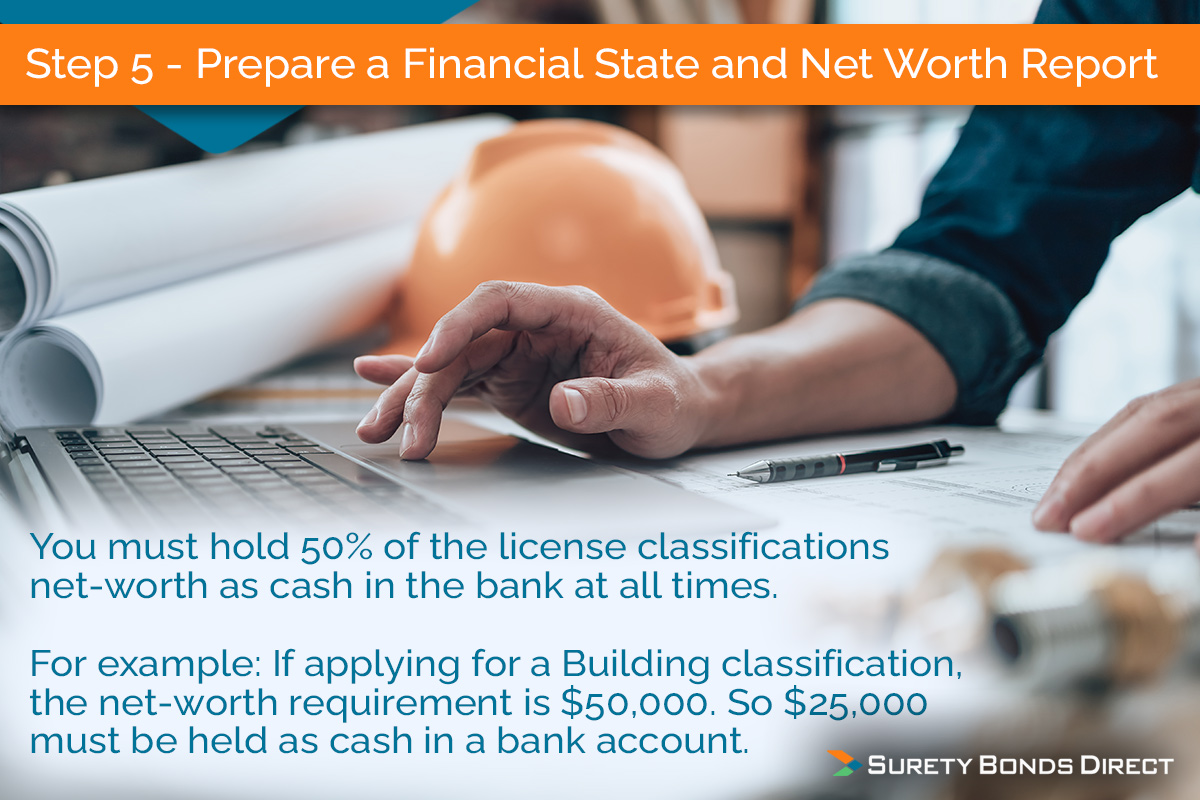

Step 5 - Prepare a Financial State and Net Worth Report

A Certified Public Accountant must prepare this report and you're not allowed to use an in-house CPA.

This report must include:

- A report letter from the CPA

- A balance sheet of the business

The balance sheet will dictate the amount of cash reserves that must be in a bank account at all times.

One half (50%) of the net-worth (calculated from the balance sheet) must be held as cash (no stock notes or other asset classes) in a bank account. The net-worth must match the net-worth requirement for the specific classification you're getting licensed for.

The example given on the application is clear.

If applying for a Building classification, the net-worth requirement is $50,000. So $25,000 must be held as cash in a bank account.

This is to ensure the individual or business has the financial reserves to handle any emergency scenarios where the contractor damages a project owner by a breach of contract or a subcontractor when furnishing labor.

This is very similar to the purpose of the contractor license bond.

If you can't meet this requirement or you don't want to tie up the requirement amount of capital, you can purchase a different type of surety bond.

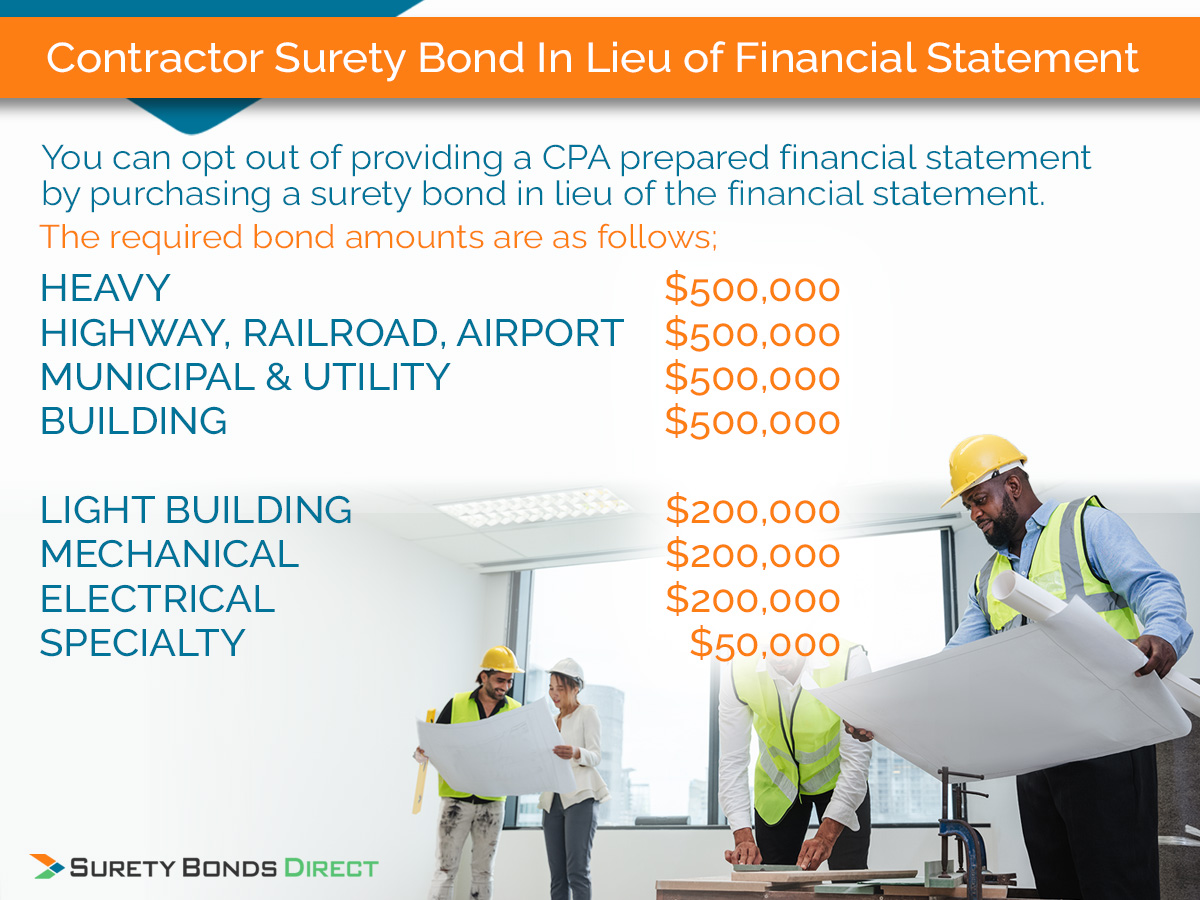

Contractor Surety Bond In Lieu of Financial Statement

This is the official name of the form you would be required to fill out.

Surety Bond in Lieu of Financial Report

Keep in mind this is a completely different surety bond compared to the required $10,000 contractor bond.

The amounts of this bond are:

| Bond Amount | Bond Term | Price | Purchase |

|---|---|---|---|

| $10,000 | 1 Year | $100.00 | Click Here to Purchase |

This bond is not required to be active for the life of a contracting business.

It can be cancelled if and when you prove you have the cash reserves in a bank account. To cancel a surety bond, you typically let it expire.

The price to purchase this bond will require a custom rate. No fixed prices can be secured.

As an example, the table below shows possible pricing for the Heavy classification bond amount with rates ranging from really good to average.

| Bond Amount | Rate | Price |

|---|---|---|

| $500,000 | 0.5% | $2,500 |

| $500,000 | 1.0% | $5,000 |

| $500,000 | 1.5% | $7,500 |

| $500,000 | 2.0% | $10,000 |

For this bond, we will price shop for you to find you the lowest price. There is no cost to have us find you the lowest price. And there's no obligation to purchase once we find you pricing. You have nothing to lose.

Click here and start the quote process. It takes only 90 seconds to complete the form.

Step 6 - Business Filing And Workers Compensation Insurance

These last requirements are easy to meet.

If you're an LLC or Corporation, you must submit a copy of Articles of incorporation on file at the Secretary of State's office. If a fictitious (doing business as) name has been created, submit this name's registration form as well.

If you have one or more employees, you must purchase Worker's Compensation insurance.

Make sure you check with the Arkansas Contractors License Board, even if you're a solo contractor with an LLC, you may be considered the employee of the LLC and be required to purchase Workers Compensation.

Step 7 - Submit Your Application

Each application is reviewed during a board meeting. The application must be completed and submitted three weeks prior to the next board meeting to be reviewed.

You can submit your application for approval before you purchase your required $10,000 contractor bond or provide workers compensation insurance, but your license will not be issued until these requirements are met.

Let Surety Bonds Direct Find You The Lowest Pricing For Your Contractor Bond

When you're ready to purchase your $10,000 contractor bond, visit this our Arkansas contractor page and purchase your bond immediately.

It will take about one business day to prepare your bond with the correct information. Once this is complete, we can email it to you and you can submit it to the Arkansas Contractors License Board.

If you need the Surety Bond in Lieu of Financial Statement, start the quote request today.

We can have pricing to you within one to two business days. It usually only takes one. Then you'll have pricing and you'll be able to make the best decision for your business.

If you have any questions, contact a bond specialist at 1-800-608-9950.