The International Fuel Tax Agreement (IFTA) is an agreement between the lower 48 states of the United States and the 10 provinces of Canada bordering the United States to unify a motor fuels use tax for qualified motor vehicles.

What Is A Qualified Motor Vehicle?

Every state and province shares the definition of a qualified motor vehicle.

A qualified motor vehicle is:

- Any vehicle with three or more axles.

- A two axle vehicle with a gross weight of more than 26,000 pounds.

- A vehicle used in combination (with trailer) with a gross weight of more than 26,000 pounds.

- And if your fleet is traveling across state lines or into and out of Canada.

When you meet one of these qualifications you must obtain a IFTA license.

Personal recreational vehicles like motor homes or trucks with trailing campers used for personal pleasure are not classified as qualified motor vehicles.

How Much Does a IFTA License Cost?

Many states do not charge a license fee though some charge a decal fee.

California charges a $10 license fee covering all of the vehicles in your fleet plus a $2 fee per decal set.

New York does not have a license fee, but charges a decal fee of $8 per decal set. Every vehicle in the feel requires two decals or one decal set.

Massachusetts charges a $10 per year fee for getting the IFTA license and an $8 per decal set fee.

Check your individual base jurisdiction for any fees to obtain your IFTA license and decals.

What Is Your Base Jurisdiction?

The base jurisdiction for your qualified motor vehicle (and fleet) is the state where these three requirements are met:

- The vehicle or vehicles are registered

- Where you maintain operational control and records are maintained

- Where some milage is accrued

The fuel use tax for each state travelled is paid through your base jurisdiction. This simplifies the payment process and it's one reason the IFTA was created.

How Much Is The Tax And When Is It Due?

Tax rates are complicated and each state has a unique rate based on the type of fuel being purchased. Some states have a flat tax rate.

Here is a breakdown of each states tax rate per gallon based on fuel type. This is put together by the IFTACH.org, a non-profit to help simplify the data for calculating IFTA tax rates and requirements per state. This is not guaranteed to be accurate, make sure you check the individual states you traveled through for up to date tax rates.

Not all states have a tax rate per fuel type. South Carolina for example (currently) charges a flat $0.28 per gallon. And some states like Texas refer you back to IFTACH.org.

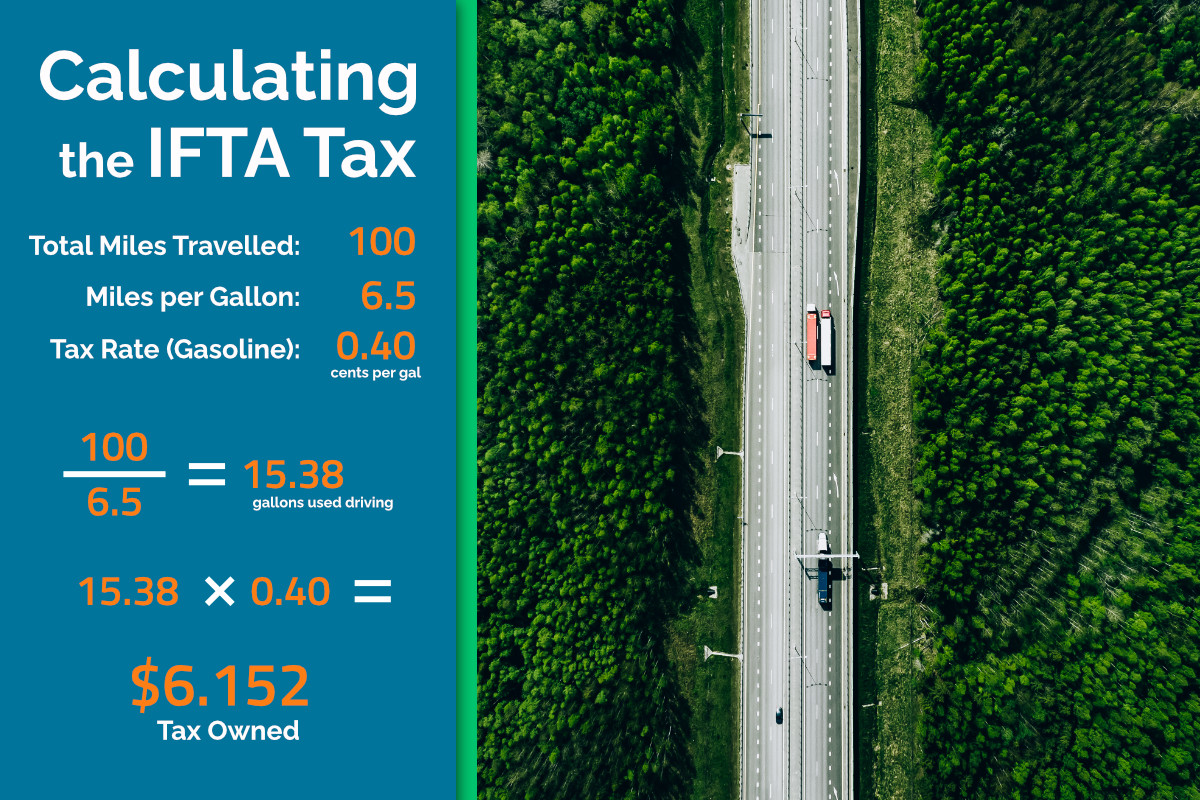

The fuel use tax is based on the total miles traveled in the state and your average miles per gallon to calculate your approximate gallons used in the state. Multiple this figure by the tax rate for your fuel type of determine the tax liability for that state.

After each quarter, taxes for that quarter are due before the end of following month. You calculate the tax per jurisdiction and pay all applicable taxes through your base jurisdiction. A tax return must be filed per jurisdiction even if you did not travel through that state.

It's important to remember. You must record a zero in the states you did not travel through.

IFTA Tax Refunds From The State

If you purchase fuel in the state, you will be paying the state fuel tax at the terminal or pump. This fuel sales tax amount will be deducted from the tax owed from traveling in the state. In many cases you may receive a payment from the state to offset the taxes paid for fueling.

IFTA Tax Surety Bond Requirements

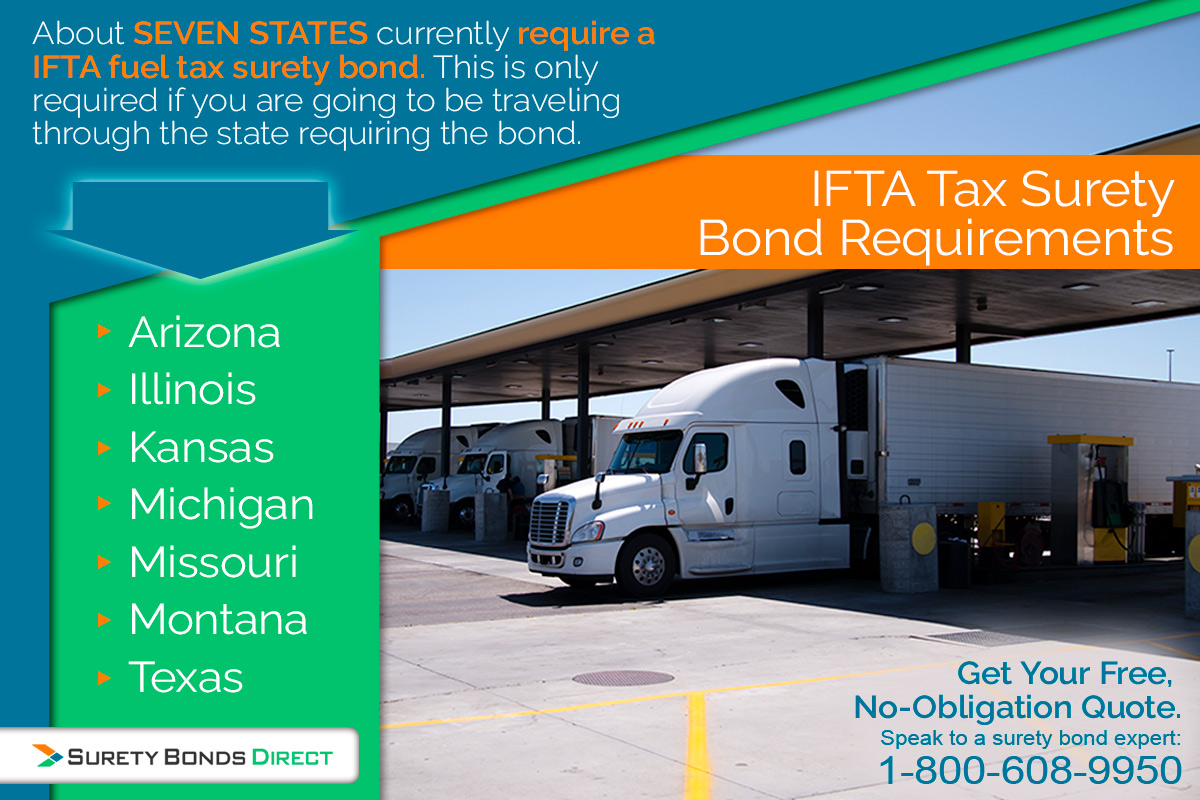

About seven states currently require a IFTA fuel tax surety bond. This is only required if you are going to be traveling through the state requiring the bond.

The amount of the bond is determined at the state level. Arizona requires a $5,000 bond value while other states like Texas and Montana base the bond value on twice the licensee's estimated quarterly tax liability, but not less than $500.

This surety bond protects the states from not receiving the fuel tax owned to them under the International Fuel Tax Agreement.

Not all states require a bond to obtain an IFTA license. Montana and Colorado require a surety bond:

- After you've failed to pay owed taxes in a timely manner

- When taxes have not been remitted

- When after an examination of the account indicates a bond is required.

If you require a IFTA surety bond, get an instant online quote or talk to a IFTA bond expert by calling 1-800-608-9950.

The Short History Of The International Fuel Tax Agreement

The International Fuel Tax Agreement was created because a large number of states realized fuel taxes were unevenly distributed to specific states. During a given trip, trucks would fill up the majority of the time in their beginning and destination states. Other states became known as pass through states, a state that was frequently travelled through, but rarely used for fuel fill ups.

Since these pass through states were part of the operations of these shipments, the IFTA was put into place.

This allowed every state to get their fair fuel tax. Fuel taxes are a vital funding tool for road system maintenance and new construction.