A retainage surety bond is often required for both private and state funded construction projects. A retainage bond is often called a retention bond and in this short article you'll learn:

- Why a retainage bond may be required

- How a retainage bond is priced

- How you can get pricing and purchase your bond today

What is a Construction Project Retainage?

Retainage is the practice where a project owner will keep a percentage of the total cost of the construction project (money owed to the contractor) in an account until the project is completed.

Once the project is completed this money will be released back to the contractor. Officially this is called release of retainage.

It's important to note, when dealing with private construction projects, retainage is negotiable.

The project owner may say they require 10%, but you can negotiate this down based on factors in the contract, timelines, and the relationship you have with the project owner.

For state funded or government funded projects, there is typically a 3% to 5% retainage requirement. For example in the state of Washington and California, retainage for public works projects is typically capped at 5% of the project cost.

In each project, whether private or public, there are strict timelines for the funds release.

In California a private construction project owner has 45 days to fully release the funds after completion.

And in both Washington and California the state agency overseeing the project has 60 days to release the funds.

Each state has different laws regarding retainage. Examples include:

- In South Carolina there is no limit on private projects and public projects are capped at 3.5%

- Colorado has a 5% cap and on public projects it's only required for projects valued $150,000 or more

- Ohio has an 8% cap on public projects, no cap on private and when a project crosses the 50% complete mark, no more retainage can be withheld

As you can see each state is unique in its retainage laws.

Why Consider Purchasing a Retainage Surety Bond?

Obviously, any contractor does not want to have their funds withheld on a project. Doing so can make it difficult to:

- Meet payment schedules

- Pay for materials

- Pay for subcontractors

- Keep the project on schedule

To release the funds immediately, the contractor can purchase a surety bond in the amount of the retainage and the project owner will release the funds.

Having immediate access to project funds makes hitting milestones and product demands far easier.

Plus purchasing a retainage surety bond is going to be a small fraction of the retainage amount.

Get Your Bond Pricing Today

You can get pricing for the contractor bond you need. Click the button below. You need to know the amount of your bond.

Need Help? Call Us Today

Talk to a bond specialist today. They will help you find the surety bond you need and get you the lowest possible price. 1-800-608-9950

What is a Retainage Surety Bond?

A surety bond - at a high level - is a legal contract you purchase that holds you accountable to the promises you make to the project owner.

So a retainage bond is a legal contract you purchase promising that you will complete the project on time with no liens, defaults, or delays.

If a contractor completes a project that ends up having liens, contractual defaults, or any excessive delays, the project owner can make a claim against the retainage surety bond for compensation to remedy the specific situations.

A retainage bond is similar to a performance bond in a construction project. The key difference is a performance bond is a hard requirement for a project and is focused on ensuring the contract is fulfilled to the letter.

Other common construction bonds include:

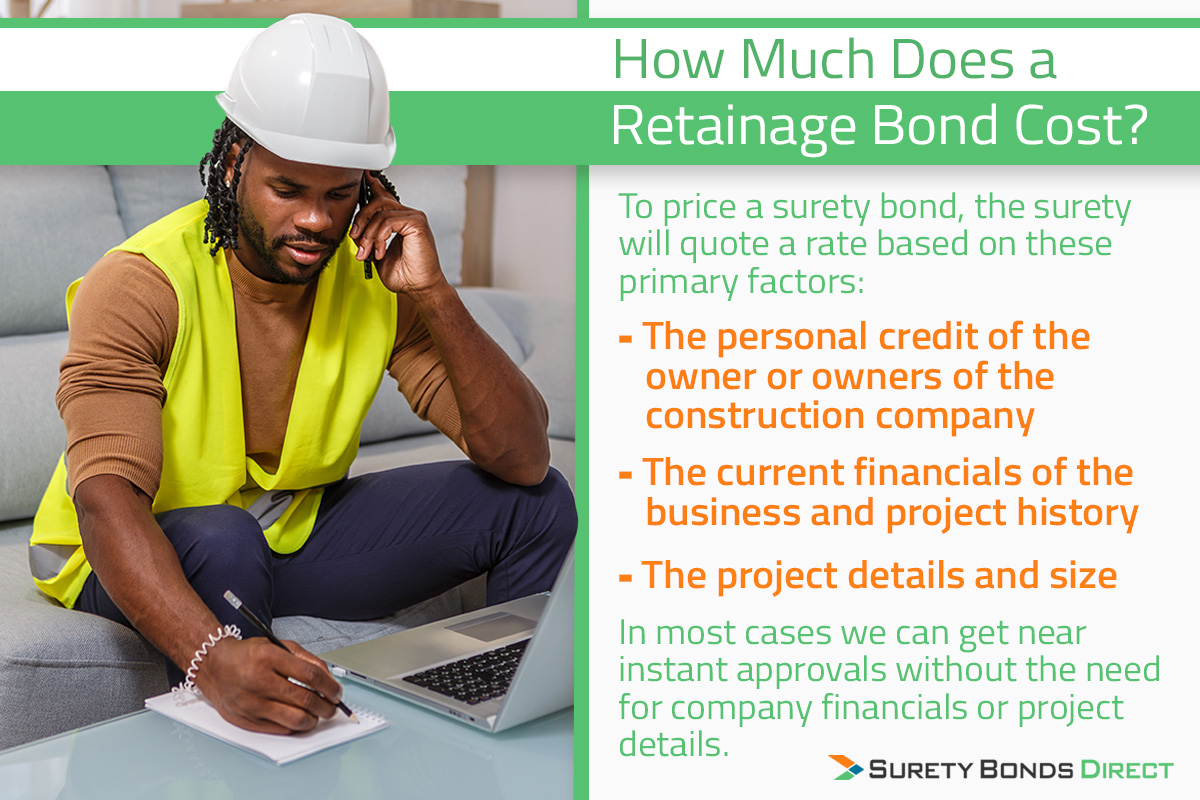

How Much Does a Retainage Bond Cost?

The price of the retainage bond is a small percentage of the retainage amount required.

Surety bonds are priced by a surety. A surety is a specialized insurance company that chooses to underwrite construction based surety bonds.

To price a surety bond, the surety will quote a rate based on these primary factors:

- The personal credit of the owner or owners of the construction company

- The current financials of the business and project history

- The project details and size

In most cases we can get near instant approvals without the need for company financials or project details. However, it's good to know these are factors may play a role in your specific situation.

How To Ensure You Don't Overpay For Your Bond?

We are Surety Bonds Direct, a specialized surety agency. We work with the highest A-rated sureties to ensure our customers pay the lowest possible price for their surety bonds.

It doesn't even make sense to us, but different sureties evaluate applicants with completely different standards. We've seen the same contractor get quoted with rates that are 2% to 3% different.

This means you can save hundreds, even thousands of dollars by getting the lowest rate.

Here's How The Process to Buy Your Retainage Bond Works

Step 1 - Request a Price Quote

Complete an online price quote request or call a bond specialist at 1-800-608-9950.

Tell us the bond amount you need and as much about your project as you can.

The good news is you can get approved for your retainage bond when you're also getting approved for your bid bond and performance bond.

Step 2 - We'll Price Shop For You

Because we work with the highest A-rated sureties, we can find you the lowest price in under one business day.

When we get the lowest possible rate and price, we'll email and call you.

To give you an idea of how much money you can save, let's say you need a $30,000 retainage bond.

- A great rate would be 1% for a price of $300

- An average rate would be 4% for a price of $1,200

| Bond Amount | Rate | Price |

|---|---|---|

| $30,000 | 1.0% | $300 |

| $30,000 | 4.0% | $1,200 |

You can easily save hundreds of dollars when you purchase your retainage bond.

Step 3 - Purchase When You're Ready

If the price looks good and you're ready, you can purchase your bond.

We'll make sure your bond is correct and setup with the:

- Correct bond form

- Correct data and information for the project

- Required power of attorney

Most surety bonds also require a short application. This obtains your business information on file with the surety that is underwriting your bond.

From this point we'll either email your bond to you or mail if if you need the physical bond itself.

Either way we'll make sure your retainage bond is correct so you can have it accepted and move on with your project requirements.

This process only takes 1 to 2 business days at most. They keys to ensure we can be efficient for you are:

- Ensuring the correct legal business name is used as based on the contract

- You complete the application on time and using the correct business names

Getting a Retainage Surety Bond is a Common Choice

Every construction project has a series of different surety bond requirements. Sometimes these surety bonds are required and sometimes like with the retainage bond, they are not.

In the case of a retainage surety bond, it's typically the right decision to release the funds you need to complete your project on budget and on schedule.

When you're ready to get pricing for your retainage, including other construction bonds, use our online quote form or call a bond specialist at 1-800-608-9950.

Get Your Bond Pricing Today

You can get pricing for the contractor bond you need. Click the button below. You need to know the amount of your bond.

Need Help? Call Us Today

Talk to a bond specialist today. They will help you find the surety bond you need and get you the lowest possible price. 1-800-608-9950