Every state has different rules and regulations for managing medical marijuana. Florida is one of the more strict states when it comes to getting licensed as a Medical Marijuana Treatment Center (MMTC). Only MMTCs are allowed to cultivate and dispense low-THC medical marijuana to card carriers and physicians. Once a MMTC is given final approval, the performance bond must be secured within 10 days.

This short article will focus on the Florida medical marijuana performance bond requirement.

- What is a surety bond or performance bond

- What is the Florida Medical Marijuana Performance Bond

- How much does the bond cost

- How to obtain the bond quickly to meet Florida timeline requirements

What is a Performance Surety Bond?

A surety bond is similar to an insurance policy, but it's not purchased for the protection of the individual or business purchasing the bond. A surety bond protects your customers - and in many cases a state agency - from deliberate fraud, negligence, or misconduct from the individual or business that is bonded.

The surety bond amount, also called the bond penalty, is the amount of financial protection afforded to customers and the state.

Every surety bond is essentially a performance bond. It's a financial promise that you as the business owner will perform your services according to the laws and licensing guidelines set forth by the state.

In the case of the Florida Medical Marijuana Performance bond, a licensed MMTC is promising to follow the:

- Cultivation guidelines

- Processing procedures

- Dispensing laws to customer and physicians

- Laws for premises and IT security

- Plus all the other Florida MMTC requirements

What is the Florida Medical Marijuana Performance Bond?

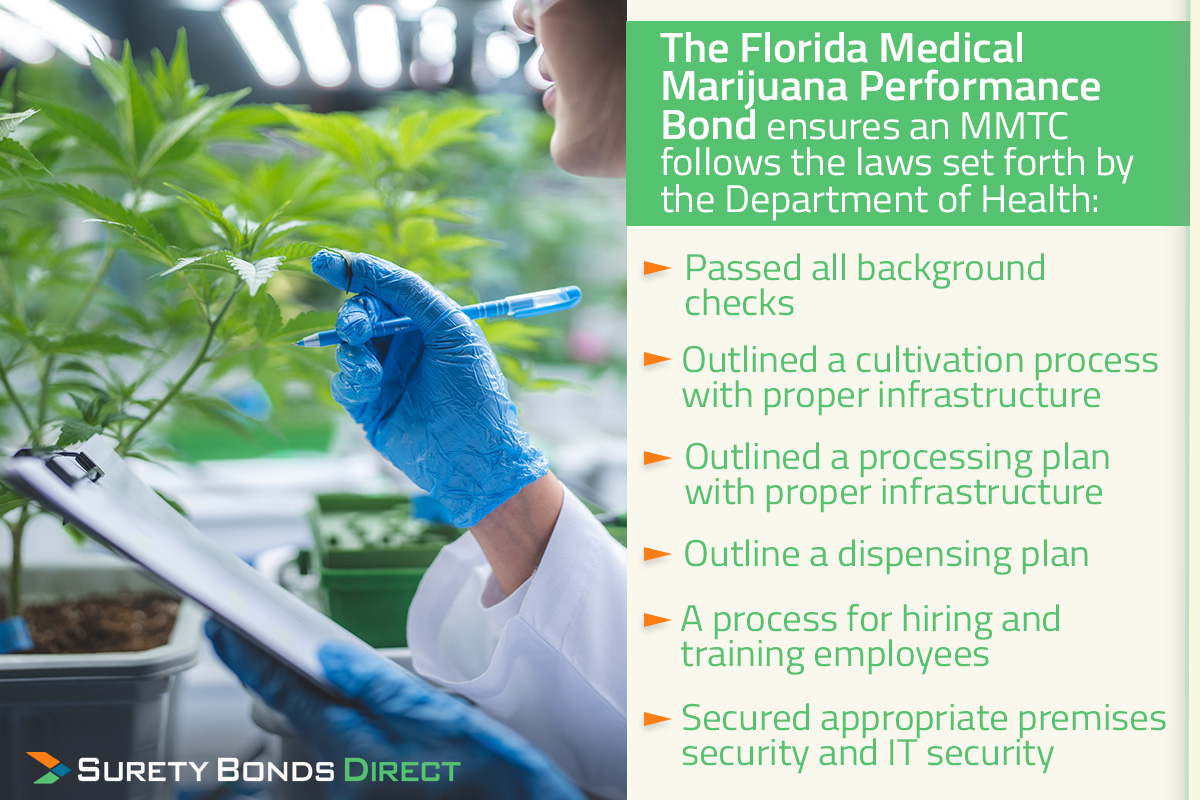

The application process for Medical Marijuana Treatment Center's is very strict. Unlike most state based licensing processes, the Florida Department of Health Office of Medical Marijuana Use scores applications through three phases. Only the highest scoring applications are considered for licensure and only a handful of MMTCs are approved.

The Florida Department of Health takes license approval very seriously and this is where the role of a surety bond comes in.

In the case of the Florida Medical Marijuana Performance Bond, the surety bond amount set by the Department of Health is 5 million dollars. This amount is not the cost to purchase the bond! Determining the surety bond cost will be covered shortly, but it's a small fraction of the bond amount.

By completing the application process and being chosen for licensure, the Department of Health is vouching for the MMTC as a Florida medical marijuana authority patients and physicians can trust.

An individual and/or business who has:

- Passed all background checks

- Outlined a cultivation process with proper infrastructure

- Outlined a processing plan with proper infrastructure

- Outline a dispensing plan

- A process for hiring and training employees

- Secured appropriate premises security and IT security

- Plus many other requirements

When a new MMTC is licensed, the supply of medical marijuana increases allowing:

- New patients to purchase the necessary prescriptions

- New physicians the ability to access medical marijuana products

- Current MMTCs to better serve their community

The supply and service area of MMTCs is closely managed by the Florida Department of Health. Having an MMTC license revoked by the Department of Health can cause large disruptions in medical marijuana availability.

What Does The Florida Medical Marijuana Performance Bond Protect Against?

This bond protects the customers and state from damages resulting from Medical Marijuana Treatment Centers not following the strict requirements of licensure and having their license revoked.

Again, some of these requirements are:

- Cultivation requirements

- Pesticide requirements

- Dispensing requirements

- Collecting and paying appropriate taxes

Plus many other scenarios. Failure to follow these requirements results in the Department of Health revoking a MMTC's license.

By requiring this Florida Medical Marijuana Performance Bond the Florida Department of Health is protecting the public and itself from the financial and supply aftermath of a license being revoked.

When a license is revoked, the costs to fill the need can be great. Here are the outlined costs according to the surety bond form.

Costs Of Replacing The Medical Marijuana Treatment Center

All costs and expenses incurred by the Department of Health attributed to replacing the MMTC.

Costs Of Patients To Find And Purchase Replacement Product

All costs and expenses incurred by patients that are attributed to securing a new source of medical marijuana including transportation costs, delivery costs, and increase cost of the product as long as each cost is assigned to the Department of Health

Costs Of Other MMTCs To Supply The Excess Demand

All costs and expenses incurred by other MMTC that are attributed to adjusting cultivation, processing, and dispensing increase to ensure access to medical marijuana can be met as long as these costs are assigned to the Department of Health.

This is why the Florida Medical Marijuana Performance Bond is required once a new MMTC is chosen for licensure.

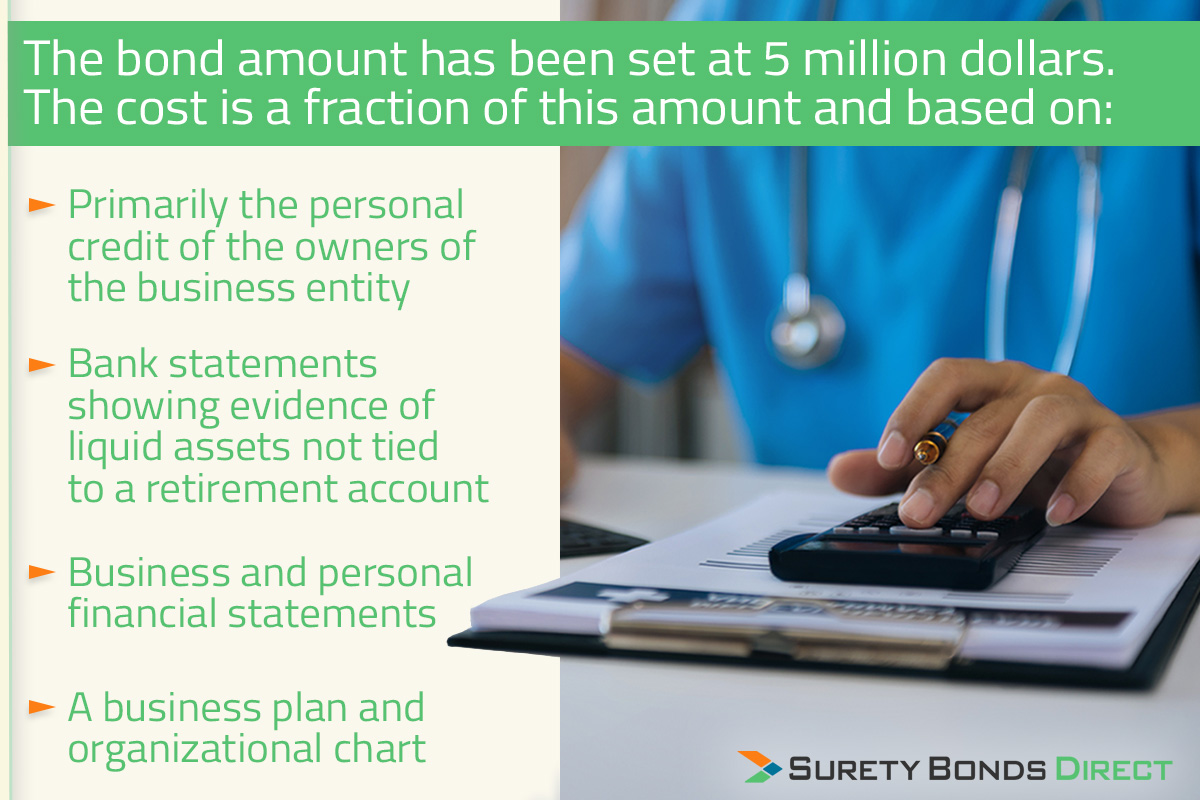

How Much Does a Medical Marijuana Performance Bond Cost?

The bond amount has been set at 5 million dollars by the Florida Department of Health. This amount can be reduced to $2 million if the MMTC has proof of serving a least 1,000 qualified patients.

This bond must be renewed on a two year term. As a MMTC grows their patient base, they can eventually qualify for the reduction of the bonding amount.

The cost is based on a rate quoted by a surety. A surety is the insurance company writing the surety bond. Surety Bonds Direct is a specialized surety agency that works with the select - A rated - Sureties capable of writing a medical marijuana performance bond.

The quoted rate is based on:

- Primarily the personal credit of the individual or owners of the business entity

- Bank statements showing evidence of liquid assets not tied to a retirement account

- Business and personal financial statements

- And a business plan and organizational chart

This rate multiplied by the bond amount is the cost of the bond, known as the bond premium. Because the licensing process is so detailed and only the top applicants secure a MMTC license, it's likely most rates will be at or below 1%.

Because Surety Bonds Direct works with multiple Sureties, we're able to provide quotes from the few Sureties that write this bond. In the end, using an agency like Surety Bonds Direct can save you thousands of dollars when fulfilling the bonding requirement.

Call Surety Bonds Direct When You Need Your Florida Medical Marijuana Performance Bond

First, congratulations on obtaining final approval for a Medical Marijuana Treatment Center license. Let's get your bond issued well within the 10 day limit.

Use our free quote form to start the process online. Or you can call a bond specialist at 1-800-608-9950. This bond requires more information compared to many bonds. Make sure you have all the appropriate information mentioned above to make getting your bond a fast process.