Getting a dealers license in Michigan is a straight forward process. However, there are some considerations you'll need to make and important steps you should understand to make this process as easy and fast as possible.

This article will cover:

- The five major factors for getting your dealer license in Michigan

- The 10 license types

- The rules for establishing your place of business

- Insurance requirements

- Surety bonding requirements

- Handling dealer plates

- Plus more

The 5 Major Factors For Getting a Dealers License in Michigan

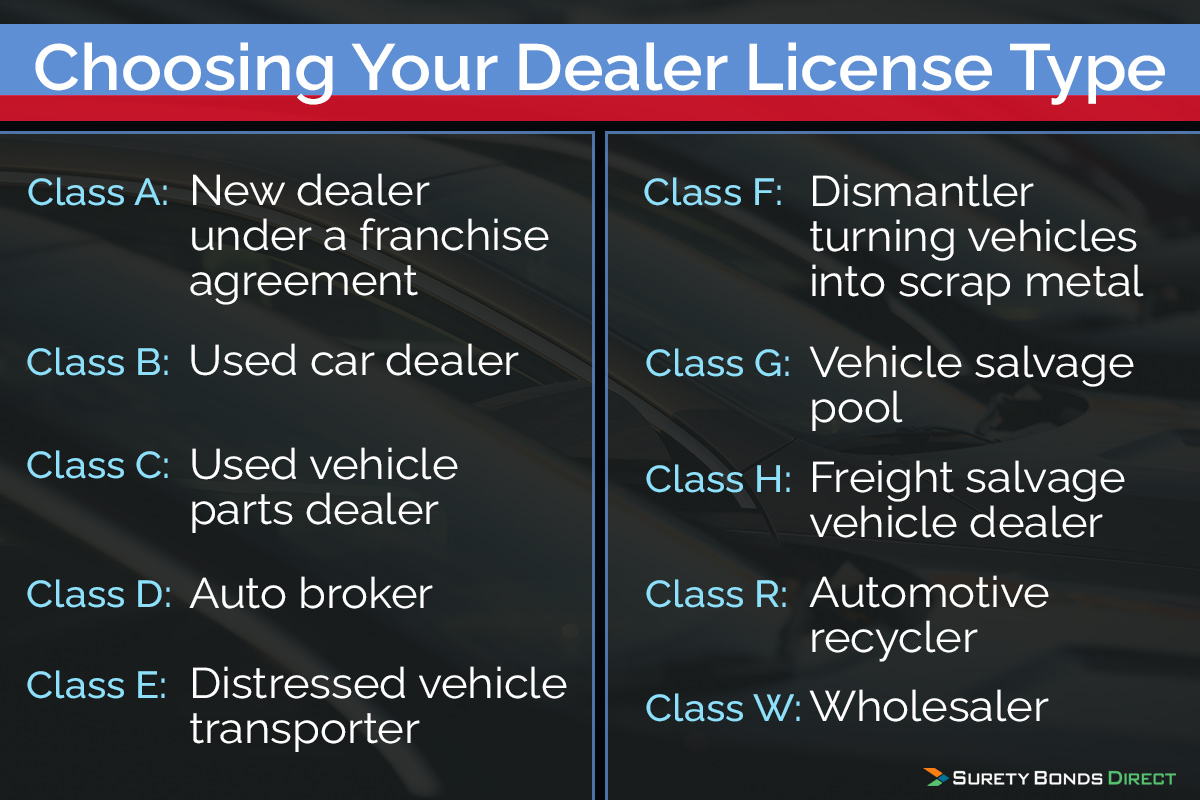

Factor 1: Choosing Your Dealer License Type

- Class A: New dealer under a franchise agreement

- Class B: Used car dealer

- Class C: Used vehicle parts dealer

- Class D: Auto broker

- Class E: Distressed vehicle transporter

- Class F: Dismantler turning vehicles into scrap metal

- Class G: Vehicle salvage pool

- Class H: Freight salvage vehicle dealer

- Class R: Automotive recycler

- Class W: Wholesaler

This article will primarily focus on Class B, used auto dealer, licensing. However, here are details about some of these licenses.

All licenses have a license fee of $160.

Class D: Auto Broker

An auto broker connects a buyer with a seller. Brokers typically work for a buyer to find a seller with a car that matches specific vehicle parameters.

Class E: Distressed Vehicle Transporter

This license buys, transports, and sells vehicles to Class C parts dealers, scrap metal processors and automotive recyclers.

Class G: Vehicle Salvage Pool

This license stores and displays damaged or distressed vehicles for insurance companies.

Class H: Foreign Salvage Vehicle Dealer

An individual or entity licensed in another state who can buy, sell, and deal with the wholesale of salvageable parts or late model distressed vehicles.

Class W: Wholesaler

A license responsible for selling vehicles to other dealers.

Dealer Licensing Is Required If

The Michigan Department of State requires a license if:

- More than 5 vehicles (requiring a title) are sold per year

- Buy, sell, exchange, broker, deal in salvageable parts for 5 or more vehicles per year

- Buying 5 or more vehicles to sell vehicle parts or prices into scrap metal

All licenses expire on December 31st each year. There is a late fee of 50% of the specified renewal cost. The renewal cost is different for each license. Any renewal more than 30 days late will require the licensee to purchase a new license and go through the licensing process again.

As with most states, accessing dealer-only auctions requires a license. Learn more about how to get a car dealer license for auctions.

Factor 2: Establish a Place of Business

There must be a primary "established place of business" to serve at the main location for the dealership. For Class A and Class B licensed dealers, this location is the primary location where records and accounting are kept.

A Class A and Class B dealer can use a secondary location for record keeping, but it must be within 15 miles of the primary location. Plus written permission of the Michigan Department of State is required.

Location requirements:

- A dealership cannot share a location with another licensed dealer

- Additional locations in the same county, who conduct the same dealer activities, DO NOT require additional fees

- Additional locations in different counties require a new license regardless of the dealer activities

Some of the physical building requirements:

- The building must be permanently enclosed

- The building must be owned, leased, or rented and it can't be a personal residence, a tent, or any type of temporary structure

- The building must be at least 150 square feet with a working restroom and a telephone landline, matching the phone listed on the dealer license

- Must have a repair and servicing facility unless the dealer has a written agreement (form AR-0012) with a registered repair facility at a location no more than 10 miles away

Property requirements:

- The land space must be a minimum of 1300 square feet

- There must be enough room to display a minimum of 10 vehicles

- There must be an additional minimum 650 square feet for customer parking

Signage requirements:

- A permanently fixed exterior sign displaying the name of the dealership as stated on the license

- The sign can be fixed to the building or in the ground

- The sign must be visible from the road

- Clearly posted hours of operation on the exterior of the building

- Hours of operation cannot be less than 30 hours per week where half of the stated hours must be between 8am to 5pm Monday through Friday

These are the major Class A and Class B license requirements for the physical location. Michigan's Department of State has a list of any additional requirements for other license types.

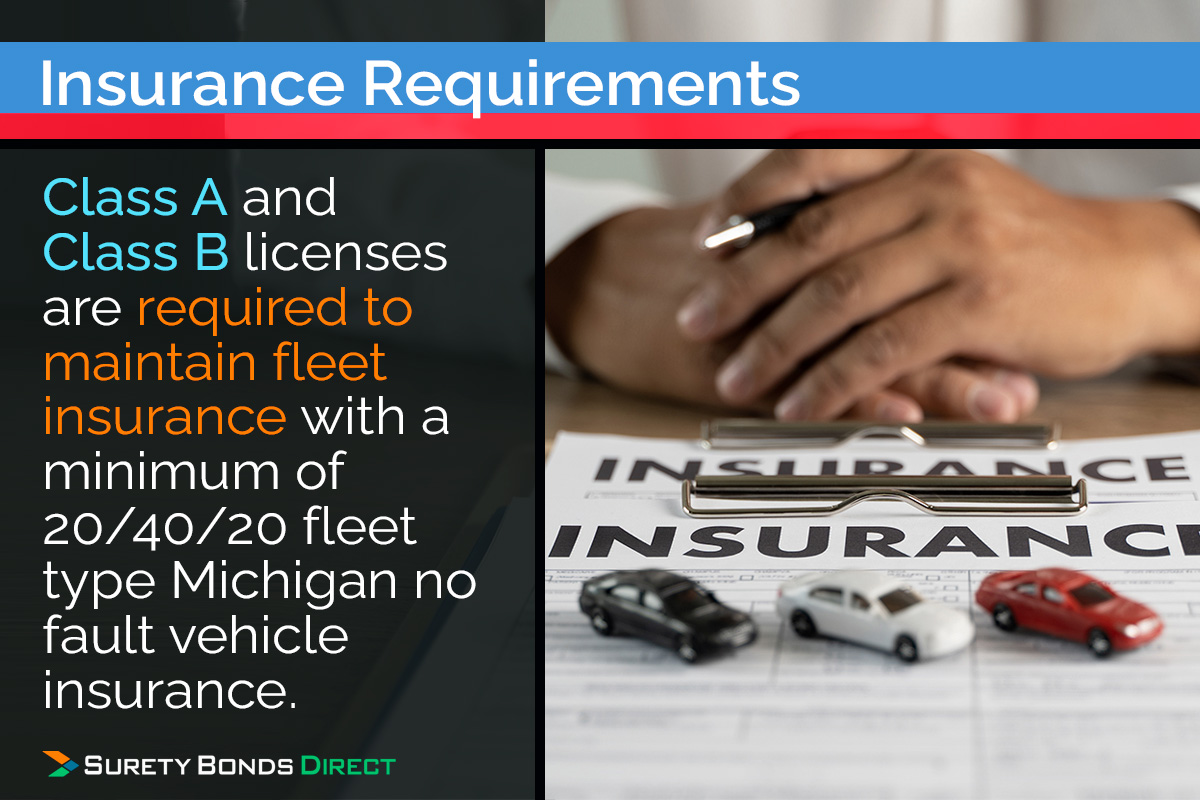

Factor 3: Insurance Requirements

Class C and Class R licenses are required to hold worker's compensation insurance. Proof of workers comp insurance is not required for other license types.

Class A, B, and W licenses are required to maintain fleet insurance. Fleet insurance is an insurance policy protecting multiple vehicles under one policy. Michigan requires dealers to maintain a minimum of 20/40/10 fleet type Michigan no fault vehicle insurance.

A copy of the fleet insurance must be kept with each vehicle that leaves the lot, including test drives.

Factor 4: Surety Bonding Requirements

All Class A, B, and D licenses are required to purchase a $25,000 auto dealer bond.

Most new business owners are unaware of what a surety bond is. Michigan is one of the few states that helps business owners by providing a definition of a surety bond:

"The bonds are used to reimburse purchasers, sellers, financing agencies, and government agencies for monetary loss caused by any tax deficiency, fraud, cheating, or misrepresentation in the conduct of the dealer's vehicle business."

What Is a Surety Bond?

A surety bond, in this case a motor vehicle dealer bond, is similar to insurance. A bond is not purchased to provide protection for you and your business, rather its purchased to protect your customers, the Michigan Department or State, and Department of Treasury.

Here are scenarios where a surety bond provides recourse:

- Misrepresenting titles

- Falsifying titles

- Failing to deliver titles on a timely basis

- Mishandling customer deposits and funds

- Falsifying vehicle information like year, odometer numbers, and prior vehicle history

- Failing to report sales

- Failing to pay sales tax

- Failing to follow license requirements

Read through all title requirements (chapter 3) and sale tax requirements (chapter 8) for Michigan. The title requirements are extensive and specific.

How Much Does a Surety Bond Cost?

The required bond amount for Michigan dealers is $25,000. This is the amount of protection afforded to customers and government agencies. Any claim made against your bond can only be paid up to the $25,000 bond amount.

The cost to purchase a $25,000 bond will be a small percentage of this amount. The cost is based on a quoted rate determined by:

- Personal credit history

- Business and industry experience

- Business financials

- Prior claims from past bonds (if applicable)

Quoted rates can range from below 1% to above 5% depending on the specific situation. Here's a small table to give you an idea of bond prices based on a variety of quoted rates.

| Bond Amount | Premium Rate | Total Cost |

|---|---|---|

| $25,000 | 0.5% | $125 |

| $25,000 | 1.0% | $250 |

| $25,000 | 1.5% | $375 |

| $25,000 | 2% | $500 |

| $25,000 | 3% | $750 |

| $25,000 | 4% | $1,000 |

Where To Purchase a Surety Bond

Insurance companies write surety bonds. However, most insurance companies do not write surety bonds. On top of that, insurance companies that write surety bonds do not work directly with consumers. So you need an agent or broker.

It's best to work with a specialty surety agency like Surety Bonds Direct. Surety Bonds Direct has relationships with multiple sureties. For every dealer customer multiple rates are collected and only the lowest rate is delivered.

Surety Bonds Direct offers free online surety bond quotes plus bond specialists available at 1-800-608-9950.

Factor 5: Dealer Plates

The last major factor for getting a dealer license in Michigan are the dealer plates. Both Class A and Class B licenses must purchase at least two dealer plates.

Dealer plates are used for:

- Driving to repair facilities, storage lots, and other locations where vehicles are stored prior to sale

- Moving vehicles to different locations to be bought or sold

- Driven by prospective customers of the dealership for testing (up to 72 hours total)

- Purchased vehicles can maintain a dealer's plate up to 72 hours after taking delivery

- When driven to banks for transferring funds or other financial transactions

Dealer plates CANNOT be used for:

- Vehicles not owned by the dealership

- Service vehicles or wreckers

- Vehicles owned by the dealership, but operated by a person who is not the dealer, an employee, agent, or prospective customer

- Vehicles titled to be scrap or salvage

When You're Ready To Finalize Your Michigan Dealer License Call Surety Bonds Direct

These are the major factors required to get a Michigan dealer's license.

The key is to have your business plan ready so you know what license or licenses you're required to have. Plus make sure you maintain proper business and owner naming throughout the process. Mismatched names on license applications, insurance policies, surety bonds, and tax forms will cause delays in this process.

Do not delay getting your surety bond quote. While most quotes can be obtained within a business day, it's possible this process can get stretched to two days. So start the quote process now. This will make purchasing your bond fast when the time comes. You can request a dealer bond to be effective up to 60 days in advance. So if today is September 10th, and you're opening the dealership on November 1st, you're ready to request a quote.

Surety Bonds Direct will provide a free surety bond quote. It takes about 120 seconds to request your quote online. If you'd prefer to talk with a person, call a bond specialist today at 1-800-608-9950.