Opening a nail salon requires a lot of work and there's a lot to coordinate. And you probably never thought that you would have to purchase a surety bond. And if you're like many new business owners, you've probably never heard of a surety bond before.

In this short article you'll learn about the New York nail salon wage surety bond requirement:

- What a surety bond is

- What the purpose of this wage bond is

- How much it will cost you

- How to update when and if needed

What is a New York Nail Salon Wage Surety Bond

As a nail salon owner the New York Department of State requires you get your Nail Specialty License and a business license. One of the requirements is purchasing liability insurance coverage to cover wages owed or purchase a wage surety bond.

The major difference is the extended liability insurance will require monthly premium payments, while a wage surety bond will only require a year premium.

This surety bond is specifically referred to as a wage bond, but it serves the same purpose as all surety bonds, to make sure you do what you're supposed to do.

In this case as the salon owner you're collecting all the revenue with the promise to distribute it to your technicians as the wages they deserve. This is why this surety bond is called a wage bond, a type of financial guarantee bond.

What Does a New York Salon Wage Bond Protect Against?

Again, as the business owner, your salon will be collecting the revenue from your customers. Your technicians are owed wages for the customers they served.

The New York Department of state uses the wage bond to hold you accountable to paying your technicians the correct wages to your technicians. It's unfortunate but ever year there are legitimate complaints against salon owners who purposefully withhold wages owed to their technicians.

If a technician or multiple technicians are financially harmed by a salon owner, they can make a claim against the salon owner's wage surety bond for the financial damages they suffered.

The maximum amount of one claim or multiple claims is capped by the required body amount.

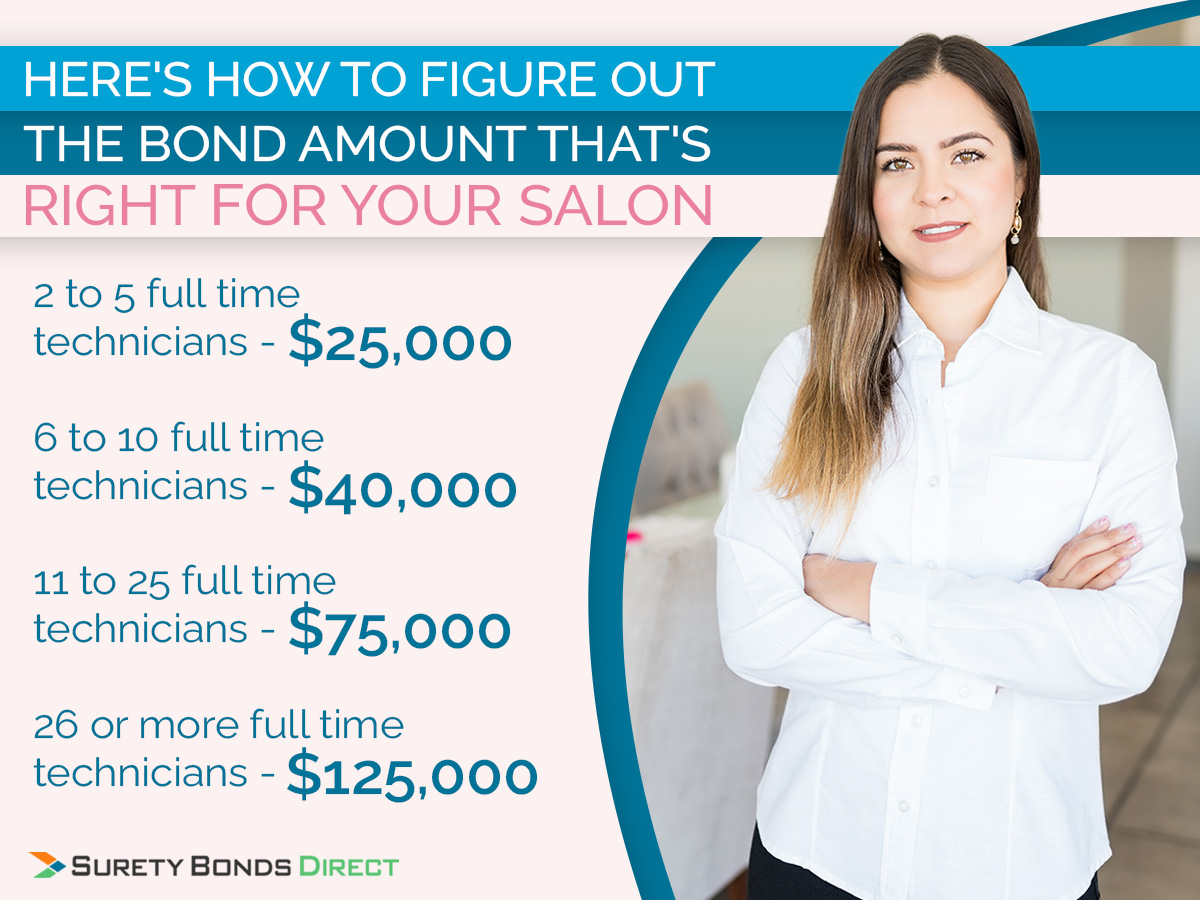

Here's how to figure out the bond amount that's right for your salon.

| Full Time Technicians | Bond Amount |

|---|---|

| 2 to 5 full time technicians | $25,000 |

| 6 to 10 full time technicians | $40,000 |

| 11 to 25 full time technicians | $75,000 |

| 26 or more full time technicians | $125,000 |

Remember, this is the bond amount, the maximum amount of coverage available. The price to purchase your bond is going to be one yearly payment that is a small fraction of your bond amount.

How To Determine Your Nail Salon Wage Bond Price

The price of surety bonds is determined similar to traditional insurance you're used to. A surety, the insurance company that underwrites wage bonds, will quote a rate and this rate multiplied by the bond amount is the price you'll pay.

The rate that is quoted will be based on:

- Your personal credit and the credit of any other owners in the business

- Any business and industry experience

- Any bond history if you or another owner has been bonded in the past

There is no way around the personal credit check no matter where you purchase your wage bond.

Whether you have excellent credit or limited credit, we will help make sure you pay the lowest price.

Here is example pricing at common rates. We'll use the $40,000 bond amount as the example bond amount.

| Bond Amount | Premium Rate | Total Cost |

|---|---|---|

| $40,000 | 0.5% | $200 |

| $40,000 | 1.0% | $400 |

| $40,000 | 2% | $800 |

| $40,000 | 3% | $1,200 |

| $40,000 | 4% | $1,600 |

How To Purchase Your Wage Bond

We are Surety Bonds Direct, a specialized surety agency. We work with the A rated sureties to price shop and find our clients the lowest price we can for the bond they need.

The process is really easy.

Step 1: Request Your Price Quote

You can fill out our online quote form or you can call a bond specialist (1-800-608-9950). We need to collect some basic information about you and your business so we can get your pricing.

Step 2: Let Us Price Shop For You

If you have excellent credit we can typically get you pricing immediately, but it's fair to expect a few hours so we can collect rates from all of our sureties.

Step 3: Purchase Your Bond

Once you receive pricing, you can purchase your bond. You are under no obligation to purchase through us and all price quotes are good for 30 days before they have to be quoted again.

If and when you're ready, purchasing your bond only requires completing an online order form or purchasing over the phone.

There are two key things to make sure when you purchase:

- One, make sure the business name and any DBAs on your bond matches the name registered with the Department of State

- Two, choose an activation date for when you want the bond coverage to start

When your payment is processed, our bond issuance team will:

- Prepare the correct bond form you need

- Make sure all the signatures and seals are on the bond

- Attach the required power of attorney

Once your bond is ready, you'll receive an email with a copy of your bond so you can submit it with your business license application.

The entire process to get your completed bond takes about one business day, two at the most.

How to Keep Your Nail Salon Wage Bond Active

If you choose to get the wage bond, as long as you're in business you need to have an active bond on file with the Department of State.

Plus you'll need to keep your bond updated at the appropriate level based on your salon's full-time employee growth.

This is another great reason to work with us. When you purchase your bond, you're assigned a bond specialist who will manage your bond for you.

As your bond's expiration date approaches, they will email and call you about 30 days in advance to remind you of your expiration date and help you update your bond amount if it's required.

The renewal process only required you pay your renewal premium and your bond on file with the Department of State will remain active. There is nothing else you have to do.

If you have to increase or decrease the bond amount, that will require a new bond that you must send to the Department of State.

Again, we'll manage the bond for you so you don't forget about it or let it lapse.

When You're Ready We'll Help You Get Your New York Nail Salon Wage Bond

As you go through the license process, you'll be checking off a lot of requirements so you submit your application to the state.

Most of these requirements are application fees and making sure your salon will meet all of the operational requirements. While you're getting that in order, start the wage bond process by getting your pricing.

This way, you'll have an exact price so when you're ready to purchase you can get your bond quickly.

If you have any questions, call a bond specialist at 1-800-608-9950. You can also get the pricing process started right now by filling out an online bond quote request.