What Is a Federal Maritime Commission Surety Bond?

Which types of businesses are required to obtain surety bonds from the FMC and what businesses can expect when obtaining an FMC bond.

Marine freight is one of the industries that keeps the world moving, with global marine carriers shipping over 1.83 trillion tons of goods in 2017. Ocean Transportation Intermediaries (OTIs) are companies that coordinate U.S. and international shipping without owning their own vessels, and they play a key part in the marine freight industry. However, in order to ensure that OTIs act responsibly, the Federal Maritime Commission (FMC) requires them to demonstrate financial responsibility before beginning operations in the U.S.

One of the most common ways that OTIs meet the FMC’s financial responsibility requirement is by obtaining surety bonds in set amounts and submitting these bonds as part of the OTI licensing process. Businesses wishing to enter the market as OTIs will need to be familiar with FMC bonds and understand the fastest and most cost-effective ways to obtain them.

In this article, we’ll discuss the basics of FMC bonds, which types of businesses are required to obtain them, and what businesses can expect when obtaining an FMC bond. First, we’ll give a brief introduction to the FMC, the organization that regulates OTIs.

What Is the Federal Maritime Commission?

The Federal Maritime Commission is the U.S. government agency responsible for regulating the U.S. maritime supply chain and international marine shipping in U.S. waters. The FMC’s mission is to ensure that U.S. maritime trade is conducted according to all relevant legal standards, and the organization oversees OTIs as part of its regulatory authority.

When an OTI applies for licensure from the FMC, the FMC requires the OTI to provide proof of financial responsibility, such as obtaining an FMC surety bond. An FMC bond helps ensure that the OTI is financially stable and guarantees its compliance with the law.

Basics of Federal Maritime Commission Surety Bonds

Federal maritime commission bonds are a type of surety bond. For a complete explanation of surety bonds, see our article, What Is a Surety Bond? The basic structure of a surety bond is a three-party agreement that provides a financial guarantee for the obligation of one party (called the principal) to another (called the obligee), using a neutral third party called a surety. In the case of FMC bonds, the parties are as follows:

- The principal is the OTI required to obtain the surety bond.

- The obligee is the Federal Maritime Commission.

- The surety is an insurance company that provides a financial guarantee of the principal’s obligations.

In the event that the FMC or one of the OTI’s clients believes that an OTI has broken the law or a contractual obligation, they will first seek redress from the OTI. If the OTI and the complainant do not reach a satisfactory resolution, the complainant may file a claim against the OTI’s FMC bond. The surety will investigate the claim and pay the claim amount (up to a certain number called the penalty sum or bond amount) if the surety finds the claim to be valid.

An OTI applying for a surety bond should remember that the principal of a surety bond is fully financially liable for paying back the surety for any money that it pays to a claimant. Unlike most other forms of insurance, a surety bond exists to protect the principal’s clients and relevant government agencies rather than protecting the principal themselves.

Key Laws to Understand for Surety Bonds

A surety bond is a legally binding contract, so OTIs applying for their FMC bonds should be sure that they thoroughly understand all applicable laws before obtaining an FMC bond. Many of these laws originate from the Shipping Act of 1984 and the Ocean Shipping Reform Act of 1998. All marine industry operators should be familiar with these important laws, particularly the sections that apply to their specific subsets of the shipping industry.

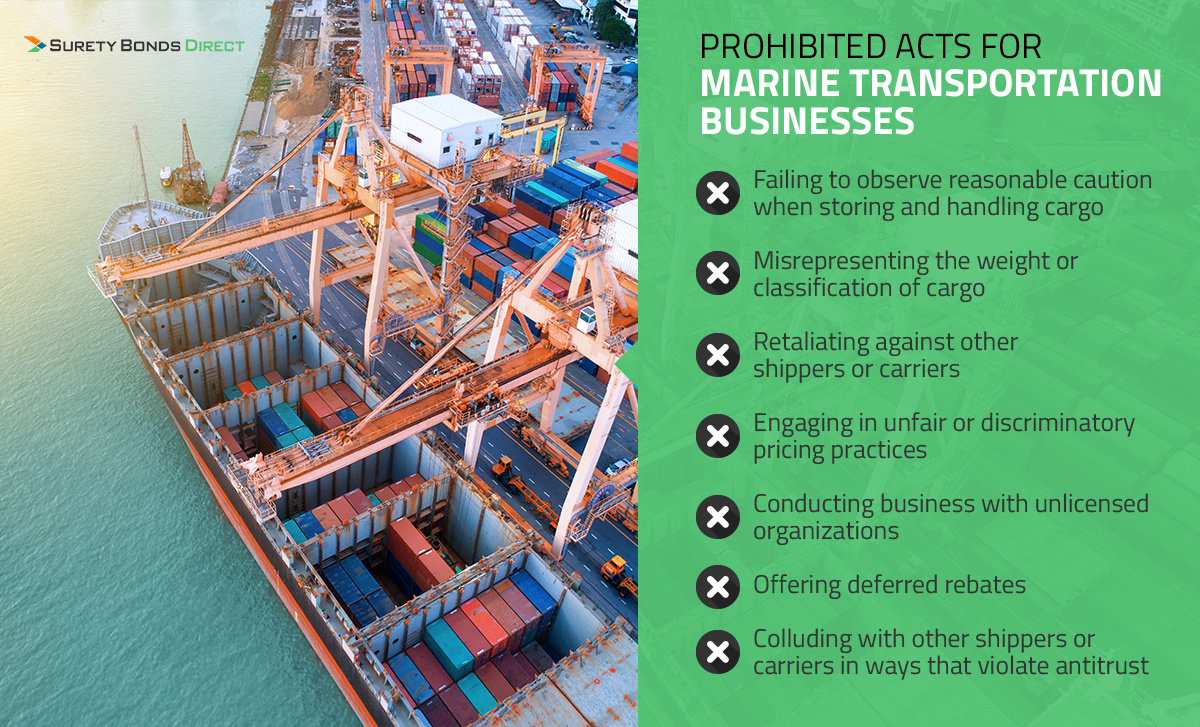

The regulations for OTI licensure and bonding are codified in 46 US Code Chapter 409, including the requirements for the financial responsibility of OTIs. OTIs should also take care in noting the regulations in 46 U.S. Code Chapter 411, which outlines prohibited acts for marine transportation businesses, such as:

- Failing to observe reasonable caution when storing and handling cargo

- Misrepresenting the weight or classification of cargo

- Retaliating against other shippers or carriers by refusing to rent cargo space when available

- Engaging in unfair or discriminatory pricing practices

- Conducting business with unlicensed organizations

- Offering deferred rebates

- Colluding with other shippers or carriers in ways that violate antitrust laws or otherwise unfairly reduce competition

By making these key laws the cornerstone of their shipping practices, an OTI will help ensure that their operations are compliant with relevant legal standards and avoid bond claims.

OTIs should also make sure to understand the claims process for FMC bonds, as outlined in 46 CFR § 515.23. These regulations outline the procedures for filing a claim against an FMC bond and the scope of an OTI’s financial responsibilities in the claims process.

Who Is Required to Get an FMC Bond?

FMC bonds are legally required for two types of marine shipping businesses—namely, ocean freight forwarders and non-vessel-operating common carriers. Each type of business must comply with slightly different surety bond requirements from the FMC.

Ocean freight forwarders (OFFs) are a type of freight forwarder that provides maritime services. An OFF performs tasks such as preparing and submitting documentation and coordinating vessel and container rentals for shippers, but an OFF doesn’t take possession of the cargo and does not ship under its own bills of lading. Thus, an OFF is not counted as a type of carrier.

Non-vessel-operating common carriers (NVOCCs) are a type of carrier that does not own its own vessels. NVOCCs take a greater level of responsibility for shippers’ cargo, taking physical possession of the cargo and shipping under a house bill of lading. An NVOCC is considered to be a carrier but is more like a shipper in its relationship with other ocean carriers.

Both of these types of businesses are key elements of the global shipping industry, and both may need to file an FMC bond as part of the paperwork required to become licensed by the FMC. Next, we’ll discuss some important facts about how much an FMC bond costs.

How Much Does an FMC Bond Cost?

The first factor that influences the cost of an FMC bond is the penalty sum or bond amount. The required penalty sum for an FMC bond differs according to the type of business:

- Ocean Freight Forwarders: $50,000

- Non-Vessel-Operating Common Carriers domiciled in the U.S., or non-U.S.-based NVOCCs licensed by the FMC: $75,000

- Non-Vessel-Operating Common Carriers domiciled outside the US and not licensed by the FMC: $150,000

The FMC also has the authority to demand a higher bond amount in certain circumstances.

The premium that the business pays for its FMC bond is a percentage of the bond amount (aka the “penalty sum”). However, certain factors affect the premium rate, including:

- Whether the OTI has had previous bond claims filed against them

- Whether the OTI has been previously disciplined by the FMC, including having their license suspended or revoked

- The credit scores & reports of the OTI’s principals and qualifying individuals

- How long the OTI has been in business

The credit report is among the most important factors in obtaining a quote for an FMC bond, and principals with lower credit scores or derogatories will often pay higher surety bond rates. However, options are available for getting a surety bond with bad credit, including adding a co-signer and using premium financing plans to spread out the cost of a premium.

The Bonding Process for FMC Bonds

The process of obtaining an FMC bond is relatively straightforward. The steps are as follows:

- The OTI applies for a quote on an FMC bond from a surety bond agency.

- The surety performs underwriting on the OTI to determine its risk level.

- Based on the OTI’s risk level, the surety generates an FMC bond premium quote for the OTI.

- The OTI is free to accept or decline the premium quote. If the OTI accepts, it pays the premium and the surety writes the bond.

- The surety sends the completed bond paperwork to the OTI, and the OTI’s authorized signatory signs the bond.

- The OTI files the surety bond with the FMC as part of the application process for its OTI license.

Once an OTI has its FMC bond, it is the OTI’s responsibility to keep the bond in force by renewing the bond annually.

Other FMC Requirements for OTIs

The FMC also has some other requirements for OTI licensure, including:

- The OTI must appoint a qualifying individual with at least three years of demonstrable experience in the U.S. OTI freight industry and who must be either a principal or officer of the corporation.

- The OTI must complete and submit Form FMC-18 to the FMC.

- The OTI must pay the FMC’s license application fee.

- NVOCCs must publish and maintain a tariff in accordance with 46 CFR § 520.3.

NVOCCs based outside the U.S. must also establish a presence in the U.S. (such as a branch office) and must designate a registered agent to receive legal communications (such as subpoenas) before the FMC will issue a license.

Surety Bonds Direct makes it simpler and faster to get an FMC bond. We work directly with a large network of reliable sureties to save our clients money and time, and we offer free, no-obligation surety bond quotes that typically take just two minutes to receive. Get started today with a free FMC bond quote, or call our surety experts at 1-800-608-9950 to learn more.

Jason O'Leary

Jason O'Leary

updated: