The City of Fort Worth has only two bonding requirements for local contractors. Both of these are for right of way projects (ROW) and in this short post you'll learn:

- What a right of way project is

- What a surety bond is

- Why you're required to purchase this bond

- How much your bond will cost

- And how to get this process done fast

If you have any questions, feel free to contact us or call a bond specialist at 1-800-608-9950.

What is a City of Fort Worth Right of Way Project

If you're new to the contractor space, you may be unfamiliar with right of way projects.

A right of way project is construction project that will temporarily damage public state, county, or city property.

Examples of this property include:

- Sidewalks and curbs

- Streets

- Sewer systems

- Underground cables

- Landscaping like shrubs and trees

Most of the time these projects are commissioned by government entities, but private companies or utility companies can also commission a right of way project.

What Is a Right of Way Surety Bond?

At a high level a surety bond is a legal contract, you as the contractor, are required to purchase as a guarantee of:

- Following state, county, and city licensing laws

- Following project contracts and completing projects

- Paying subcontractors

Essentially it's a tool used to ensure you don't commit purposeful fraud against your customers or the people your projects affect.

There are a lot of different types of surety bonds in the contracting space. This City of Forth Worth right of way bond is a type of performance bond.

Why is a Right of Way Construction Bond Required?

The jurisdiction that is responsible for the public land you'll be temporarily "destroying" wants to ensure that you will properly repair the areas affected as part of the project.

They don't want a contractor damaging public property and then abandoning it for the city to fix at the tax payers expense.

If a contractor were to purposefully abandon damaged city property as part of another project, the city could make a claim against the contract's right of way surety bond for financial compensation.

The level of financial compensation is capped at a bond amount set by the city.

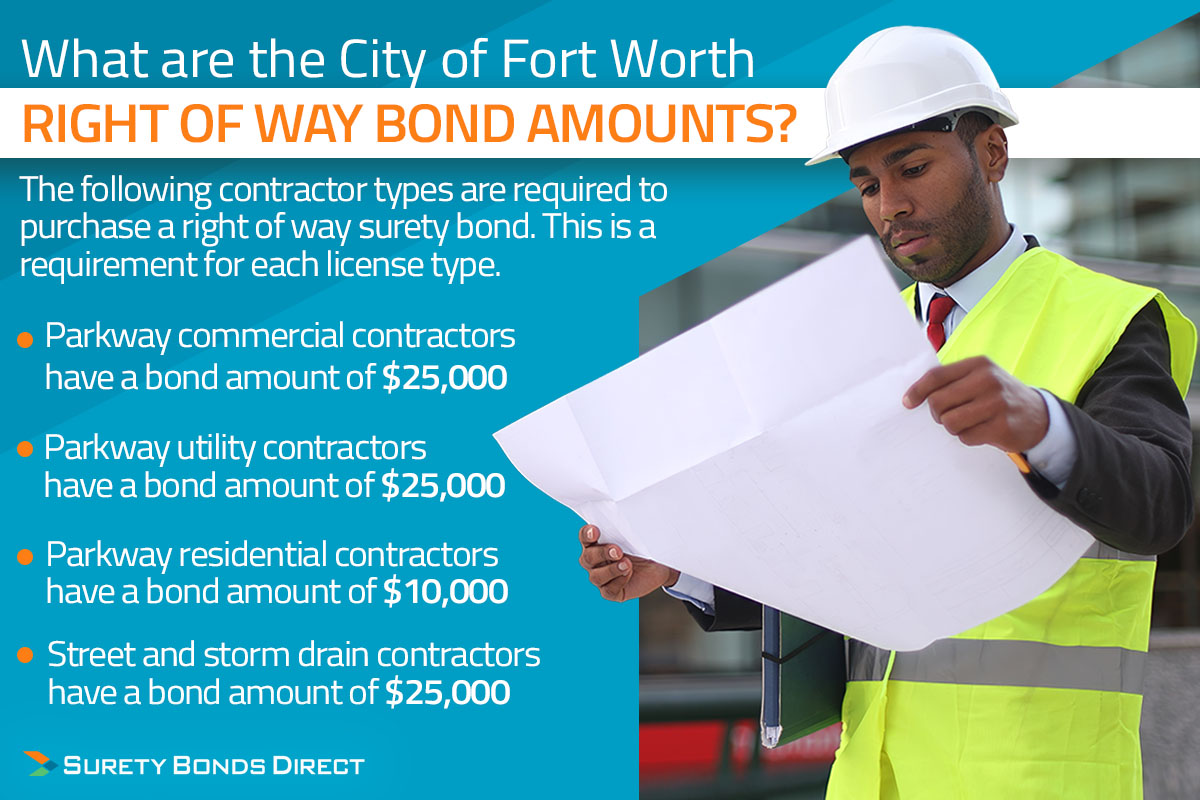

What are the City of Fort Worth Right of Way Bond Amounts?

The following contractor types are required to purchase a right of way surety bond. This is a requirement for each license type.

- Parkway commercial contractors have a bond amount of $25,000

- Parkway utility contractors have a bond amount of $25,000

- Parkway residential contractors have a bond amount of $10,000

- Street and storm drain contractor have a bond amount of $25,000

Again this is the maximum amount of financial compensation available to the government agency that is responsible for the public property that will be temporarily damaged.

How Much Does a City of Forth Worth Surety Bond Cost?

The cost of surety bonds is determined by a surety, an insurance company that underwrites right of way contractor performance bonds.

And at a high level, in order to come up with a price, the surety independently assess the:

- Personal credit of the construction companies owner or owners

- Business and public works project experience

- The bond history if an owner has been bonded in the past

From these factors they would quote a rate and this rate multiplied by the bond amount you need is the price you'll pay.

However there is good news for the City of Forth Worth Parkway right of way surety bond and the sewer and storm drain surety bond prices.

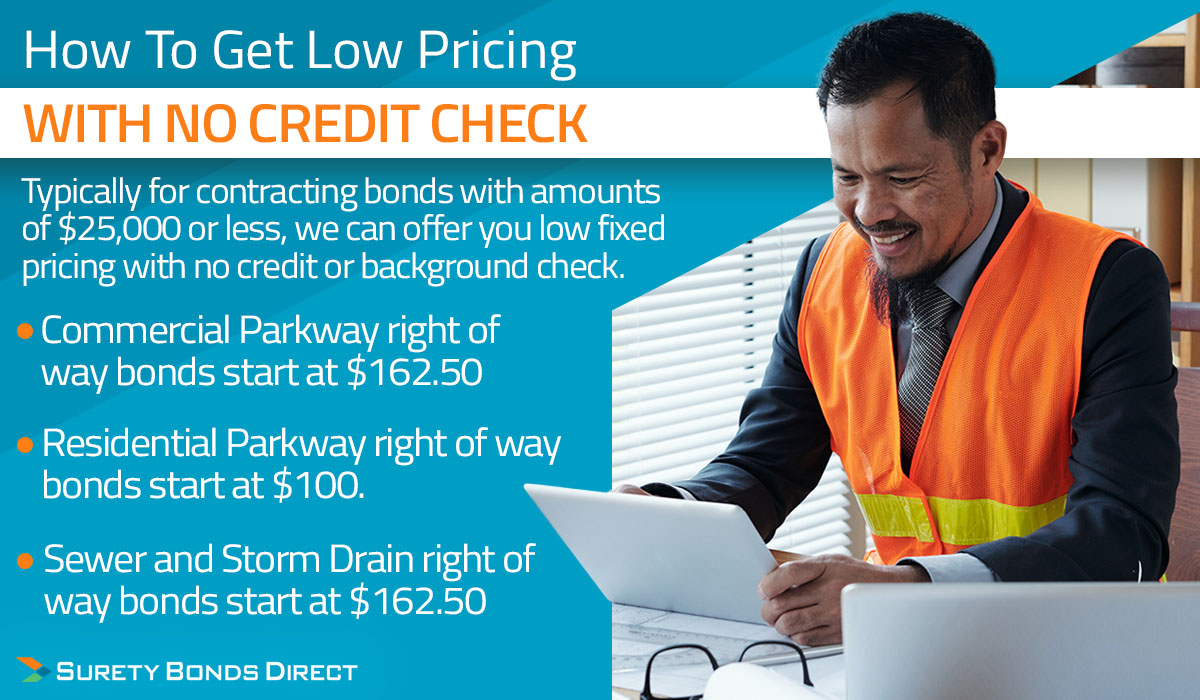

How To Get Low Pricing With No Credit Check

We are Surety Bonds Direct, a surety agency. We work with a number of A-rated sureties to find our contracting clients the lowest prices on the bonds they need.

And, typically for contracting bonds with amounts of $25,000 or less, we can offer you low fixed pricing with no credit or background check.

For these City of Fort Worth right of way bonds, including the sewer and storm drain bond, pricing starts at about $162 for a one year bond term, which is the minimum.

If you know you have excellent credit and history with right of way projects, we can often obtain slightly lower pricing, but it wouldn't be by much since $162 is less than a 1% rate which is excellent already.

How Do You Purchase Your Surety Bond?

When you're ready to obtain your bond, purchasing your bond is as easy as completing an online order form or completing your payment over the phone.

The important part of the purchase process is ensuring we can help you fill the bond form out correctly.

It's important the name on the bond is the business name that's registered with the Texas Secretary of State. If there is a mismatch, the City of Forth Worth will reject the bond and we'll have to fix it for you.

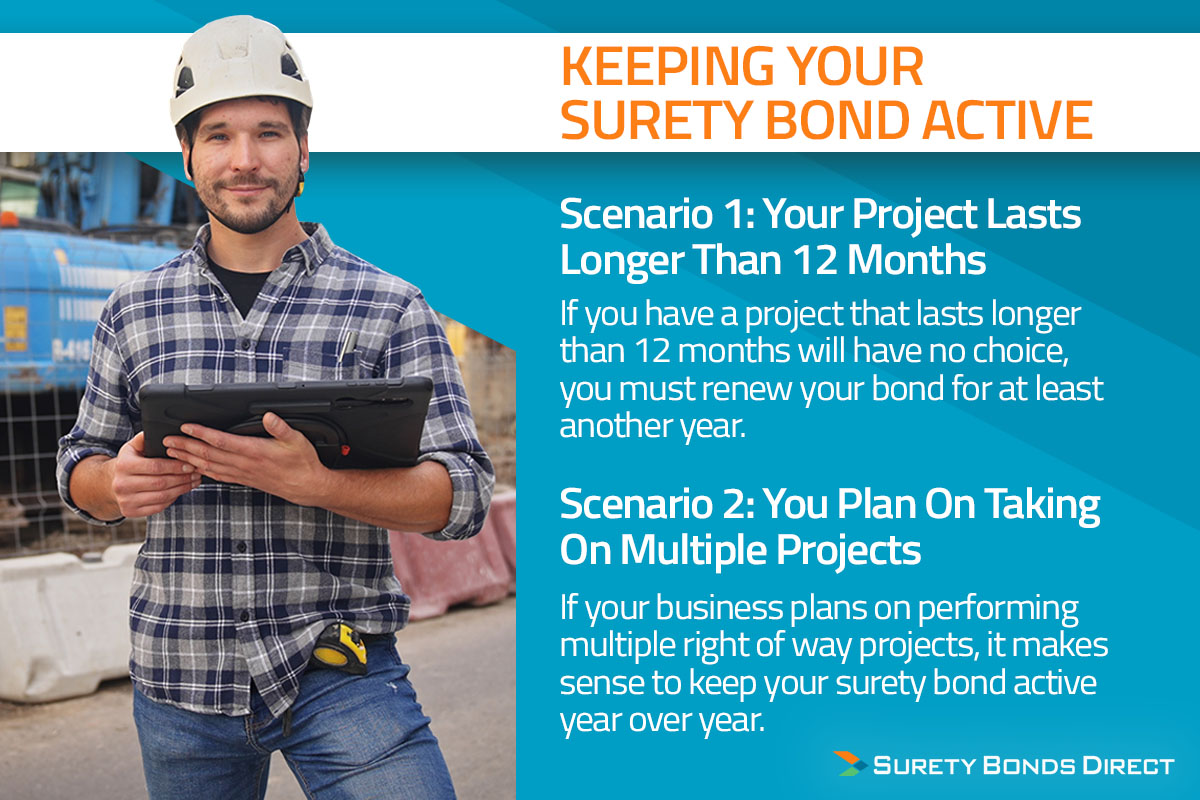

Keeping Your Surety Bond Active

As we've mentioned when talking about pricing, the pricing was one payment for a 12 month period.

There are two scenarios where you may want to keep your bond active from one year to the next.

Scenario 1: Your Project Lasts Longer Than 12 Months

If you have a project that lasts longer than 12 months will have no choice, you must renew your bond for at least another year.

Scenario 2: You Plan On Taking On Multiple Projects

If your business plans on performing multiple right of way projects, it makes sense to keep your surety bond active year over year.

And if you ever get to a point where you stop these projects, you can just let your surety bond expire during its renewal period.

Let's Get You Bonded While Saving Money

If you're actively bidding on City of Fort Worth Parkway projects or street and storm drain projects and you're looking to secure your bond, we can help. Plus we'll make sure you save money.

All you have to do is request a bond price using our online quote form. As we've mentioned, it's likely we'll get you immediate pricing with no credit check required. If this ends up not being the case we'll call to let you know.

You can have your bond done within the next business day. If you feel more comfortable, call a bond specialist at 1-800-608-9950 today.